Moderna stock sank Friday after the Food and Drug Administration approved its RSV vaccine, dubbed mResvia, allowing the biotech giant to launch its second-ever product.

RSV, the shorthand for respiratory syncytial virus, causes coldlike symptoms in most people. But it can be serious or even deadly in babies and older adults. Like rivals Pfizer and GSK — which gained their approvals and launched last year — Moderna tested its vaccine in people age 60 and older.

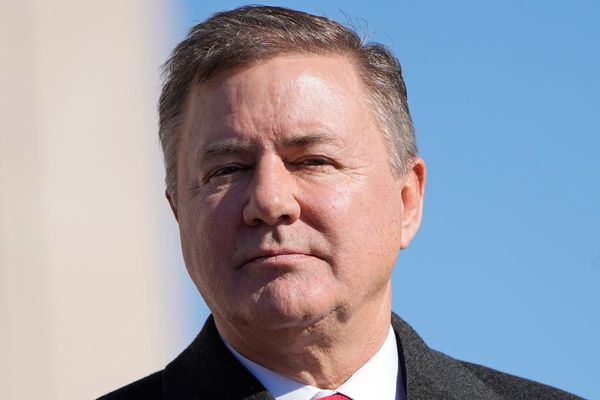

The approval could further validate the messenger RNA, or mRNA, technology that also backs Moderna's Covid vaccine, Spikevax, says Moderna Chief Financial Officer Jamey Mock. These vaccines help the body make a piece of a protein found on the outside of the virus. In response, the immune system creates antibodies to attack it.

"We're super-excited for many reasons," Mock said in an interview before Moderna's first-quarter earnings release. "It's our second product, so I think it helps validate the mRNA, or Moderna, platform. I think it's the second product in the world from an mRNA perspective, so we're encouraged as we anticipate approval in the first half of the year."

Moderna stock fell more than 3% to 146.66 in late morning trades.

Moderna stock has been on a run recently. Shares broke out for the first time in over a year, topping a buy point at 115.89 out of a cup-with-handle base, MarketSurge shows. Moderna shares are now above the chase zone, which runs up to 121.68.

Moderna Stock: A Second Product Launch

Moderna tested its RSV vaccine in 35,541 adults. After a median follow-up time of 112 days — roughly three to four months — the shot proved 83.7% effective against lower respiratory tract disease with at least two signs or symptoms of RSV.

The shot was also 68.4% effective against acute respiratory disease.

William Blair analyst Myles Minter noted trial recipients of Pfizer's and GSK's RSV vaccines — which don't use mRNA technology — experienced Guillain-Barre syndrome following vaccination. Guillain-Barre is a rare autoimmune disorder that impacts the nerves. Surgery or vaccines can trigger it.

The Advisory Committee on Immunization Practices is closely watching for side effects from RSV shots.

"The ACIP still views the benefits of a single RSV vaccination dose as outweighing the potential risks," Minter said in a report. "Moderna noted no incidence of GBS in Study 301 and we believe this could be a key differentiator from available vaccination options."

Minter kept his market perform rating on Moderna stock.

Moderna Touts Prefilled Syringe

CFO Mock says Moderna could also have a leg-up on its competitors. Moderna's RSV vaccine is the only one that uses a pre-filled syringe. This makes the process of vaccinating people much simpler.

"This will mostly be given in a pharmacy," he said. "Those pharmacies are really stretched, particularly in the second half (of the year) when they have to give flu and Covid and RSV (shots). That pre-filled syringe is just so easy for pharmacists to utilize."

The RSV vaccine could be a big moneymaker for Moderna in the future. Moderna stock analysts project just $345 million in sales this year, nearly doubling to $730 million next year. In 2029, sales could top $3.4 billion, according to FactSet.

In comparison, analysts expect Pfizer's Abrysvo to bring in almost $1.3 billion this year, advancing to $2.26 billion in 2029. GSK's Arexvy is projected to generate $1.98 billion and $3.32 billion in those years, respectively.

Similarly, another late-stage product for Moderna, a flu shot, could start out bringing in $142 million this year before growing more than sixfold to $898 million in 2025. In 2029, analysts expect the flu vaccine to bring in $2.75 billion.

Both are part of Moderna's pipeline of 10 late-stage products, Mock said. The company has four respiratory products in development, three in cancer, one in latent diseases and two in rare diseases.

"This mRNA platform is really broadening and diversifying itself with much data to come in across those many candidates across the year," he said.

RS Rating Is On The Rise

Moderna stock has an improving IBD Digital Relative Strength Rating of 96 out of a best-possible 99. This rating pits a stock's 12-month performance against all other stocks. A month ago, Moderna shares had a much lower RS Rating of 23. Six months ago, the RS Rating was a poor 10.

Shares have a lower Composite Rating of 58, meaning Moderna stock ranks roughly in the middle of all stocks when it comes to fundamental and technical measures.

Follow Allison Gatlin on X, the platform formerly known as Twitter, at @IBD_AGatlin.