Nike (NKE) reports after the close on Thursday, and the results come at a difficult time. The S&P 500 recently made new 52-week lows and volatility continues to roil investors.

The athletic-equipment giant has not been immune to the selloff. The shares made new 52-week lows this week as well -- although down 47% from the all-time high is roughly double the loss investors have seen in the S&P 500 index.

Nor is Nike stock immune to the macro issues plaguing many other multinational companies.

A dollar that's surging vs. many other currencies will be a headwind for the retailer, as will supply-chain issues and inflation.

For those reasons, investors are nervous heading into Nike's print as the stock lingers below its pre-covid highs and at multiyear lows.

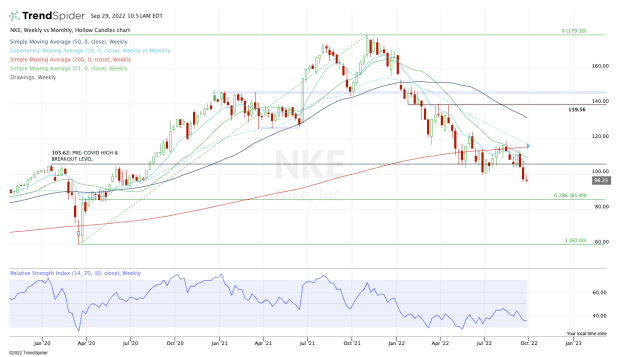

Let's review the chart.

Trading Nike Stock on Earnings

Chart courtesy of TrendSpider.com

Nike stock has not been trading well, down in five of the past six weeks. (Most stocks can make similar claims.)

Now that the stock is at new lows, in the mid-$90s, we find it at an interesting crossroads.

Despite the negativity, we could see a post-earnings pop if Nike can deliver better-than-feared results. That’s especially after it's fallen so hard in the past few weeks.

If we get that pop, first watch $100. That’s a notable psychological level and the prior low from this summer.

If the shares push through this zone, it brings up the $105 zone. There we find the declining 10-week moving average and the prior breakout level from 2020.

Just above those measures is active resistance via the 21-week moving average.

Unless the stock can clear those levels, it has a long upward battle ahead of it. But traders will also have a low to measure against in this scenario.

If the reaction to the report is bearish, investors should keep a close eye on the $90 to $93 area, then $85.

Near the former, we have a prior support/resistance zone from the post-covid selloff, where Nike consolidated and eventually moved higher.

But the latter — $85 — is really where my focus will be on a decline.

In that zone, we have the 78.6% retracement from all-time high down to the 2020 low, as well as a notable support zone from the initial post-covid bounce in April.

To get there would require a fall of roughly 12% from current levels. That may be a bit too pessimistic, given the recent action.

We’ll know more in a few hours once Nike reports, but keep these levels in mind.