The new chief executive of the new Silicon Valley Bank, Tim Mayopoulos, asked its customers to keep their deposits with the new company, which is called Silicon Valley Bridge Bank NA.

"We are open for business and are hard at work bringing all systems and solutions back online to support you," he wrote in a LinkedIn post.

He said the bank is issuing new loans and honoring existing credit facilities.

Mayopoulos asked customers to either leave their money at the bank or wire their money back.

"The number one thing you can do to support the future of this institution is to help us rebuild our deposit base, both by leaving deposits with Silicon Valley Bridge Bank and transferring back deposits that left over the last several days," he wrote.

Mayopoulos, a former CEO of Fannie Mae, was appointed the bank's new CEO on March 13.

He sympathized with the bank's customers, many of whom were unable to transfer money out on March 9 or March 10 before the FDIC took over Silicon Valley Bank.

"We are doing everything we can to rebuild, win back your confidence, and continue supporting the innovation economy," he said. "We recognize the past few days have been an extremely challenging time, and we are grateful for your patience."

Second-Largest Bank Failure in the U.S.

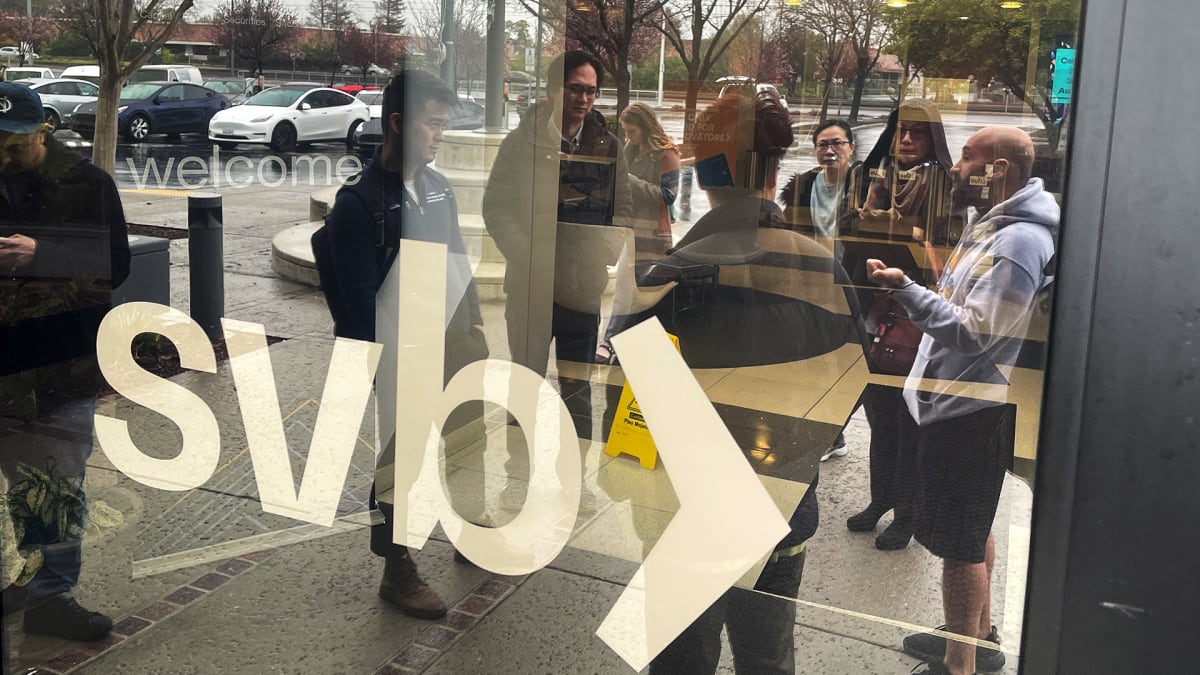

The FDIC closed Silicon Valley Bank on March 10. The FDIC and the Federal Reserve said on March 12 they would ensure that all depositors would receive their money, even the ones that had balances over the $250,000 FDIC-insured threshold.

SVB was the second-largest bank failure in U.S. history and has shaken many investors. It was the result of a bank run, caused by the firm’s announcement that it failed to raise the additional capital to increase liquidity.

Silicon Valley Bank made investments into long-dated government securities, including Treasury securities. When depositors demanded their funds, the bank sold the securities, taking a $1.8 billion loss. The Santa Clara, Calif., bank then attempted to raise $2.25 billion in capital by issuing new common and convertible preferred shares to cover the shortfall.

Depositors made a run on the bank, withdrawing their cash and transferring it into other banks.

The deposits at SVB are "fully protected by the FDIC," Mayopoulos wrote. "This action by FDIC effectively means that deposits held with SVB are among the safest of any bank or institution in the country. If you, your portfolio companies, or your firm moved funds within the past week, please consider moving some of them back as part of a secure deposit diversification strategy."

Mayopoulos also attempted to attract new customers.

"We are actively opening new accounts of all sizes and making new loans," he said.

In his letter to customers on March 13, Mayopoulos discussed how he worked during the Great Recession in 2008:

"I look forward to getting to know the clients of Silicon Valley Bank. ... I also come to this role with experience in these kinds of situations. I was part of the new leadership team that joined Fannie Mae in the wake of the financial crisis in 2008-09, and I served as the CEO of Fannie Mae from 2012-18,"

The Federal Reserve Board said on March 13 that its vice chair for supervision, Michael Barr. would lead a review of the collapse of Silicon Valley Bank.

Receive full access to real-time market analysis along with stock, commodities, and options trading recommendations. Sign up for Real Money Pro now.