Checking in on Warner Bros. Discovery on the two-year anniversary of its formation, MoffettNathanson analyst Robert Fishman highlights what has been a “choppy” ride that's about to get choppier.

With the company's stock price at nearly an all-time low, Fishman now predicts total WBD revenue to come in at around $41 billion in 2024 -- about $12 billion below his original forecast — with fast-eroding linear networks unable to keep up with the hungry resource demands of DTC streaming, and more than $40 billion of debt continuing to cast a huge shadow.

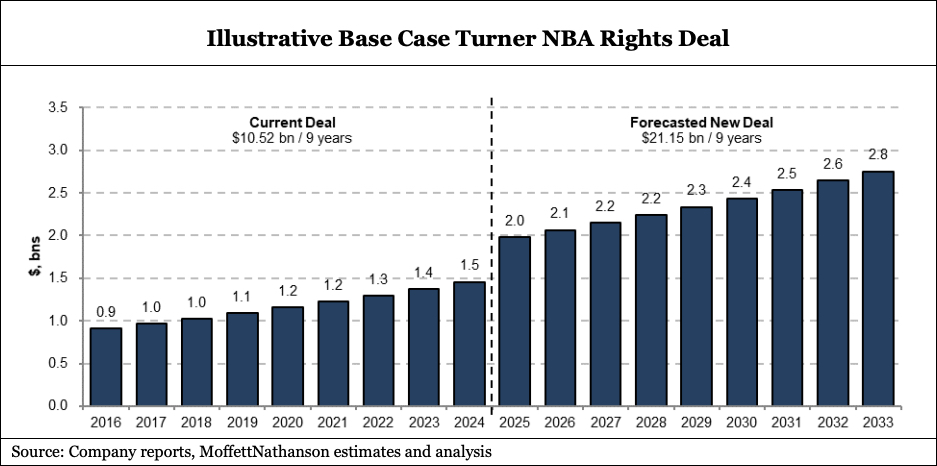

If that weren’t enough, WBD’s TNT Sports unit faces the prospect of renewing a nine-year, $10.52 billion licensing deal with the NBA, which expires after next season. Fishman sees WBD's next deal doubling its licensing fees, with the conglomerate carrying fewer games on TNT.

He believes WBD has no choice but to pay the money.

“The NBA is a key anchor sport within WBD’s cable network portfolio and the absence of a renewed deal would likely have severe impact on the company's affiliate and advertising revenues, even if it would lead to cost savings,“ Fishman said. “With the entire company relying on linear profits to fund its DTC investments and/or pay down debt, we continue to believe securing a new NBA package is of the utmost importance to Warner Bros. Discovery.”

WBD and Disney/ESPN are currently in an exclusive negotiating window with the league to renew their current contracts. That window expires in a few weeks, with Apple, Amazon and Comcast/NBCUniversal reportedly lined up to possibly make bids.