AFTER experiencing a fall in December, house values in Newcastle and Lake Macquarie recorded a slight rise in January.

According to CoreLogic's Home Value Index released on Thursday, house prices in the region increased 0.1 per cent to hold a median value of $872,193, up from a drop of -0.4 per cent in December.

Unit prices jumped 0.8 per cent in January after a rise of 1.1 per cent in the previous month to hold a median value of $681,364.

Overall, dwelling (houses and units) values in Newcastle and Lake Macquarie rose 0.3 per cent in January.

"Dwelling values are up from a fall of -0.2 per cent in December, so it has bounced back in January," CoreLogic research director Tim Lawless said.

"November was up 1.2 per cent and December may have been a correction from that, so if you look through some of the monthly noise and look at the quarterly change, it is pretty clear some momentum has come out of the marketplace."

According to the data, home values in Newcastle and Lake Macquarie recorded growth of 5.5 per cent in the past 12 months and 1.3 per cent over the last quarter.

"If you look back to mid-2023, the quarterly trend in Newcastle was showing dwelling values rising at 2.6 per cent on a rolling three monthly basis," he said.

"That has now reduced down to 1.3 per cent, so it has halved but that is still a pretty reasonable outcome, especially when you compare it to the broader NSW average which is up 0.8 per cent over the quarter or Sydney which is only up 0.1 per cent.

"The Newcastle region is slowing down in value growth but it is still out performing other regional markets around the state and substantially stronger than what Sydney is."

Mr Lawless said a rise in stock, or the number of homes being listed for sale, could explain the moderate rate of value growth through the second half of 2023 and into the new year.

According to CoreLogic, total listings across the Newcastle and Lake Macquarie region in November were 5.4 per cent higher than at the same time a year earlier.

"Buyers simply have more stock to choose from," he said.

"It is becoming more of a balanced market as we see stock levels rise but they have risen from very low levels.

"As you see prices rising further without any cut to interest rates or improvement in credit availability you have to expect there is probably going to be a flattening out in the marketplace until rates comes down and sentiment starts to improve."

In the Hunter Valley (excluding Newcastle), house values rose 0.3 per cent and unit values fell -0.8 per cent in January to hold a median price of $692,414 and $520,332, respectively.

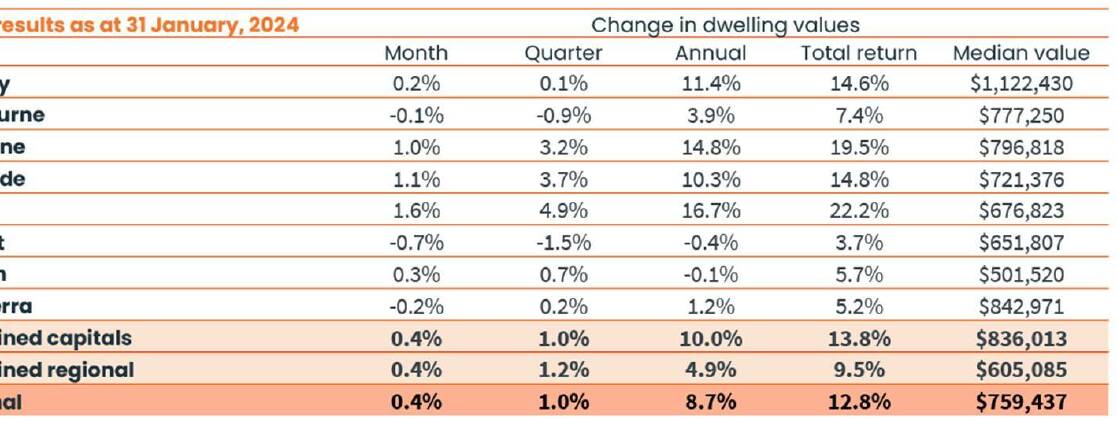

Overall, Australia's housing upswing continued through the first month of the year with CoreLogic's national Home Value Index (dwellings) rising 0.4 per cent in January.

The figure is up from the 0.3 per cent increases seen in November and December, marking the 12th straight month of value rises.

Mr Lawless said regional markets were now showing a stronger trend in value growth relative to the capital cities.

The combined regional index rose 1.2 per cent over the rolling quarter compared with a 1.0 per cent rise across the combined capitals index.

"While both the combined capitals and combined regional markets are losing momentum in the pace of value growth, the capital city trend has slowed more sharply, mostly due to the flattening of growth conditions in Melbourne and Sydney," he said.

"Across the other states, regional WA, SA and Queensland continue to record a slower pace of growth relative to their capital city counterparts; these are also the three regional markets where dwelling values are at record highs."

The data follows the latest Consumer Price Index results for the December quarter which showed inflation had fallen once again, from 5.4 per cent in September to 4.1 per cent.

This marks the fourth consecutive quarter where inflation has declined on an annual basis, and the December result is below the 4.5 per cent forecast made by the RBA last November.

- Readers can now subscribe to Australian Community Media's free weekly Newcastle Herald property newsletter.

The newsletter will keep you informed about what's currently making headlines in the region's real estate market and beyond.

To sign up, click here, scroll down, enter your details, click the 'property' box and then click 'subscribe'.