9 analysts have shared their evaluations of Dow (NYSE:DOW) during the recent three months, expressing a mix of bullish and bearish perspectives.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 4 | 5 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 1 | 0 | 0 | 0 |

| 2M Ago | 0 | 1 | 2 | 0 | 0 |

| 3M Ago | 0 | 1 | 3 | 0 | 0 |

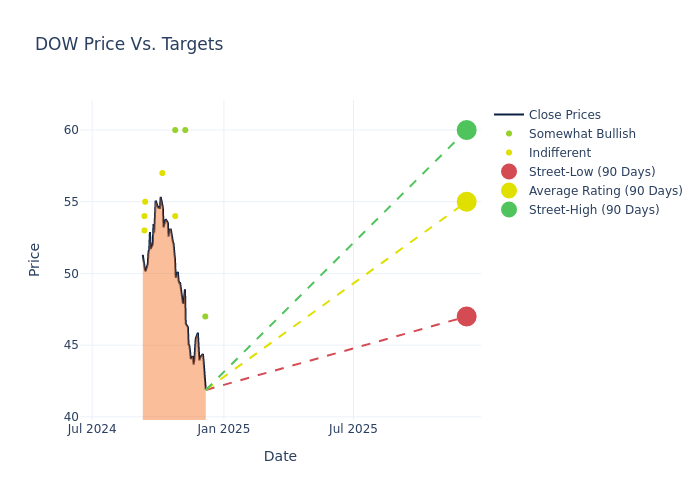

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $55.0, a high estimate of $60.00, and a low estimate of $47.00. Experiencing a 6.26% decline, the current average is now lower than the previous average price target of $58.67.

Understanding Analyst Ratings: A Comprehensive Breakdown

The standing of Dow among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Jeffrey Zekauskas | JP Morgan | Lowers | Overweight | $47.00 | $55.00 |

| Charles Neivert | Piper Sandler | Lowers | Overweight | $60.00 | $62.00 |

| Michael Sison | Wells Fargo | Lowers | Overweight | $60.00 | $62.00 |

| John McNulty | BMO Capital | Lowers | Market Perform | $54.00 | $57.00 |

| Michael Leithead | Barclays | Lowers | Equal-Weight | $57.00 | $58.00 |

| Jeffrey Zekauskas | JP Morgan | Lowers | Overweight | $55.00 | $60.00 |

| Arun Viswanathan | RBC Capital | Lowers | Sector Perform | $55.00 | $57.00 |

| Frank Mitsch | Fermium Research | Lowers | Hold | $54.00 | $60.00 |

| David Begleiter | Deutsche Bank | Lowers | Hold | $53.00 | $57.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Dow. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Dow compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Dow's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Dow's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Dow analyst ratings.

Get to Know Dow Better

Dow Chemical is a diversified global chemicals producer, formed in 2019 as a result of the DowDuPont merger and subsequent separations. The firm is a leading producer of several chemicals, including polyethylene, ethylene oxide, and silicone rubber. Its products have numerous applications in both consumer and industrial end markets.

A Deep Dive into Dow's Financials

Market Capitalization Analysis: With a profound presence, the company's market capitalization is above industry averages. This reflects substantial size and strong market recognition.

Revenue Growth: Dow's revenue growth over a period of 3 months has been noteworthy. As of 30 September, 2024, the company achieved a revenue growth rate of approximately 1.39%. This indicates a substantial increase in the company's top-line earnings. When compared to others in the Materials sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Dow's net margin excels beyond industry benchmarks, reaching 1.94%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Dow's ROE excels beyond industry benchmarks, reaching 1.15%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Dow's ROA excels beyond industry benchmarks, reaching 0.36%. This signifies efficient management of assets and strong financial health.

Debt Management: Dow's debt-to-equity ratio stands notably higher than the industry average, reaching 0.98. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

The Basics of Analyst Ratings

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.