Further “modest” interest rate hikes will likely be needed to cool soaring inflation, but the crisis between Russia and Ukraine has clouded the outlook, according to a Bank of England deputy governor.

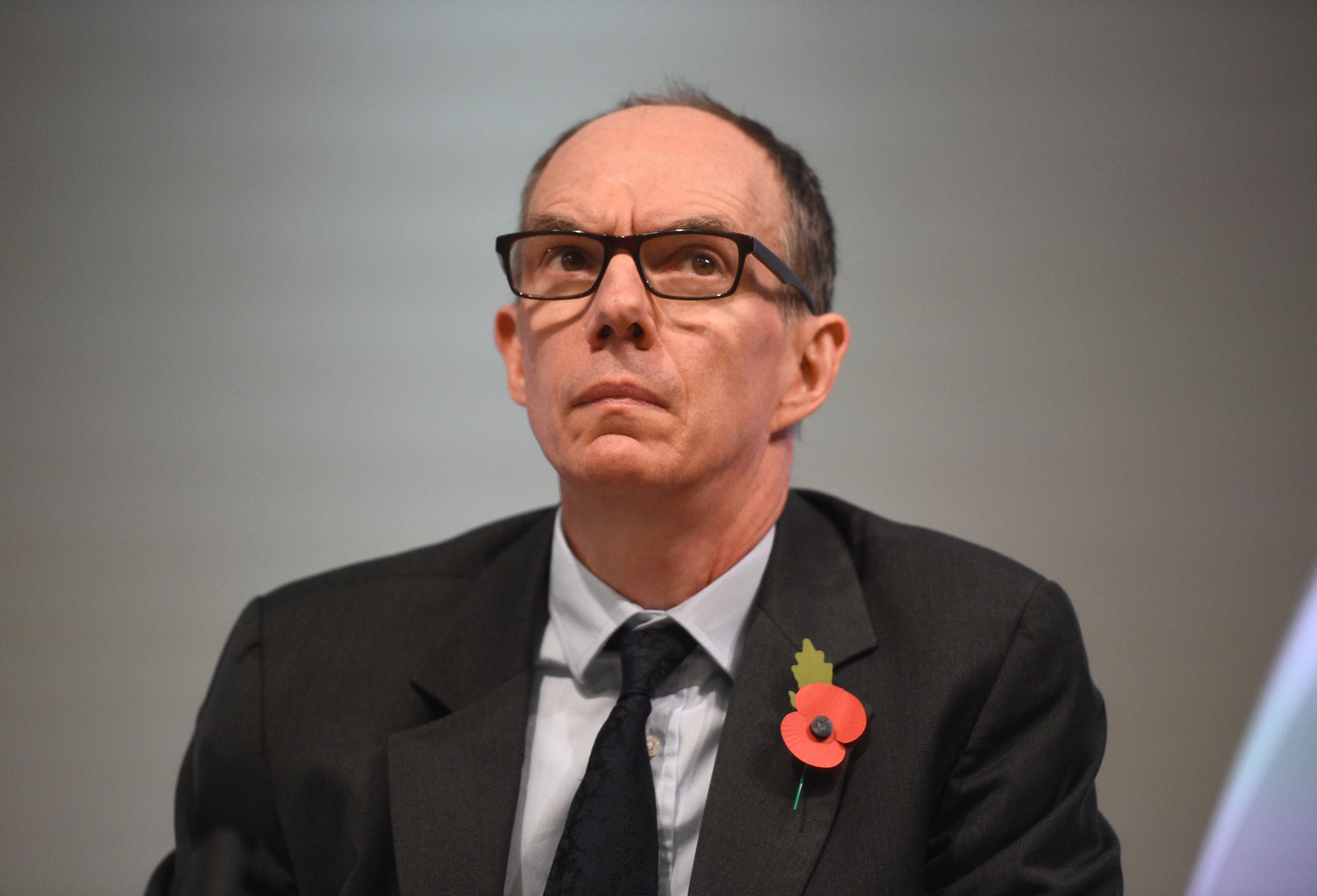

Sir Dave Ramsden – deputy governor for markets, banking and resolution – said more rate hikes are set to be on the cards in the coming months as the Bank faces its biggest inflation challenge since being made independent in 1997.

He said rates were not expected to reach levels seen before the financial crisis or the historical heights endured in previous inflation spirals, but cautioned that “things might turn out differently” as events in Ukraine unfold.

The Bank raised rates to 0.5% from 0.25% earlier this month after an increase at its previous meeting in December.

Sir Dave was one of four members on the Bank’s Monetary Policy Committee (MPC) who were outvoted in calling for a bigger rise to 0.75%, given fears over rocketing inflation.

The Bank made it clear at the time that more rises would be needed to rein in inflation, which has risen to a near 30-year high of 5.5% and is set to peak at an eye-watering 7.25% this April.

In a speech to the National Farmers’ Union Annual Conference in Birmingham, Sir Dave said: “Some further modest tightening in monetary policy is likely to be appropriate in the coming months.

“The word ‘modest’ is significant here though – I do not envisage the Bank Rate rising to anything like its pre-2007 level of 5% or above, let alone to the kind of levels we used to see before the MPC was formed in 1997.”

But he added that there was uncertainty over the rates outlook, especially given the escalating tensions between Russia and Ukraine.

“New shocks can arise – we did not foresee the recent rise in energy prices, and as we meet today the crisis in Ukraine is intensifying – and so we should remain humble about the possibility that things might turn out differently,” he said.

He said the uncertainty over energy prices in particular “makes it particularly difficult to make predictions about where monetary policy might be headed in the medium term”.

Financial markets are pricing in rates peaking at almost 2% by the end of this year, which is far higher than levels the Bank had signalled earlier this month would be needed to get inflation back to the 2% target.

Many economists are expecting rises at the Bank’s next two meetings in March and May.

Sir Dave echoed recent comments made by the Bank that volatile energy prices could see inflation either come in higher or far lower than its predictions.

He said there were also “risks from tightening monetary policy too much”.

“The energy price shock has created a particularly challenging trade-off for the MPC to manage, between strong inflation and weakening growth,” said Sir Dave.

“We will need to remain watchful and responsive to events as they unfold.”