Family members fighting over money is a tale as old as the world itself. While some can’t even begin to imagine that happening among those of their kin, in reality, no family is actually immune from disagreements over someone’s wealth.

This redditor’s family was no exception. When her mom passed away without a will, the latter’s husband got all the inheritance, promising to give half of it to the OP. Unfortunately, his words turned out to be nothing more than empty promises.

A person leaving wealth behind can cause troubles between family members

Image credits: Ron Lach / Pexels (not the actual photo)

This woman’s mother passed with no will, leaving the entire inheritance in the hands of her husband

Image credits: cottonbro studio / Pexels (not the actual photo)

Image credits: Vlada Karpovich / Pexels (not the actual photo)

Image credits: HauntedGhostAtoms

Image credits: Tirachard Kumtanom / Pexels (not the actual photo)

Many people haven’t created a will, despite realizing how important it is

While it seems that leaving whatever it is that you have gained or created to those that you love might make their lives easier or better, quite often it has an opposite effect and leads to broken family ties. And unfortunately, it is a situation that many people have found themselves in, even if they never believed that could happen to them.

Some sources note that there has been an increase in inheritance-related feuds reported annually since 1985. A piece in The Wall Street Journal seconds the idea that the number of disputes over family wealth has grown, pointing out that a wave of inheritance has brought a rise in lawsuits related to family assets. According to said piece, more than $84 trillion dollars in wealth has already been, or is set to be, transferred by estates between 2021 and 2045.

Unfortunately, certain valuables—be it money, real estate, or something that has immeasurable sentimental value—can make even the closest of people turn against one another. That’s why it’s crucial to try and solve, or at least discuss inheritance-related matters with your family, despite how uncomfortable it might be.

A survey carried out by LegalShield found that the vast majority of people—as much as 90% of them—understand the importance of having a will, but more than half of them don’t have one nevertheless. The main reason for postponing working on such a document reportedly is not knowing where to begin.

Image credits: Karolina Grabowska / Pexels (not the actual photo)

Having a plan can alleviate the load at an already difficult time

It’s understandably difficult to begin working on such a document like one’s will, as it usually requires discussing the end of your own life or that of your loved one. However, leaving them without one, as the OP’s story shows, can leave them in a quite unfavorable situation. LegalShield’s survey found that nearly six-in-ten people have—or know a person who has—experienced conflict because of a lack of will.

Be it brothers cutting all ties with each other, adult children fighting their stepparents for what they believe is rightfully theirs, or grandchildren dragging their favorite cousins to court for their grandparents’ real estate – no matter the scenario, after such events, families might find it difficult—if at all possible—to recover from the damage that has already been done.

Seeking to avoid or minimize the likelihood of such scenarios, some families manage to talk things through beforehand. The Wall Street Journal reported that even though many families avoid the discussion until a health scare or other stressful life event, close to 30% have already discussed (and more than 40% are planning to do so) the matters related to the family legacy.

Needless to say, having a plan can help not only navigate the intricacies of handling the wealth that is bestowed upon the family members, but also take some weight off of them at an already difficult time. “Everyone handles grief differently, more so when money is involved,” a financial advisor at Granite Financial, Laurie Humphrey, told Investment News. “Having a specific plan in place that is legally binding and determined in advance can help to facilitate the smooth transition of assets, helping to mitigate some of the emotion that occurs during that time.”

Unfortunately, the OP wasn’t left with a will, which resulted in having to trust the word of her late mother’s husband. But when he showed that it wasn’t worth much, the redditor made sure that everyone around him knew how much he was worth himself, after he had pocketed all the inheritance that he promised to share.

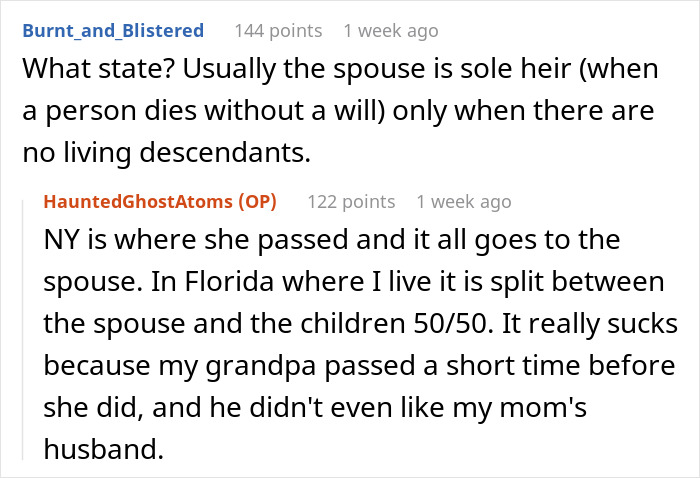

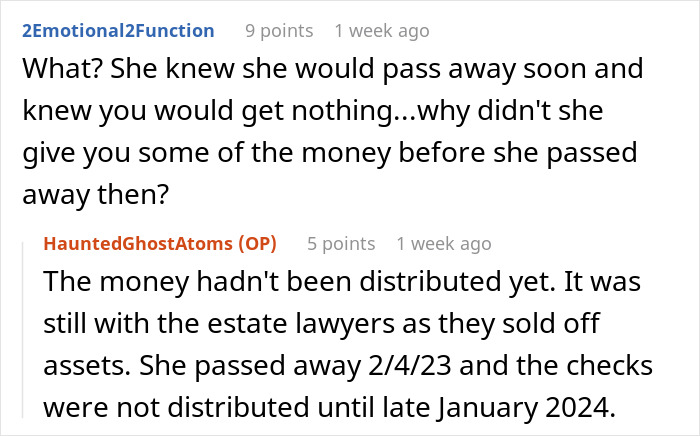

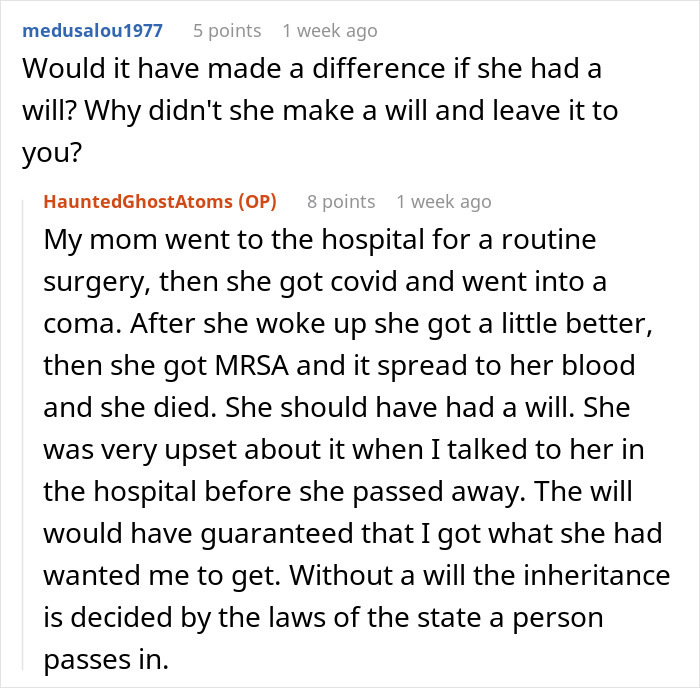

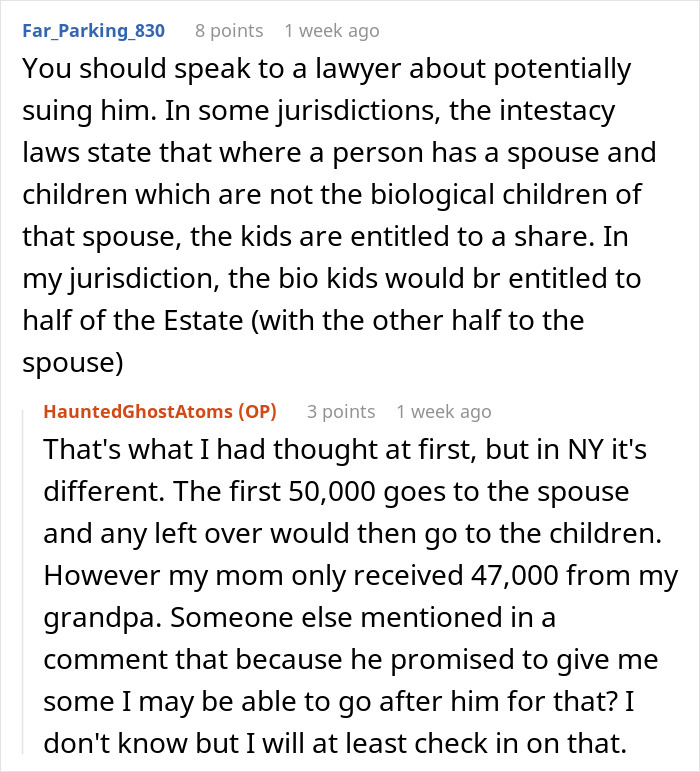

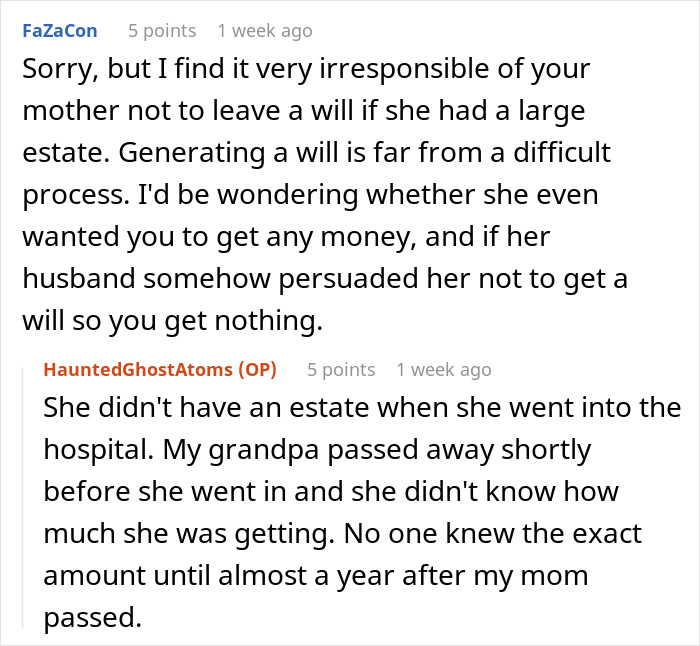

The OP revealed more details in a discussion with fellow netizens

People posed questions and shared advice regarding the matter

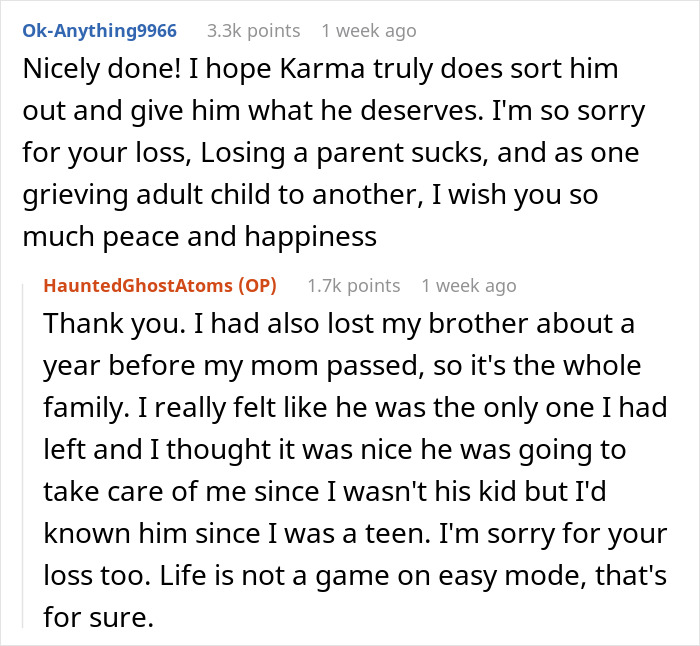

Some did not think the OP had anything to be upset about

Another redditor opened up about a similar situation in their family