Roku (ROKU) shares are more than 12% higher on June 8, while Netflix (NFLX) is hitting a session high, too, up about 3.5%.

The rumor on Wall Street is a potential takeover of Roku by Netflix. In premarket trading Roku shares were modestly higher while Netflix was lower.

With both now trading higher, it may suggest that investors — and the market — approve of such a deal, should one be in the works.

Netflix has the robust subscriber base (and even more potential should it lock down on password sharing). Roku has a dominant streaming-video operating system/platform, a strong presence in video ads and is quickly improving its operating profit and margin.

A marriage of both likely comes in a cash-and-stock or all-stock deal, which does muddy the situation a bit given that both stocks have suffered peak-to-trough declines in excess of 75%.

While one could make a reasonable case for the deal, what are the charts saying?

Trading Roku Stock

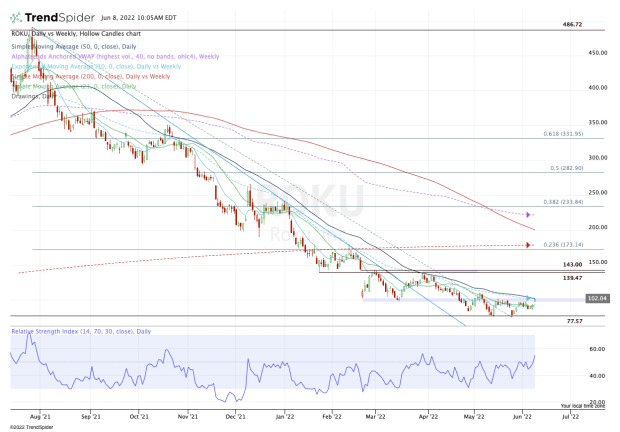

Chart courtesy of TrendSpider.com

The chart above looks busy, but it overlays both the daily and the weekly levels, while highlighting the stock’s fall from almost $400 to $75.

Now back near $100, the stock has had a respectable move off the low. When considering how far it has fallen, though, Roku could rally quite a bit higher while still being well below the all-time high.

Of course, any agreed deal with Netflix would affect the price considerably.

The $100 area was a prior support zone in the first quarter, and has been resistance so far in the second quarter. Roku stock is also running into the 50-day and 10-week moving averages.

In an ideal world, the bulls would see a rapid rally if Roku were to break out over this area, potentially putting $140 in play. That’s almost double the lows.

But even at $140, the stock would still be down 71.5% from the all-time high. In that respect, one can see how we can get a monster rally in some of these beaten-down growth stocks — especially if we start seeing short squeezes and a return to tech.

If the stock moves above $140, the $175 level sticks out. That’s where we find the first big retracement level — the 23.6% — and the 200-week moving average.

Again, any potential deal with Netflix makes this somewhat of a binary situation — unless it’s a stock-based deal, then Netflix’s price action is to be considered.

Trading Netflix Stock

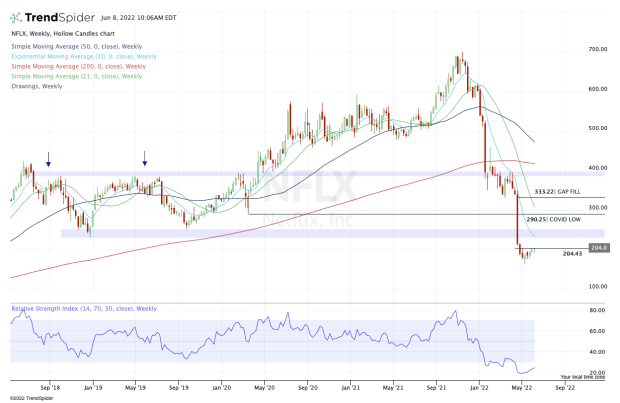

Chart courtesy of TrendSpider.com

Speaking of Netflix, the stock was hanging on by a thread in the $330s when the entertainment-streaming major reported earnings in April.

The shares cratered on the report, crashing through the covid-19 low at $290, then plunging through the double-bottom low between $230 and $250, which was made in 2018 and 2019.

Now carving out a low, Netflix stock is trying to push back through the key $200 area.

If it succeeds, we could see a rally to the $230 to $250 zone, as well as the 10-week moving average. Above $250 and suddenly the $290 level and the declining 21-week moving average are in play.

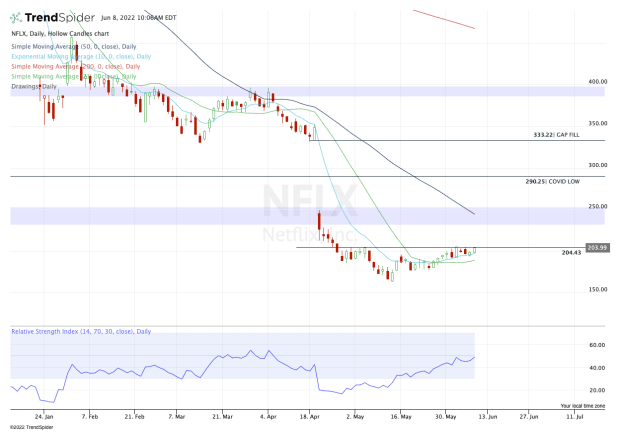

Chart courtesy of TrendSpider.com

When we shift down to a daily chart, one can see how pivotal this area is. A strong push from here could put a potentially strong rally in play.

Ultimately, it shows how a return back to the gap-fill level near $333 is realistic if the trend can remain bullish and if a few factors begin to favor the longs.

A caveat: NFLX and ROKU have been hit hard and the pain has been much broader than two stocks. If the market moves lower once again, these names will have a hard time rallying, with or without a deal.

For Netflix, keep an eye on $200. A close below this level keeps the 10-day and 21-day moving averages vulnerable. Below both measures and $175 is in play, followed by a retest of the low near $163.