Buyers are facing further mortgage turmoil as UK markets react to signs of spiralling inflation, which could cause a knock-on effect for renters.

Interest rates are expected to rise to 6 per cent after wages spiked at a record pace in the latest official figures from the Office of National Statistics (ONS).

Data showed that wages in the UK are rising quicker than expected, mounting pressure on the Bank of England (BoE) to respond next week.

Yields on short-term government bonds, used to set customer borrowing rates by lenders, have spiked even higher than during Liz Truss’ disastrous mini-Budget.

ONS figures released on Tuesday show UK wages grew at their fastest pace on record, excluding the pandemic period, in the three months to April this year – at a clip of 7.2 per cent, following a rise in the national minimum wage.

Much speculation surrounds the response of the Monetary Policy Committee, with suggestions they may opt for a 0.5 percentage increase on the existing rate of 4.5 per cent.

Governor Andrew Bailey told peers in an assessment of the situation today: “As I’m afraid this morning’s numbers illustrated, we’ve got a very tight labour market in this country.”

Ministers admitted the rising rates were a cause for concern but added that inflation was the “number one enemy”, and essential to tackle.

While rates continue to increase, the number of mortgage products available continues to fall, with many lenders pulling the country’s biggest banks and building societies have been pulling loans.

Santander became one of the latest lenders to temporarily pull mortgage deals for new lenders, as a BoE policy maker warned interest rate rises “cannot be ruled out”.

Major bank HSBC and Nationwide Building Society also pulled loans, though the former now selling mortgages through brokers, though rates have increased by 0.10 to 0.15 percentage points.

“Lenders should be prepared to help out mortgage holders who get into financial difficulties due to rising rates,” Downing Street has said.

The situation is set to cause more misery for Britons, already facing a cost of living crisis fuelled by rising inflation.

Renters are also expected to bear the brunt of rising rates, with concerns that dwindling profits could see a mass departure of landlords and properties from the market.

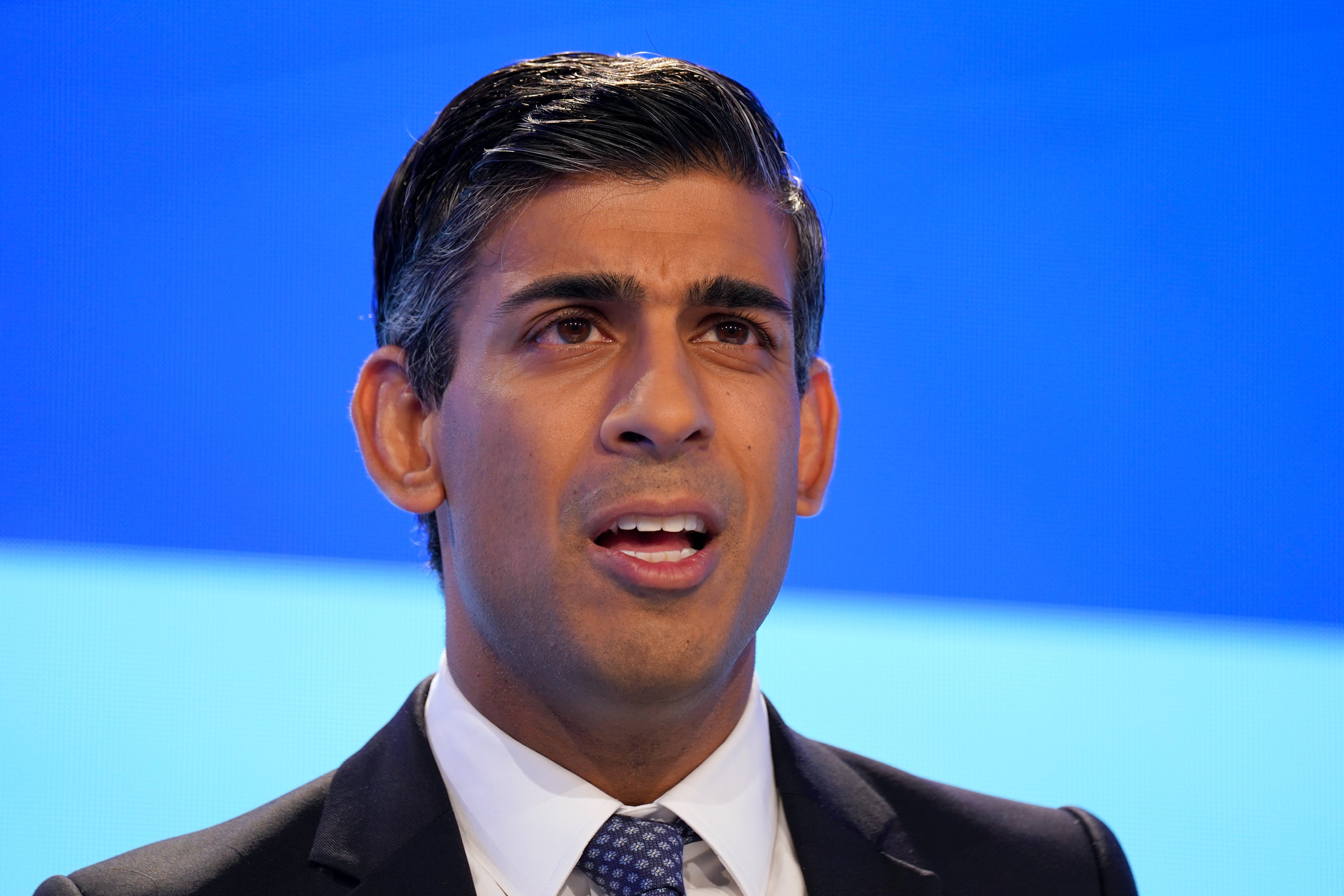

The prime minister said the “single biggest thing” the government could do was work with the Bank of England to bring down inflation. “There [does] remain a large range of mortgage deals available to the public, but we know this current situation may be concerning for some homeowners and mortgage holders.

“The chancellor has made clear his expectation that lenders should live up to their responsibilities and support any mortgage borrowers who are finding it tough right now. For our part, alongside the work on inflation, we are providing £3,300 per household to help with rising costs.”

Asked what sort of help could be offered to struggling households, the spokesperson said “pricing and availability of mortgage products is a commercial decision for lenders” but “we do encourage them to help people who are struggling right now, as the government is doing on its part”.