The stock market is on track for its worst week in a year.

At last check on Friday, the S&P 500 fell 1.8%, the tech-focused Nasdaq Composite was down 2.7%, the Dow Jones Industrial Average declined 1%, and the Russell 2000 Index fell 1.6%.

The decline followed a worse-than-expected nonfarm-payrolls report. Total nonfarm payroll employment increased by 142,000 in August, up from 89,000 in July but short of the 164,000 expected by economists.

Trending stocks:

All Magnificent 7 stocks are down midday. Apple dropped 0.9%, while others in the group gave up more than 3%. Tesla is posting the biggest decline among the seven, down 7%.

Broadcom fell on weak guidance, while Super Micro dropped on an analyst downgrade.

Shutterstock-T. Schneider

S&P 500 big stock movers today

Five S&P 500 stocks making big midday moves are:

- Dollar General (DG) +2.6%

- Pulte Group (PHM) +2.2%

- Chipotle Mexican Grill (CMG) +2.0%

- D.R. Horton (DHI) +1.9%

- Hormel Foods (HRL) +1.7%

The worst-performing five S&P 500 stocks with the largest midday drops are:

- Broadcom (AVGO) -9.6%

- Albemarle (ALB) -7.6%

- Tesla (TSLA) -7.1%

- Super Micro Computer (SMCI) -6.2%

- Wells Fargo (WFC) -5.1%

Stocks also worth noting include:

Bowlero pops on revenue beat

Bowlero stock gained 8% after the company posted higher revenue for its fiscal fourth quarter and estimated higher revenue for fiscal 2025.

For the fiscal 2024 fourth quarter ended June 30, the bowling-center operator swung to a net loss of $62.2 million from net income of $146.2 million in the year-earlier quarter. Revenue increased 18.6% from the year-earlier period to $283.9 million. That beat analysts' consensus estimate of $273.4 million. Same-store revenue increased 6.9% to $242.5 million.

For all of fiscal 2024, Bowlero posted a net loss of $83.6 million, compared with year-earlier net income of $82 million. Revenue increased 9.1% to $1.15 billion.

Bowlero expects total revenue for fiscal 2025 to grow in a range of mid-single digits percent to more than 10% from fiscal 2024. That translates to between $1.22 billion and $1.28 billion. The upper end of this revenue forecast exceeds current estimates.

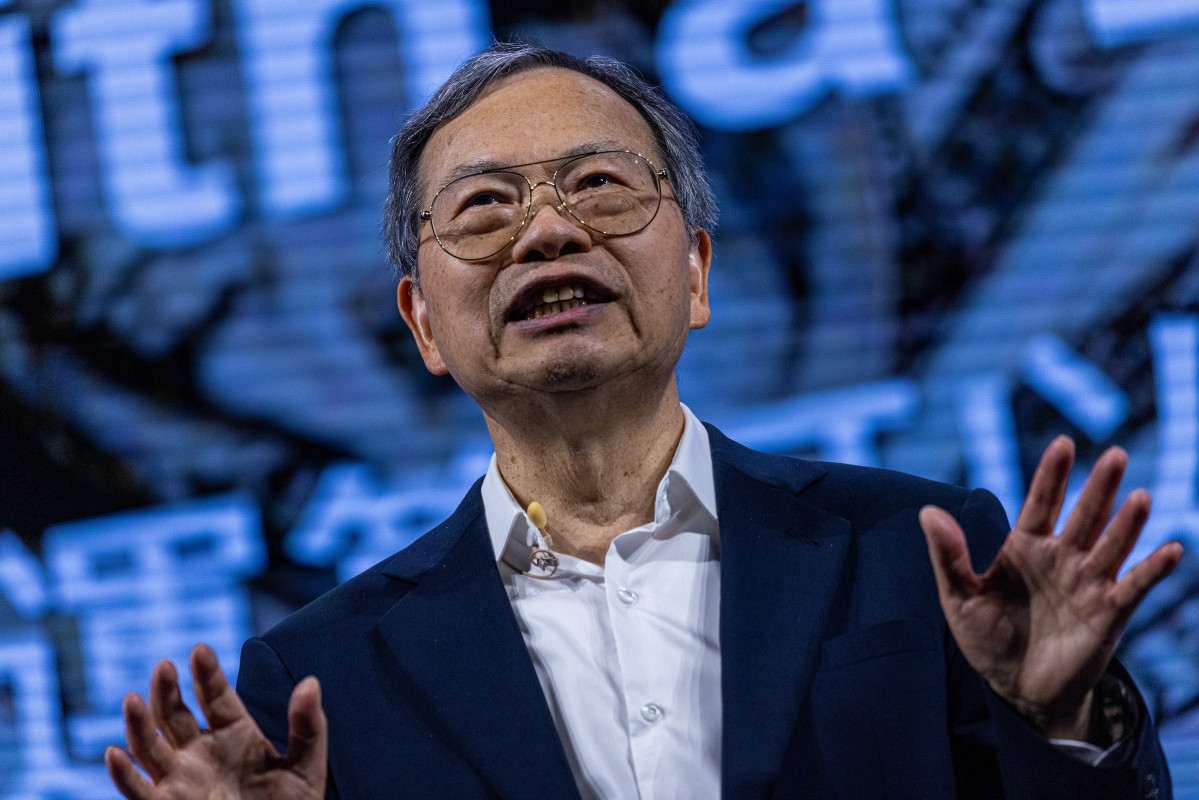

Broadcom falls despite earnings beat

Broadcom lost 9% after the company reported fiscal-third-quarter results that beat analysts’ expectations for revenue and earnings while posting weaker-than-expected revenue guidance.

For the quarter ended Aug. 4, the company reported adjusted earnings of $1.24 per share, higher than the $1.20 analysts had estimated. Revenue of $13.07 billion also beat the $12.97 billion forecast.

"Broadcom's third quarter results reflect continued strength in our AI semiconductor solutions and VMware. We expect revenue from AI to be $12 billion for the fiscal year 2024 driven by Ethernet networking and custom accelerators for AI data centers," said Hock Tan, chief executive of Broadcom.

Broadcom forecast $14 billion in revenue for its fiscal fourth quarter, just short of the $14.04 billion analysts expected.

Super Micro Computer slides on JP Morgan downgrade

Super Micro Computer dropped 6% following JP Morgan's downgrade to neutral from overweight. The investment firm now has a price target of $500, down from $950.

JPMorgan says the downgrade is based on the short-term perspective that there is no compelling reason for new investors to buy the shares while uncertainty about regaining regulatory compliance remains, according to a note from The Fly.

More AI Stocks:

- Analyst revisits Microsoft stock price target after AI reporting change

- Analyst resets Nvidia stock price target before earnings

- Analysts revise Palo Alto Networks stock price targets after earnings

JP Morgan is waiting for a further response from Super Micro to reassure that customers will not divert orders, "which could involve aggressive pricing," the analyst said.

Related: Veteran fund manager sees world of pain coming for stocks