By Matthew Cochrane

Electronic Arts EA creates and distributes games that are played and watched across different platforms. The video game publisher's strategy is to use its portfolio of gaming IP to "create innovative games and content that enables us to build ongoing and meaningful relationships with communities of players, creators, and viewers." This includes incorporating different business models (e.g., subscription services, individual game sales, etc.), distribution channels (e.g., digital downloads vs. physical retail sales), and platforms (mobile, console, and PC), dependent on the preferences of the end customer.

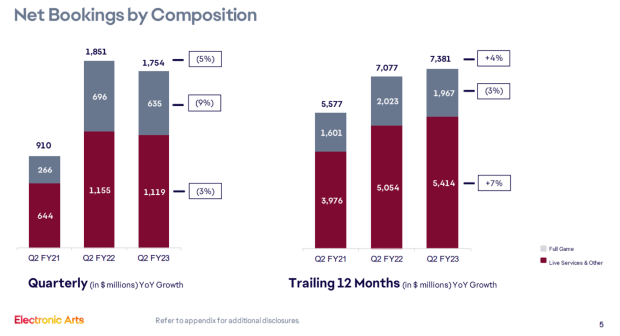

In EA's 2023 Q2, revenue rose to $1.9 billion, a modest 4% increase year over year, and earnings per share grew to $1.07, a 5% gain over 2022's Q2. Live services continue to grow in importance to EA and now represent 73% of total net bookings over the trailing twelve months. (Net bookings is defined as the net amount of products and services sold digitally or in-store). Live services include online game play, extra content, subscriptions, and other revenue generated outside the sale of its games.

Here are the three quarterly highlights that investors need to know:

EA Has a Huge Marvel Videogame Deal

While some of EA's Star Wars games were criticized by fans, they were undoubtedly successful and did not seem to have damaged the company's relationship with Disney DIS. Days before it released its Q3 earnings, EA and Marvel announced a long-term deal for the game publisher to develop three new games using Marvel's superhero IP, with the first being a new Ironman title. During the conference call, COO Laura Miele stated that EA was excited to land the new deal because Star Wars had proven to be a successful way to bring in new players to EA's fold:

So we consider this licensed IP an incredibly important component of expanding, diversifying and casting our net wider to bring new players in. And when we looked at our Star Wars business, as an example, we brought millions of players into our community. And what we realized and have seen is that over 40% of those players have gone on to play other games in our portfolio. So we consider adding licensed IP as a pretty significant engagement model to our overall community as we grow.

Total speculation: Don't sleep on Disney eventually acquiring EA. With EA the owner of some of the best-selling sports games, its past work on Star Wars games, and now this Marvel deal, the synergies with Disney's best IP and ESPN seem apparent.

EA's FIFA Had a Record Launch

In the first week of FIFA 23's October launch, more than 10 million players across more than 200 countries participated in gameplay, making it the biggest launch in EA Sports history. FIFA Mobile's daily, weekly, and monthly active players were all up more than 100% year over year. FIFA unit sales were up 10% versus the comparable launch for FIFA 22, and FIFA Ultimate Team players saw a 6% rise. With the World Cup approaching later this calendar year, EA's management was excited about capitalizing on that exposure by releasing new World Cup content across its console, PC, and mobile games.

Management does not seem concerned about losing the FIFA licensing rights with so many of the leagues' and players' rights locked up in exclusive contracts. CEO Andrew Wilson said:

Across our ecosystem, we've built the world's largest football community with our players, 19,000 athletes, 700 teams, 30 leagues and federations, and more than 300 partners. As we now move into the future with EA SPORTS FC, we have an even greater opportunity to engage the global audience of 3.5 billion football fans. Players will continue to experience everything they love about our games today. The modes, leagues, competitions, clubs, athlete, brands, and more. We'll push the technical boundaries for even greater innovation, immersion, and authenticity. And through more platforms and new modalities, we will reach new football fans all around the world, bringing them into our global community. This is what EA SPORTS FC is all about. In this unique year, with our biggest-ever console and PC title, a deeply engaging worldwide mobile experience, our online PC services in Asia, and now with men's and women's World Cup content coming, we are in an incredible position to unlock a truly extraordinary future with EA SPORTS FC.

EA's Immersive Gaming Community

EA's player network has now surpassed 600 million and continues to grow. More than 200 million are engaged in EA Sports titles. Wilson said it's reasonable to believe that EA's network can grow to one billion players averaging one hour of gameplay daily.

One opportunity Wilson highlighted was fueling sports fans' fandom through immersive activities beyond just games by offering fans additional ways to create, watch, and connect with other fans all year round.

Players who find new communities and forge meaningful connections are much less likely to churn, leaving the game for another title. When players create content, it opens up new ways for other players to engage with the content. Wilson said that over half of the community engages with player-created content.

Do you want your portfolio to outperform the market? Our lead advisors uncover the top 7 opportunities in the stock market each month for our members. Click here to try 7investing for $1.

Is the EA Stock a Buy?

We believe EA deserves a spot on your watchlist. There are several tailwinds that shareholders should benefit from: 1) EA operates in a popular and growing industry; 2) EA owns IP that has shown lasting power and demand; and 3) EA has cultivated and grown its gaming network to more than 600 million global users.

About the author: Matthew Cochrane is a Lead Advisor for 7investing. After investing on his own for years, Matthew began writing articles for the Motley Fool in early 2017, where he made public stock recommendations that, collectively, easily beat the S&P 500 index. He spends most of his time today covering the fintech and payments sector, though he loves looking at interesting opportunities from every corner of the stock market.