Investors kept a close look at China’s solar and wind power stocks last year, but were least interested in the hobbled education sector

By Bamboo Works team

Chinese concept stocks experienced unprecedented challenges in the Year of the Ox. The small and mid-sized companies covered by Bamboo Works were no exception, also coming under intense pressure. Looking past their stock prices and financial reports, how did these companies perform in terms of media and investor attention? Which companies stood out despite all the pressures? Our special report highlights such trends using our objective large database of statistics.

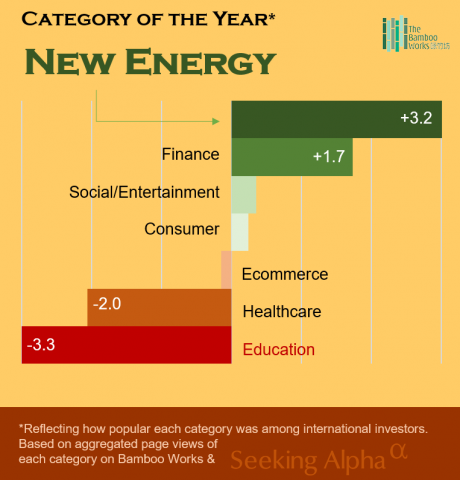

1. Category of the Year

We calculated click rates on thebambooworks.com and Seeking Alpha for more than 500 Bamboo Works stories in 2021 and compared the aggregate number of visits for each category against the average. From this, we can see new energy got the most attention.

Attention was average for our consumer and e-commerce categories. Based on that benchmark, attention to new energy stories was 3.2 times higher than the average. Conversely, attention to education stories was 3.3 times lower than the average during the unprecedented crisis for that whole category.

“New energy was the hottest category among those that we cover last year, no puns intended,” said Doug Young, co-founder and editor-in-chief of Bamboo Works. “People are looking to China to become a world leader in everything from electric cars to solar panels. Meantime, education was the big loser, as Beijing took steps to relieve the pressure on overworked students from companies offering after-school tutoring.”

Also noteworthy was the social and entertainment category’s ranking, which was behind only finance and new energy. This shows which Chinese companies in related fields may have the greatest potential for future development at home and abroad.

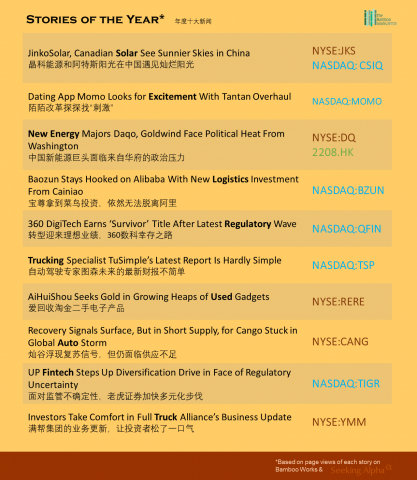

2. Stories of the Year

We also calculated the 10 most read stories in 2021. Not surprisingly, news from the new energy, finance, and social/entertainment sectors occupied most spots in this ranking.

Big names like Jinko, Canadian Solar, Daqo, Goldwind and TuSimple represented the new energy category’s huge influence.

Zhiwen Group, which owns dating apps Momo and Tantan, was the only social media representative in the top 10, single-handedly raising the attention level of global investors toward the entire category. Yalla’s story ranked close to the top 10. Although Chinese people are not very familiar with it, this foreign-focused social media company with a Chinese founding team represents another route for Chinese enterprises to go global.

Emerging companies such as ATRenew and Cango have also attracted investor attention.

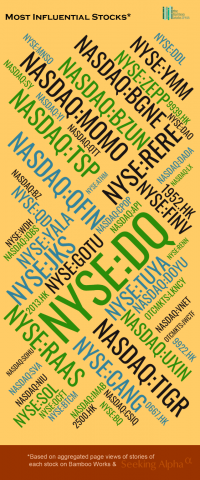

3. The most influential Chinese concept stocks

We ranked individual stocks by their influence based on the aggregate number of story views. In the ticker cloud above, the bigger the font, the more influential the stock was. From it, you can see the 50 small and mid-cap Chinese stocks with the most global influence. These stocks represent the huge potential for Chinese companies to develop globally.

The leader on this list is Daqo, which may not be well known to most readers, but has attracted big attention from global investors as one of the most important raw material suppliers in the new energy category.

Detailed ranking of the 50 most influential Chinese concept stocks:

1 Daqo (NYSE:DQ)

2 Hello Group (NASDAQ:MOMO)

3 360 DigiTech (NASDAQ:QFIN)

4 Jinko Solar (NYSE:JKS)

5 TuSimple (NASDAQ:TSP)

6 Up Fintech (NASDAQ:TIGR)

7 Cloopen (NYSE:RAAS)

8 Full Truck Alliance (NYSE:YMM)

9 Baozun (NASDAQ:BZUN)

10 Uxin (NASDAQ:UXIN)

11 Zepp (NYSE:ZEPP)

12 Gaotu Techedu (NYSE:GOTU)

13 Yalla (NYSE:YALA)

14 RenSola (NYSE:SOL)

15 Qudian (NYSE:QD)

16 FinVolution (NYSE:FINV)

17 Dingdong (NYSE:DDL)

18 BeiGene (NASDAQ:BGNE)

19 Sinovac (NASDAQ:SVA)

20 Agora (NASDAQ:API)

21 Niu (NASDAQ:NIU)

22 BIT Mining (NYSE:BTCM)

23 Canadian Solar (NASDAQ:CSIQ)

24 VNET (NASDAQ:VNET)

25 I-Mab (NASDAQ:IMAB)

26 Dada (NASDAQ:DADA)

27 So-Young (NASDAQ:SY)

28 Luckin (OTC:LKNCY)

29 Douyu (NASDAQ:DOYU

30 Autohome (NYSE:ATHM)

31 Sohu (NASDAQ:SOHU)

32 Everest Med (1952.HK)

33 JW Thera (OTC:JWCTF)

34 LexinFintech (NASDAQ:LX)

35 Renren (NYSE:RENN)

36 Kanzhun (NASDAQ:BZ)

37 Pop Culture (NASDAQ:CPOP)

38 Waterdrop (NYSE:WDH)

39 111 Inc (NASDAQ:YI)

40 Tuya (NYSE:TUYA)

41 Venus Medtech (2500.HK)

42 Miniso (NYSE:MNSO)

43 Youdao (NYSE:DAO)

44 51job.com (NASDAQ:JOBS)

45 New Oriental (NYSE:EDU)

46 Qutoutiao (NASDAQ:QTT)

47 ATRenew (NYSE:RERE)

48 OneConnect (NYSE:OCFT)

49 Cango (NYSE:CANG)

50 Weimob (2013.HK)

It’s worth noting that this list dominated by NASDAQ- and NYSE-listed companies also includes Hong Kong stocks such as Everest Medicines and Venus MedTech, and they are from the relatively weak category of healthcare. We have reason to believe that given time, Chinese medical companies will bring more surprises to global consumers and investors.

4. Global Investor Map

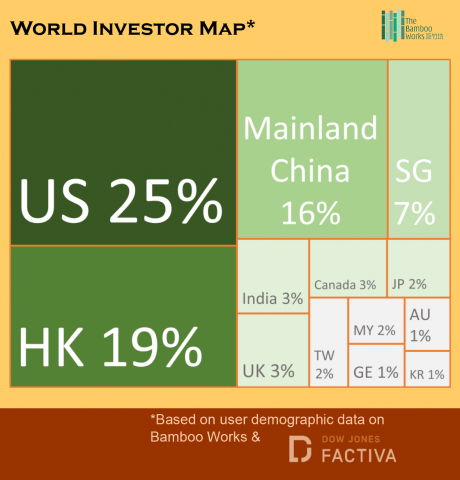

Using demographic data from thebambooworks.com and Dow Jones Factiva, we have calculated the ranking of countries and regions that are most interested in Chinese concept stocks.

Not surprisingly, the United States accounts for 1/4 of Chinese stock investors. Hong Kong, accounted for 19%. Sometimes we have to admire the huge energy of this single city. As secondary listings of Chinese concept stocks in Hong Kong gradually grows, there may be new changes in this map.

Jony Ho, managing editor of Bamboo Works, said “Amid all the pressure, second listings in Hong Kong have become a way for Chinese companies to diversify political risk, increase their liquidity and boost their valuations. We expect to see this trend become even more popular this year.”

Consistent with our subjective feelings, a majority of investors in China Concept Stocks are from the mainland. After factoring in the influence of Internet access and language barriers, mainland investors who actually pay attention to China Concept Stocks should be slightly higher than the 16% in the figure.

Developed countries such as the United Kingdom, Canada, Japan, Germany, and Australia are on the list because the ranking of the number of Chinese stock investors has a certain direct correlation with the GDP ranking of each country. When you see that India ranks slightly higher than the United Kingdom and Canada, don’t be too surprised, because India’s GDP ranked seventh in the world. At the same time, East Asian and Southeast Asian countries and regions such as Singapore, Taiwan, and Malaysia also occupied places in the top 10.

Many listed companies may not be able to clearly identify their readership among investors for any individual country or region. Our map may be used as a rough informative reference.

5. Conclusion

Since our inception in 2021, Bamboo Works’ independent reports have been helping global investors learn more about Chinese companies. 2021 was a year of great pressure for most Chinese stocks. However, we believe in China’s future development and strength, and believe the value of Chinese company stocks will continue to increase, and believe the integration of global capital markets is still a general trend. Therefore, we will continue to provide more reports, analysis and data to build a better bridge for Chinese companies to communicate with global investors.