The national insurance increase is “going ahead”, a Government minister has said following reports the Prime Minister is “wobbling” over the planned tax rise to boost health funding.

Boris Johnson is under pressure from some Conservative MPs to scrap the tax hike to win back support as he awaits the findings of the report from senior official Sue Gray into claims of lockdown-busting parties held in Downing Street.

The Times cited a Government source as saying Mr Johnson is “wobbling” over the increase – designed to tackle the Covid-induced NHS backlog and reform social care – as he considers delaying the policy for 12 months to appease critics on the right of the party.

They reportedly said: “He’s wobbling, I think he would do anything to survive.”

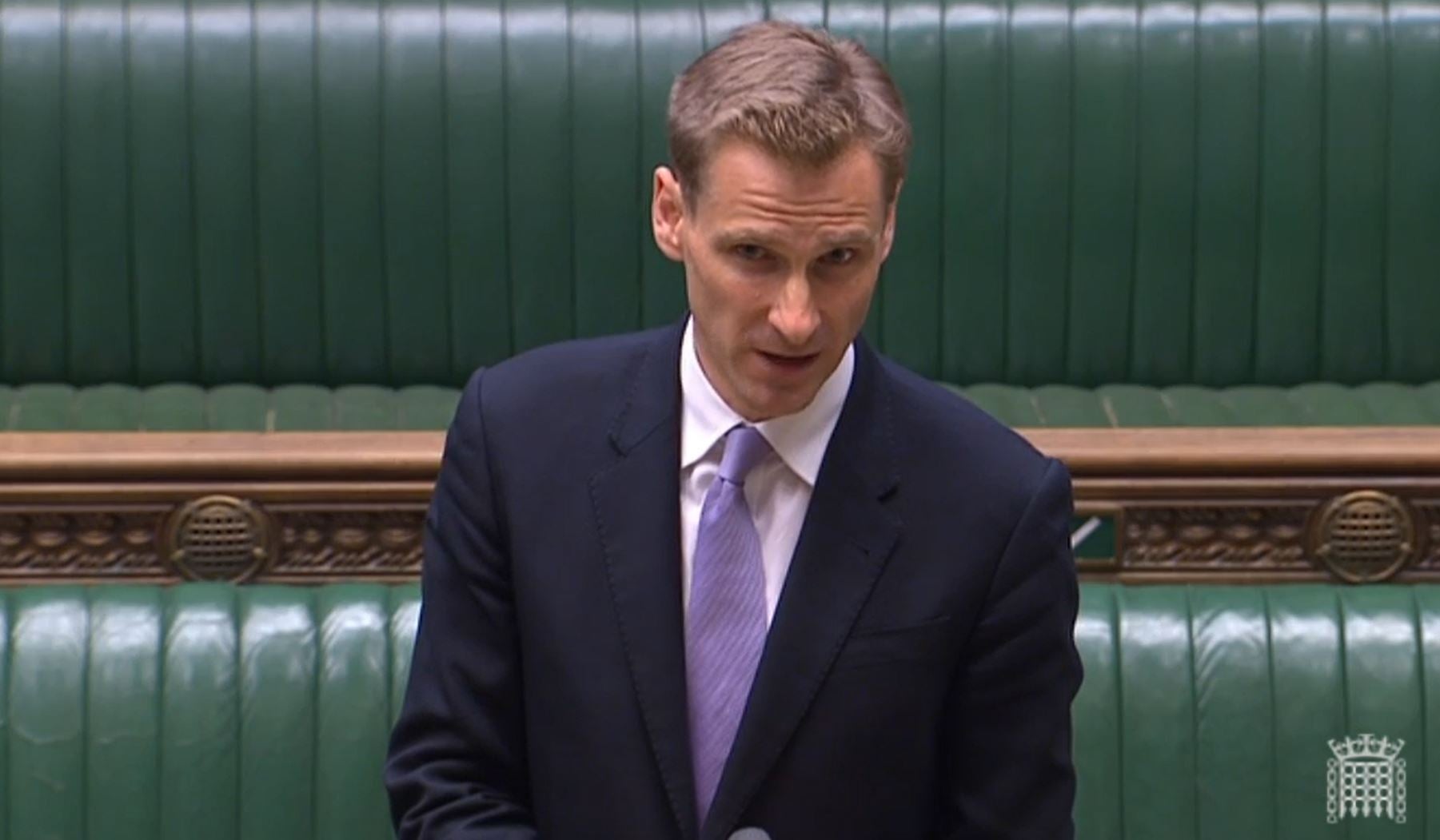

But technology minister Chris Philp denied any delay is being considered, telling Sky News the 1.25 percentage point increase is “going ahead” as proposed.

Asked separately on LBC whether he had been given a sense that the national insurance rise could be delayed, Mr Philp said: “No, the plan is to proceed as intended.

“We all, I think, acknowledge that the NHS needs extra money to recover from the pandemic – this delivers that funding increase, so it is the right thing to do.”

Mr Philp said the manifesto-breaking tax increase, and subsequent introduction of the health and social care levy from 2023, will provide £36 billion over three years to fund the NHS and social care.

With the highest earners due to pay the most and 6.5 million people on the lowest incomes not expected to pay a “single penny extra”, the minister described the tax as a “proportionate way of finding that money”.

When quizzed on the policy on Thursday, the Prime Minister did not give a guarantee the increase would be enacted but called the need to raise funding for health and care services “absolutely vital”.

In April, national insurance is due to rise by 1.25 percentage points for workers and employers.

From 2023, it is due to drop back to its current rate, with a 1.25% health and social care levy then applied to raise funds for improvements to care services.

Political opposition to the change has come from all sides of the Commons, as MPs fear the impact that cost of living pressures could have on stretched household budgets.

Inflation is at a 30-year high after the coronavirus pandemic and the energy price cap is due to lift in the spring, possibly increasing bills by 50%.

Tory MP Robert Halfon said the Government should look at different ways to support struggling families, including possibly cutting overseas aid, rather than ploughing ahead with the NI bump.

The Commons Education Committee chairman told BBC Radio 4’s Today programme that ministers should look at introducing “windfall taxes on businesses” or “possibly… increase capital gains tax” to replace the £12 billion per year that the new levy is forecast to produce.

“I would like to see the £4 billion they have saved from cutting overseas aid… to use that to cut taxes for the lower paid as well,” he added.

Mr Halfon’s concerns come after MPs on the Treasury Committee warned the rise in employer national insurance contributions would contribute to an increase in inflation.

Committee chairman Mel Stride has urged ministers to use the findings of its report, released on Thursday, as cover to delay the move by 12 months, arguing Chancellor Rishi Sunak has £13 billion of “headroom” in his fiscal plan due to better-than-expected economic growth.

Labour has regularly voiced criticism of the rise, with shadow chancellor Rachel Reeves brandishing it “the wrong tax at the wrong time” in an interview with Today.

Ms Reeves signalled that Labour would take a different approach by asking “those with the broadest shoulders to make the contribution”, as she called the upcoming hike “a tax on ordinary working people and on jobs”.

She added: “There are people who could afford to pay a bit more tax. I think that is the right approach.”

Sir Ed Davey, leader of the Liberal Democrats, said: “The Government needs to stop faffing about and just scrap this deeply unfair and untimely tax hike.

“Every day, eye-wateringly high energy bills are arriving through letterboxes, while the prices of other basics like food are soaring too. Rishi Sunak’s tax hike will be the last straw for millions of people.”