/Motorola%20Solutions%20Inc%20smartphone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

The Chicago, Illinois-based Motorola Solutions, Inc. (MSI) delivers mission-critical communications, advanced video security, and command center technologies. With a market cap of around $76.9 billion, it builds two-way radios, network infrastructure, video surveillance systems, analytics engines, software platforms, and recurring support services.

Over the past 52 weeks, MSI stock has edged down marginally, while the S&P 500 Index ($SPX) gained 11.8%, creating a visible performance gap. However, year-to-date (YTD), MSI stock has rebounded sharply, jumping 20.5% as the broader index slipped marginally.

When compared with its sector benchmark, the State Street SPDR S&P Telecom ETF (XTL) has gained 56.8% over the past 52 weeks and 14.8% in 2026, thereby surpassing Motorola’s performance.

On Feb. 12, just a day after the company released its Q4 fiscal 2025 results, MSI stock jumped 7.7%, owing to better-than-expected top and bottom-line figures. Revenue increased 12.3% year over year to $3.38 billion, surpassing analyst expectations of $3.34 billion. Adjusted EPS climbed 13.6% to $4.59 from the prior-year figure, beating the $4.35 Street estimate.

Management credited the performance to strong demand across both the Products and Systems Integration segment and the Software and Services segment.

Looking ahead, they have anchored their outlook in a healthy backlog, accelerating cloud adoption within Command Center software, and the rollout of new artificial intelligence (AI) Assist Suites for public safety agencies. For fiscal year 2026, they expect revenue of approximately $12.7 billion and non-GAAP EPS between $16.70 and $16.85.

On the other hand, analysts forecast fiscal 2026 diluted EPS of $14.76, reflecting an 8.1% year-over-year growth for the year ending in December. The projection carries added credibility because Motorola has exceeded EPS estimates in each of the four trailing quarters.

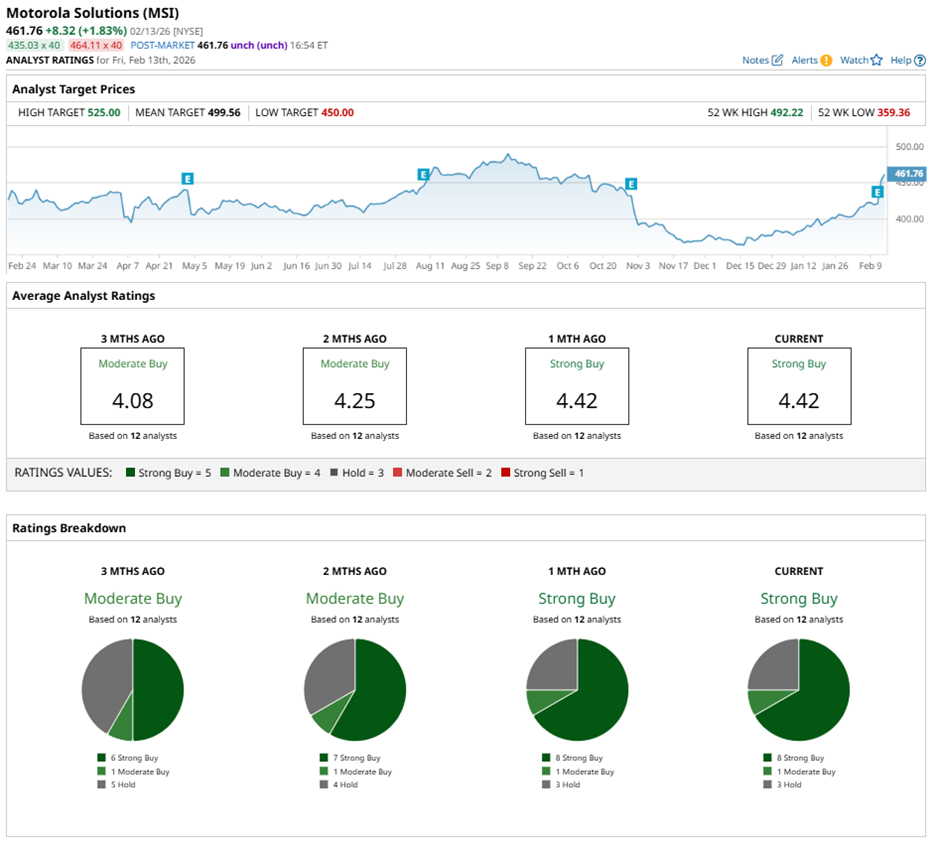

Wall Street currently assigns MSI stock an overall rating of “Strong Buy.” Among 12 analysts, eight have issued a “Strong Buy,” one recommends “Moderate Buy,” while three maintain a “Hold.”

Notably, current analyst sentiment has strengthened from three months ago, when only six analysts held a “Strong Buy” view.

The improving outlook gained further reinforcement on Feb. 12, when JPMorgan analyst Joseph Cardoso reiterated an “Overweight” rating on MSI stock and lifted the price target from $515 to $520.

Viewed collectively, these targets offer a concise snapshot of Street expectations. The mean price target of $499.56 suggests potential upside of 8.2%. Meanwhile, the Street-high target of $525 signals a gain of 13.7% from current levels.