The Nasdaq has been a surprising laggard vs. the S&P 500. Generally it’s the other way around — and that's not too surprising.

However, over the past year the Nasdaq is up just 10.6% vs. the S&P 500’s gain of 20.95%.

Further, the S&P 500 is only down 4.3% from its all-time high, while the Nasdaq is down 9.1% — more than double the decline.

At the close on Wednesday, the Nasdaq was down 10.7% from its all-time high (made in December). That officially put it in correction territory.

For what it’s worth, a 20% decline is what it would take to consider the index to be in bear market territory — something growth stocks are unfortunately quite familiar with.

The Nasdaq has been underperforming the S&P 500 and the Dow on the downside all year, as rising rates continue to scare investors.

It doesn't help when more than one-third of Nasdaq stocks have already fallen by a whopping 50%.

Trading the Nasdaq

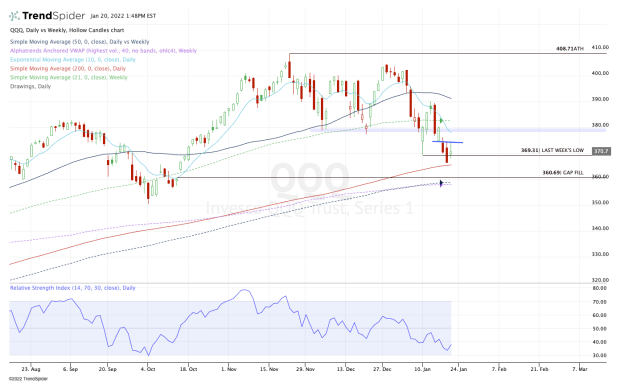

Chart courtesy of TrendSpider.com

When trading the Nasdaq, let’s look at the Invesco QQQ Trust ETF (QQQ) because it’s the most accessible among investors.

Looking at the QQQ ETF, it came incredibly close to tagging the 200-day moving average. It’s too bad it didn’t gap down this morning to this level. It would have been much healthier price action.

Instead, we’re getting a gap-up and while the Nasdaq was trading well for the first few hours of the day, it’s trading quite poorly in the afternoon.

Even with today’s rally, the $374 to $375 area has been resistance. If the QQQ can’t stay above the $369.31 level, it will lose last week’s low.

That puts a weekly-down rotation in play and thus puts Wednesday’s low in play, along with the 200-day.

Should these measures fail to support the QQQ ETF for anything more than a temporary bounce, it could put the $360.69 gap-fill in play.

A move below that could open the door to the $358 to $359 zone, where the QQQ finds its 50-week moving average and the weekly VWAP measure.

As for the upside, the QQQ obviously has to push through recent resistance, which has been in the $375 area.

Above that opens the door to the declining 10-day moving average and the prior support zone between $377 and $379. Over $380 and the 21-week moving average could be in play.