Netflix’s stock is down more than 40% year-to-date, stung by both worries about slowing subscriber growth and a broader tech-stock selloff.

As a result, investor expectations don’t look particularly high ahead of the streaming giant’s latest earnings report.

Among analysts polled by FactSet, the consensus is for Netflix to report first-quarter revenue of $7.93 billion (up 11% annually), GAAP EPS of $2.90 and – most importantly, given how much subscriber figures determine how Netflix’s stock moves post-earnings – 2.5 million paid net streaming subscriber adds.

Netflix issues quarterly sales guidance within its shareholder letters. For the second quarter, Netflix’s paid net add consensus stands at 2.55 million.

Eric Jhonsa, Real Money’s tech columnist, will be live-blogging Netflix’s report, which is expected after the close on Tuesday, along with a “video interview” with management that’s scheduled to become available at 6 P.M. Eastern Time. Please refresh your browser for updates.

7:06 PM ET: That's a wrap for Netflix's video interview. Shares are currently down 25.7% after-hours to $258.94 after Netflix missed its Q1 paid net add guidance by 2M (500K vs. 2.5M) after adjusting for a 700K impact related to Russia, and guided that it will lose 2M paid streaming subs in Q2.

During the video interview, Reed Hastings disclosed that Netflix plans to offer cheap ad-supported streaming plans to complement its paid plans. And CFO Spence Neumann disclosed that the Q1 subscriber miss stemmed from slightly elevated churn rather than lower-than-expected sign-ups, while later adding that Netflix expects to continue seeing revenue growth and return to paid net add growth in the second half of the year.

Thanks for joining us.

6:59 PM ET: Hastings: We've gone through a lot of changes over the years, and we've always figured them out. We'll figure this one out. In time, we'll look at this period as foundational in our continued journey.

Sarandos: We've always had really tough competition. I really like the competitive position we're in.

6:57 PM ET: Neumann makes a point of saying that Netflix's Q2 guidance doesn't mean paid net adds will decline in the second half of the year. He says Netflix doesn't expect its revenue growth to accelerate this year, but that it does expect to keep growing revenue and to return to paid net add growth.

6:55 PM ET: A question about how Netflix's culture has involved.

Hastings: We don't see culture as a fixed thing. We look at what's going to drive excellence. And we've made adjustments in response to that. The goal is excellence, culture is a tactic in that journey.

6:54 PM ET: A question about how Netflix is thinking about sports going forward.

Sarandos: We expand our content verticals constantly. Games are a good example. They fit our existing skillset well. We're not quite so sure we can significantly increase our profit stream by adding sports. But we're incredible excited about the success of Formula 1: Drive to Survive and other sports-adjacent content. I won't say we'll never do sports, but we'd have to see a path towards creating a significant profit stream related to it.

6:51 PM ET: A question about whether Netflix's depressed stock price could impact its hiring.

Sarandos: People join Netflix because they believe in our long-term streaming vision. Our teams on the ground are much more empowered, collaborative and risk-tolerant than peers. And that's help bring about many of our hits. We're dealing with headwinds right now, but we all see it as temporary.

6:48 PM ET: A question about what metrics Netflix is watching to measure the success of its games.

Peters: We're looking at the impact on both customer sign-ups and retention. Engagement is the primary leading indicator for retention. As with original content, we want to make sure the investment made in any given title is calibrated to its business impact.

6:45 PM ET: A question about Netflix's gaming progress.

Hastings: I really like what our gaming team has built. We've had some nice successes. We're building capacity faster than we did when we began making original films.

Peters: We're open to both licensing game content and acquiring game developers. Our recent deal to both launch a game and an animated series related to the Exploding Kittens card game is a sign of things to come.

6:42 PM ET: A question about India. Netflix cut prices there in December. What's Netflix seeing from new Indian subs?

Peters: Behavior among newer subs is similar to behavior among existing subs. The price cut was a long-term bet on growing in India. We hope that more subscribers will lead to more people talking about and consuming Netflix's content.

Sarandos: We've seen a nice uptick in engagement in India.

6:39 PM ET: A question about Netflix's 2022 cash content spend (previously forecast to be around $18B). Any plans to curtail it?

Sarandos: We plan to keep investing heavily in content. Cash content spend is expected to grow this year.

Neumann: We're going to be responsible in terms of how we manage the business. We're maintaining our operating margin guidance and expect to maintain that margin level over the next 18-24 months. We'll keep investing, but will be pulling back on some of our spending growth to hit that margin guidance.

6:35 PM ET: A question about whether Netflix remains committed to launching entire seasons all at once.

Sarandos: We've found splitting seasons has been received well. Allows some people to binge, while also appealing to people who want to watch new content more gradually.

6:33 PM ET: A question about Netflix's Q2 content slate.

Sarandos asserts Netflix is very enthusiastic about upcoming new seasons of Stranger Things, Ozark, etc., as well as new international content in the works. Also notes Netflix's 2022 content slate will be back-half loaded, though not to the same degree as 2021's

6:30 PM ET: A question about whether Netflix's views have changed on the profitability of ad-supported plans, and one about how long it would take to roll out.

Hastings: It would phase in over a couple of years in terms of being material. The online ad market has advanced. We can now be just a publisher and let other companies focus on ad tech issues.

Hastings also notes that Hulu, HBO, etc. have rolled out ad-supported plans to complement ad-free plans, and says Netflix is looking to do something similar.

6:27 PM ET: A question about whether Netflix's views on its pricing power have changed, in light of its newfound willingness to support ad-supported plans.

Peters insists there's been "no fundamental shift" here. Sarandos and Neumann concur.

6:25 PM ET: A question about the impact of recent price hikes in the U.S. and elsewhere on subscriber growth.

Peters: In terms of top-line impact, the latest price hikes are performing like prior ones. They're revenue-accretive. Sometimes, we see a temporary pickup in churn because of them. We generally plan to keep doing what we're doing in terms of using price hikes to invest more. But we also want to make sure we have a variety of pricing options.

Notably, Hastings follows up by saying that cheap ad-supported plans could be a way for Netflix to reach more cost-sensitive consumers. "Allowing consumers who would like to have a lower price and are advertising-tolerant makes a lot of sense," he says, while adding Netflix is looking into how to best do this.

Neumann follows up by saying that the price hikes weren't responsible for the slightly elevated churn Netflix saw in Q1. Rather, it stemmed from other factors such as macro issues, competition, etc.

6:20 PM ET: A question about how Netflix is looking to drive subscriber acquisition going forward.

Co-CEO/content chief Ted Sarandos: We've got to keep improving the core services. We have to monetize more of our viewing. Our engagement is still very strong. New original content is still doing very well. We're constantly improving in creating "moments" that can lead to a hit such as Squid Game or Bridgerton.

6:15 PM ET: A question about whether Netflix aims to get more revenue growth going forward from paid subscriber growth or ARM (revenue per account) growth.

Neumann: ARM will become increasingly important over time. Especially as we try to monetize account-sharing.

6:12 PM ET: A follow-up question about how Netflix aims to monetize password-sharing in places like the U.S..

Peters: We're trying to take a "customer-centric approach" that supports member choice. We're carrying out tests right now. It'll take a while to get this right. We think it'll take a year or so to optimize our approach and roll it out globally.

6:10 PM ET: Next question is about near-term headwinds and how they influence Netflix's Q2 guidance.

Neumann: Excluding Russia, there was a 2M different between our paid net adds and guidance. Customer acquisition growth was as expected. The difference was "slight elevated churn" throughout Q1. We're talking about 2 or 3 tenths of a percent. Russia/Ukraine had spillover effect in parts of EMEA. There were also some macro pressures elsewhere, some seasonality, and maybe some elevated competition. We're seeing similar trends in Q2.

COO Greg Peters: We have an addressable market that's gradually expanding in some countries. And in other countries like the U.S., we already have very high penetration. This includes both paying subs and those accessing via shared credentials. The second group is a large opportunity for us. Our main approach is asking customers to pay a bit more to share accounts with other households.

6:05 PM ET: First question is about how the tone of Netflix's commentary about competition, market maturity and macro has changed.

Reed Hastings: Our views are different because our numbers are different. COVID created a lot of noise about how to view the situation. In 2021, we thought there was pull-forward of demand. But now we realize that doesn't hold. We have pretty high market penetration after accounting for account-sharing. That plus competition is weighing on growth.

Hastings adds that Netflix is now working "super-hard" on figuring out how to monetize account-sharing.

CFO Spence Neumann: We think the long-term addressable market is unchanged. We just think COVID clouded the near-term challenges to growing penetration.

6:01 PM ET: The earnings interview is up. This quarter's interviewer is JPMorgan analyst Doug Anmuth.

5:58 PM ET: Shares are now down 26% AH. Bound to get attention: Any commentary Netflix's management shares during the interview about just how much various headwinds (reopening activity, greater streaming competition, price hikes, etc.) are currently weighing on subscriber growth, and about how much Netflix expects growth to improve in the back half of the year.

5:54 PM ET: Hi, I'm back to cover Netflix's video interview, which should go up on Netflix IR's YouTube page in a few minutes.

5:01 PM ET: I'm taking a break, but will be back to cover Netflix's video interview, which is set to be posted at 6PM ET.

Shares are down 25.1% AH to $260.98 after Netflix reported it lost 200K paid streaming subs (500K were gained outside of Russia) vs. guidance for a gain of 2.5M, and forecast that it will lose 2M paid subs in Q2.

4:58 PM ET: As usual, Netflix's letter features some viewing stats for new original content:

"On the content side, we’re doubling down on story development and creative excellence, which we see reflected in big Q1’22 TV hits like Bridgerton (627 million hours viewed for season 2 *, our 1 biggest English language series in our history) and Inventing Anna (512m hours viewed) - both from our extremely successful partnership with Shonda Rhimes - and films like Tinder Swindler (166m hours viewed, our biggest documentary film ever released) and The Adam Project (233m hours viewed), which come on the back of our Q4 hits Red Notice and Don’t Look Up."

4:53 PM ET: Netflix on its international content efforts, which from the looks of things will remain a spending priority: "Netflix is now producing films and TV in more than 50 countries with a high degree of integration in the local entertainment ecosystem resulting in the creation of blockbusters from every region. In fact, three out of our six most popular TV seasons of all time are non-English language titles: Squid Game, La Casa de Papel Part 4 and All Of Us Are Dead, which launched in Q1’22 and has accumulated 561m hours viewed in its first four weeks."

4:51 PM ET: Netflix ended Q1 with $6B in cash and $14.5B in debt. The company says it didn't buy back any stock during the quarter.

4:47 PM ET: Spending continued to grow: On a GAAP basis, marketing spend rose 8% Y/Y to $556M, tech & development (R&D) spend 25% to $657.3M and G&A spend rose 34% to $397.9M.

4:43 PM ET: Netflix's cash content spend (can by lumpy from quarter to quarter) totaled $3.9B in Q1, which the company says was less than expected.

For context, Netflix's 2021 cash content spend totaled $17.5B.

4:39 PM ET: Notably, unlike recent shareholder letters, Netflix's Q1 letter doesn't feature a chart mapping out its weekly global paid net adds. Given the company's Q1 print and Q2 guidance, there's bound to be some interest in how paid net adds trended over the course of Q1.

4:36 PM ET: Notably, Netflix says that in addition to seeing soft customer-acquisition trends in Q1, its customer retention levels was slightly below expectations, though the company insists it's still "at a very healthy level."

Russia's invasion of Ukraine is said to have impacted business in Central/Eastern Europe in March, and Latin American subscriber adds is said to be affected by "a combination of forces," including macro weakness and price hikes.

4:31 PM ET: Netflix on its Q2 guide for a loss of 2M paid streaming subs: "Our forecast assumes our current trends persist (such as slow acquisition and the near term impact of price changes) plus typical seasonality (Q2 paid net adds are usually less than Q1 paid net adds)."

4:30 PM ET: Regarding Q1 paid net adds, Netflix notes the suspension of its services in Russia had a 700K impact on subscriber growth. Thus the company added 500K paid subs globally outside of Russia, and 400K in EMEA.

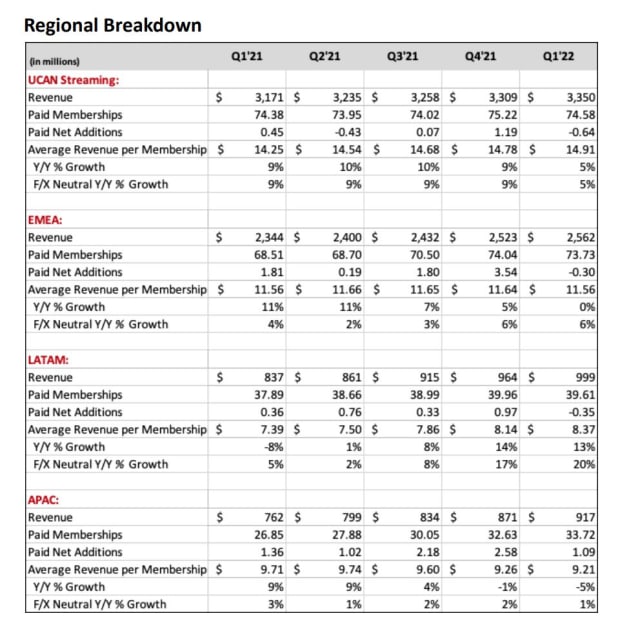

4:26 PM ET: With the help of price hikes, Netflix's average revenue per member (ARM) rose 2% Y/Y in dollars and 6% in constant currency.

ARM rose 5% in the U.S./Canada and EMEA, and 14% in Latin America. It fell 1% in Asia-Pac, where Netflix has been rolling out cheap mobile-only plans in some markets.

4:21 PM ET: Netflix's Q1 performance by region. Notably, the company lost 640K paid subs in the U.S. and Canada (compares with a year-ago gain of 450K), where it recently carried out fresh price hikes.

Paid subs were also shed in EMEA and Latin America, while 1.09M were added in Asia-Pac.

4:19 PM ET: Regarding password-sharing, Netflix says it estimates its services are being shared with 100M+ households, on top of the 222M it counts as paid subs.

The company notes it recently started testing a solution in Latin America that gives paid subs the option to pay for extra member accounts used by other households and suggests it'll make other efforts in this direction.

4:14 PM ET: Shares are now down 22.3% AH, falling to levels last seen in Sep. 2019.

Roku is down 6.4% AH, and Disney is down 3.3%. The Invesco QQQ Trust is down 0.9%.

4:12 PM ET: Netflix blames its subscriber figures on four "inter-related factors": The growth rate of its addressable market, password-sharing, streaming competition and macro factors.

4:09 PM: In spite of its paid net add numbers, Netflix is effectively maintaining its full-year guidance for a ~19%-20% GAAP operating margin. The company also reiterates it expects to remain FCF-positive in 2022 and beyond.

4:07 PM ET: Q1 revenue of $7.87B (+9.8% Y/Y) missed a $7.93B consensus. GAAP EPS of $3.53 beat a $2.90 consensus.

For Q2, Netflix is guiding for revenue of $8.05B (+9.7%) and GAAP EPS of $3.00 vs. a consensus of $8.22B and $3.03.

4:04 PM ET: Here's the Q1 shareholder letter, for those interested.

4:03 PM ET: Netflix: "Streaming is winning over linear, as we predicted, and Netflix titles are very popular globally. However, our relatively high household penetration - when including the large number of households sharing accounts - combined with competition, is creating revenue growth headwinds. The big COVID boost to streaming obscured the picture until recently."

4:02 PM ET: Shares are down 17.3% after-hours to $288.41.

4:02 PM ET: The letter is out. Netflix reports Q1 streaming paid net adds of negative 200K, below a consensus for a gain of 2.5M.

Q2 paid net add guidance is for a loss of 2M subs vs. a consensus for a gain of 2.55M.

4:00 PM ET: Netflix closed up 3.2%. The Q1 letter should be out any minute.

3:55 PM ET: Netflix's stock is up 2.9% today heading into earnings, amid a 2.1% gain for the Nasdaq. But shares are still down 42% YTD. They tumbled in January due to the light Q1 paid net add guidance Netflix provided in its Q4 shareholder letter.

3:52 PM ET: The FactSet consensus is for Netflix to post Q1 revenue of $7.93B and GAAP EPS of $2.90. But subscriber add figures tend to have a bigger impact than revenue/EPS figures on how Netflix moves post-earnings.

Netflix's Q1 paid subscriber net add consensus stands at 2.5M (in-line with Netflix's January guidance). And its Q2 paid net consensus stands at 2.55M.

Of note: In March, Netflix suspended operations in Russia, where the company had ~1M streaming subs.

3:48 PM ET: Hi, this is Eric Jhonsa. I'll be live-blogging Netflix's earnings report (shareholder letter) and video interview.