/Netapp%20Inc%20sign%20in%20San%20Jose%2C%20Ca-by%20Tada%20Images%20via%20Shutterstock.jpg)

NetApp, Inc. (NTAP), situated in San Jose, California, is a global leader in data management and cloud storage solutions, serving enterprises with hybrid and multi-cloud environments. The company, with a market cap of $20.3 billion, provides data storage hardware, software, and services designed to help businesses optimize their digital transformation efforts.

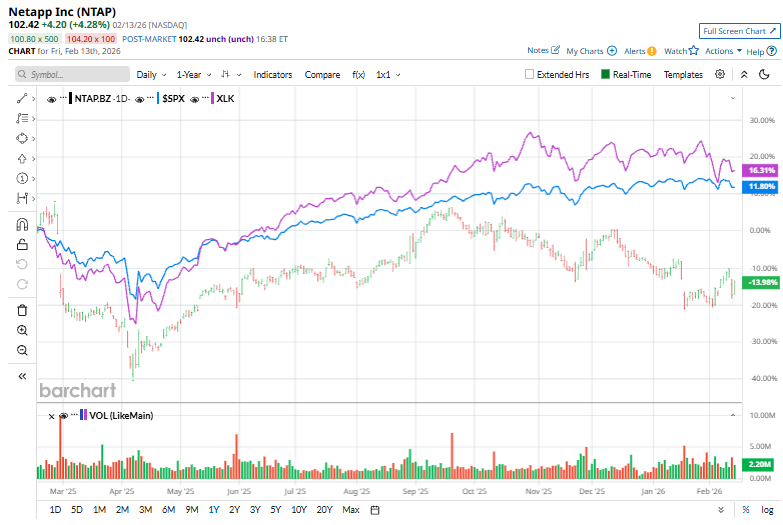

Shares of NetApp have lagged behind the broader market considerably over the past year, declining 13%, while the broader S&P 500 Index ($SPX) has rallied 11.8%. In 2026, NTAP stock is down 4.4%, compared to the SPX’s marginal drop.

Zooming in further, NTAP has also trailed the State Street Technology Select Sector SPDR Fund (XLK). The exchange-traded fund has gained 16.7% over the past year and has observed a 3.1% drop this year.

On Feb. 13, NetApp rose 4.7% following softer-than-expected U.S. inflation data for January, which reinforced expectations of multiple Federal Reserve rate cuts later in the year. The prospect of lower borrowing costs and improved economic activity lifted equities broadly, with interest-rate-sensitive technology and infrastructure names like NetApp benefiting from the positive market reaction.

For the current fiscal year, ending in April 2026, analysts expect NTAP’s EPS to grow 10.2% to $6.38 on a diluted basis. The company’s earnings surprise history is mixed. It beat or met the consensus estimate in three of the last four quarters while missing the forecast on another occasion.

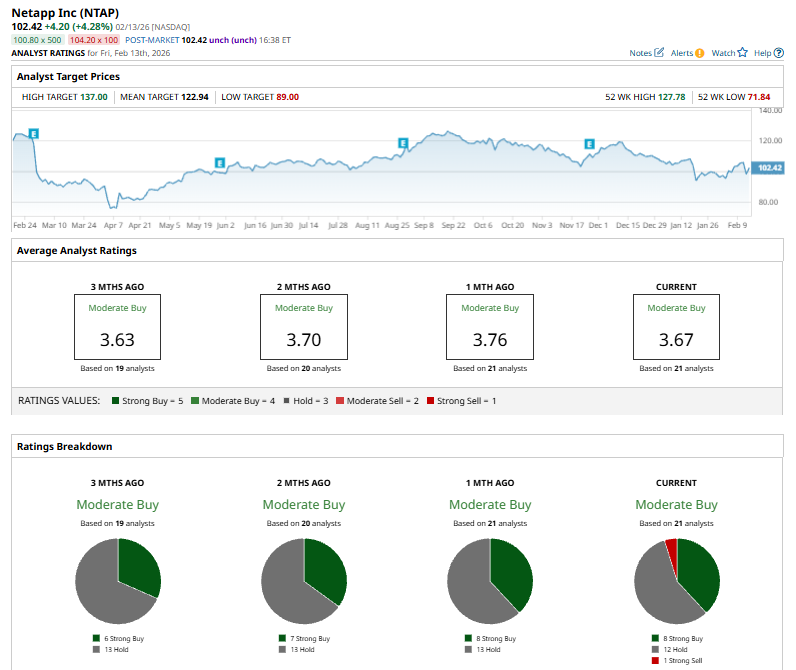

Among the 21 analysts covering NTAP stock, the overall consensus is a “Moderate Buy rating.” That’s based on eight “Strong Buy” ratings, 12 “Holds,” and one “Strong Sell.”

This configuration is less bullish than two months ago, with seven analysts suggesting a “Strong Buy.”

Analysts' views on NetApp diverged in January. On Jan. 20, Morgan Stanley’s Erik Woodring downgraded the stock to “Underweight” from “Equal-Weight” and cut the price target to $89 from $117, citing CIO survey data showing the slowest hardware budget growth in 15 years and rising demand sensitivity to cost inflation. Earlier, on Jan. 13, Goldman Sachs’ Katherine Murphy initiated coverage with a “Buy” rating and a $128 target, highlighting NetApp’s strong positioning to sustain leadership in the expanding all-flash storage market.

The mean price target of $122.94 represents a 20% premium to NTAP’s current price levels.