Chicago, Illinois-based Molson Coors Beverage Company (TAP) manufactures, markets, and sells beer and other malt beverage products. Valued at a market cap of $10.2 billion, the company offers flavored malt beverages, including hard seltzers, craft spirits, and ready-to-drink beverages.

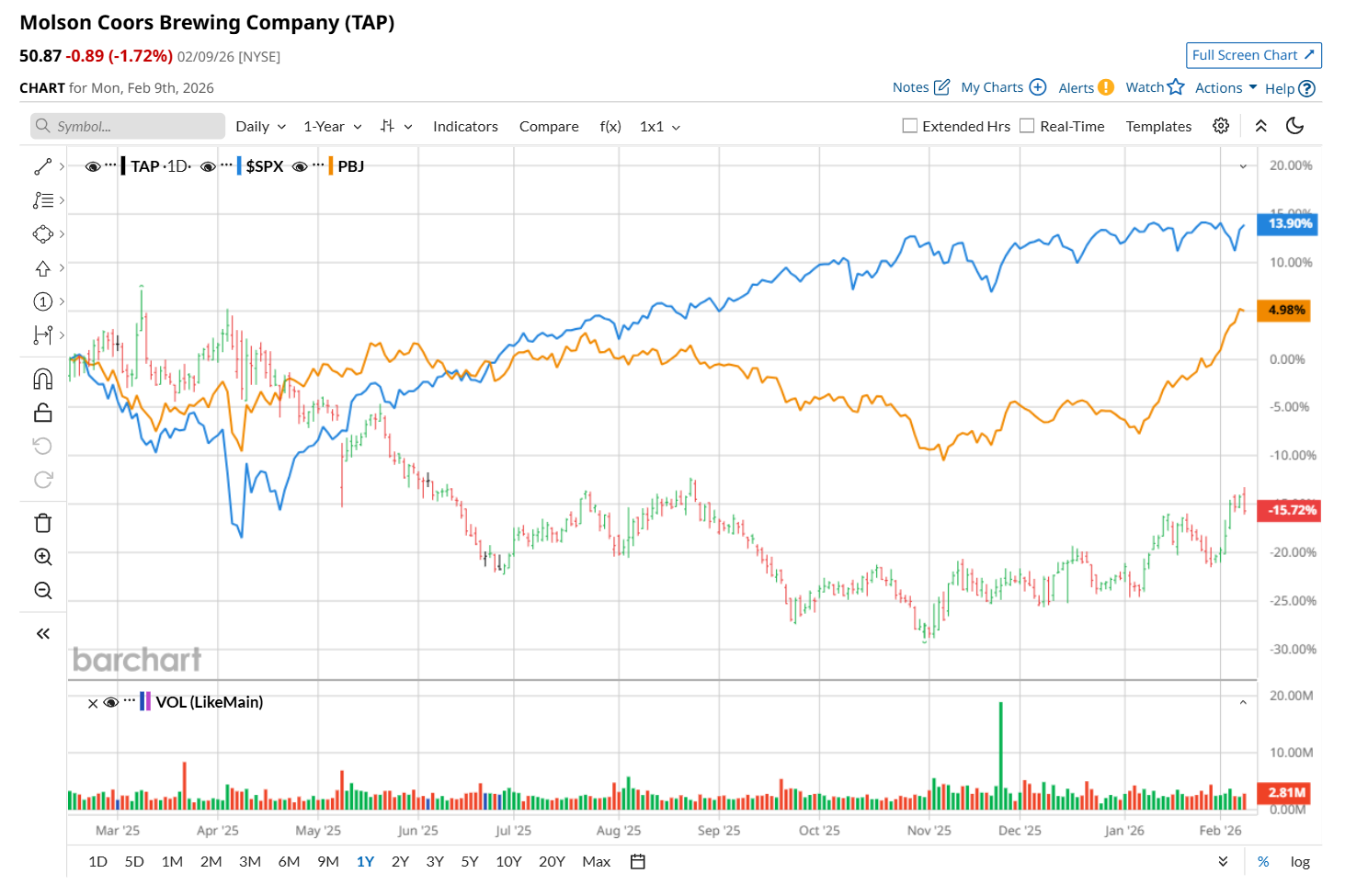

This brewer has lagged behind the broader market over the past 52 weeks. Shares of TAP have declined 6.3% over this time frame, while the broader S&P 500 Index ($SPX) has soared 15.6%. However, on a YTD basis, the stock is up 9%, outpacing SPX’s 1.7% return.

Narrowing the focus, TAP has also underperformed the Invesco Food & Beverage ETF’s (PBJ) 6.1% rise over the past 52 weeks and 11.8% uptick on a YTD basis.

On Nov 4, shares of TAP surged 1% despite reporting weaker-than-expected Q3 results. Due to incremental softness in the industry, the company’s net sales declined 2.3% year-over-year to $3 billion, falling short of Wall Street estimates by 1.7%. Meanwhile, its adjusted EPS decreased 7.2% from the year-ago quarter to $1.67, missing analyst expectations of $1.72. Weak guidance and a tougher competitive landscape continue to weigh on its results.

For the current fiscal year, ending in December, analysts expect TAP’s EPS to decline 9.7% year over year to $5.38. The company’s earnings surprise history is mixed. It exceeded the consensus estimates in two of the last four quarters, while missing on two other occasions.

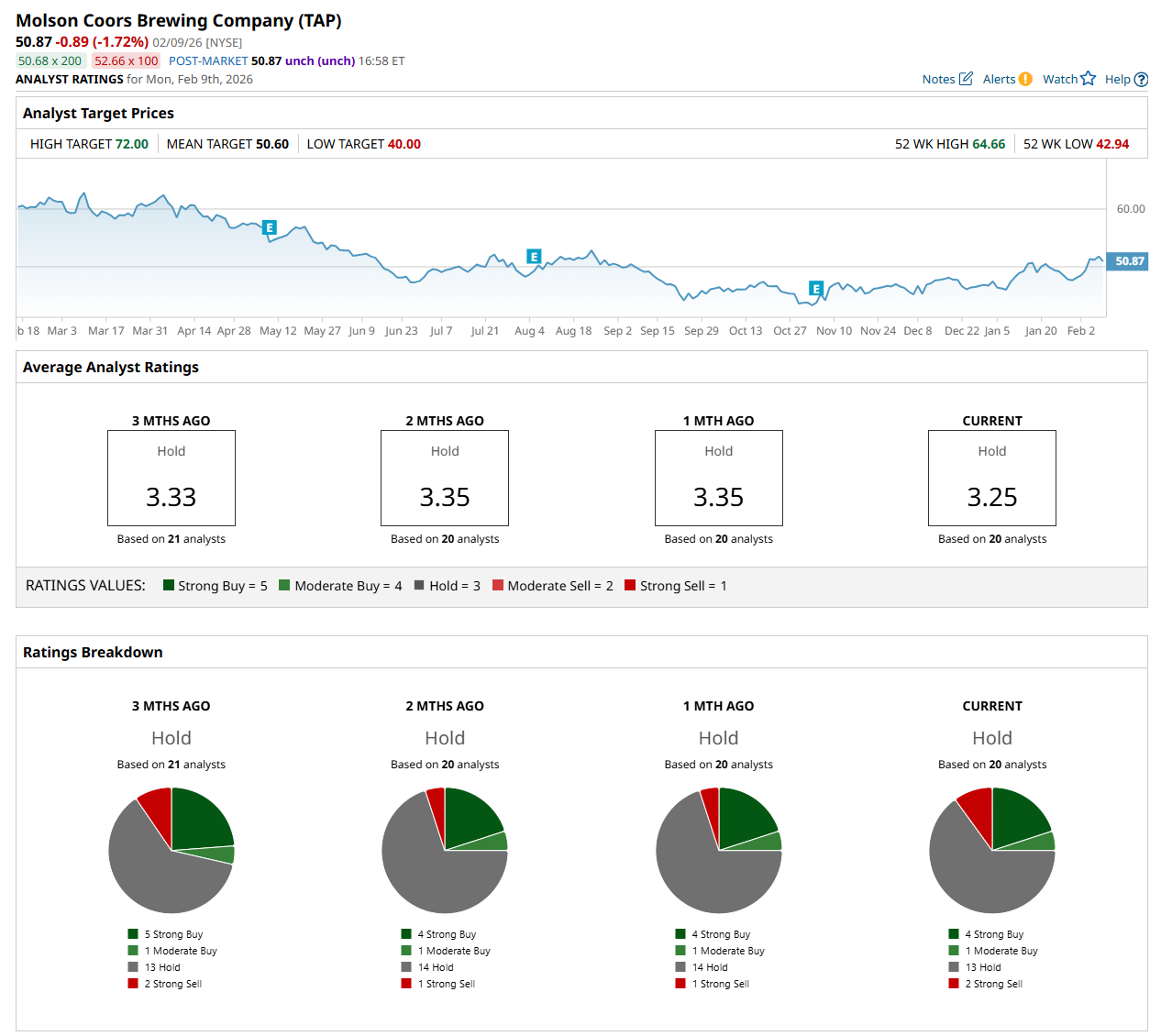

Among the 20 analysts covering the stock, the consensus rating is a "Hold,” which is based on four “Strong Buy,” one “Moderate Buy,” 13 "Hold,” and two “Strong Sell” ratings.

The configuration is more bearish than a month ago, with one analyst suggesting a “Strong Sell” rating.

On Jan. 20, AllianceBernstein Holding L.P. (AB) analyst Nadine Sarwat maintained a "Hold" rating on TAP and set a price target of $50.

While the company is trading above its mean price target of $50.60, its Street-high price target of $72 suggests a 41.5% potential upside from the current levels.