TrendForce's latest report indicates that spot prices for both DRAM and NAND flash memory are unlikely to increase soon due to two reasons. First, there's plenty of inventory on the market. Second, the Chinese government's recent actions against smuggling of refurbished DRAMs has had a further effect on DRAM prices.

In the DRAM market, spot prices continue decline, in a stark contrast to contract prices. This happens because of excessive inventory levels at module houses, which tend to buy DRAMs on the spot market. Also, weak consumer product markets contribute to the declining prices as makers of hardware do not need more memory than they already have and do not by on the spot market.

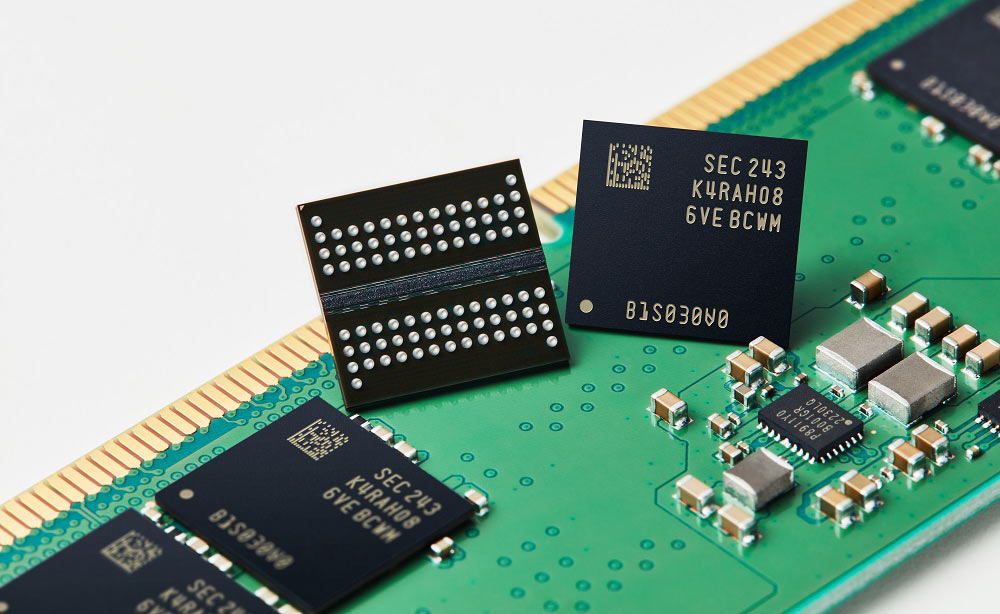

Another major factor that contributes to the decline is the crackdown on smuggling in the Chinese market, which has caused reballed DRAM chip prices to drop further. Reballing is a technique used to repair DRAM chips by replacing the solder balls on the chip's underside, which are used to connect the chip to a circuit board. In many cases, this makes them work again, but such chips are not as reliable as new DRAM.

Back to pricing. Since the end of May an average spot price of DDR4 1Gx8 2666MT/s chip decreased by 2.54%, falling from $1.881 to $1.835 in the past week alone. While the decreases may not seem significant, they are consistent.

Similarly, the spot NAND flash market is experiencing weak transactions due to sufficient inventory levels at SSD makers (some of which produce the world's best SSDs), preventing a revival of demand despite price reductions by spot suppliers. This has already led to a continued divergence between spot and contract prices. Also, there is uncertainty regarding potential demand for inventory replenishment in Q3 2024. Notably, the spot price of a 512Gb 3D TLC NAND wafer dropped by 0.57% this week, reaching $3.309.

In general, both DRAM and NAND flash sport memory markets face significant challenges in terms of pricing due to soft demand. TrendForce does not expect price recoveries in the short term due to market dynamics and external pressure, such as government crackdowns.

Just earlier this week we reported that Kioxia ceased cutting production of its 3D NAND memory and is set to increase output, potentially to boost market share. This move alone could have major implications on 3D NAND supply and price.