The stock market is up midday, with a bunch of tech stocks gaining while Nvidia is falling.

The S&P 500 is up 0.8%, and the tech-heavy Nasdaq Composite surged 1%. The Dow Jones Industrial Average increased by 1%, and the Russell 2000 Index climbed 1.2%.

Gross domestic product grew at an annualized rate of 3.0% in the second quarter, revised up from the previously reported 2.8%. The economy expanded at a 1.4% rate in the first quarter. Weekly Initial jobless claims fell to 231,000. Economists were expecting 232,000 claims.

Trending stocks:

All Mag 7 stocks were up except for Nvidia, which lost 4% after it reported earnings on Wednesday.

Best Buy surged 15% and led the S&P 500 index. Dollar General tumbled 30% following earnings miss and weak guidance.

S&P 500 big stock movers today

Five S&P 500 stocks making big midday moves are:

- Best Buy (BBY) +15.1%

- Cooper Companies (COO) +11.4%

- Ge Vernova (GEV) +5.8%

- West Pharmaceutical Services (WST) +5.8%

- CrowdStrike (CRWD) +5.5%

The worst-performing five S&P 500 stocks with the largest midday drop are:

- Dollar General Corp (DG) -29.3%

- Dollar Tree (DLTR) -9.8%

- NetApp (NTAP) -8.2%

- Bath & Body Works (BBWI) -4.2%

- NVIDIA Corp (NVDA) -3.8%

Stocks also worth noting with significant moves include:

Nvidia dips despite earnings beat

Nvidia shares lost 3.8% midday after the AI giant posted its second-quarter earnings yesterday.

For the quarter ending July 28, the company’s adjusted earnings were 68 cents, up 152% from a year ago, beating the consensus estimate of 64 cents. Revenue of $30 billion represented a year-over-year increase of 122%, beating the $28.7 billion expected.

Related: 7 takeaways from Nvidia's big earnings report

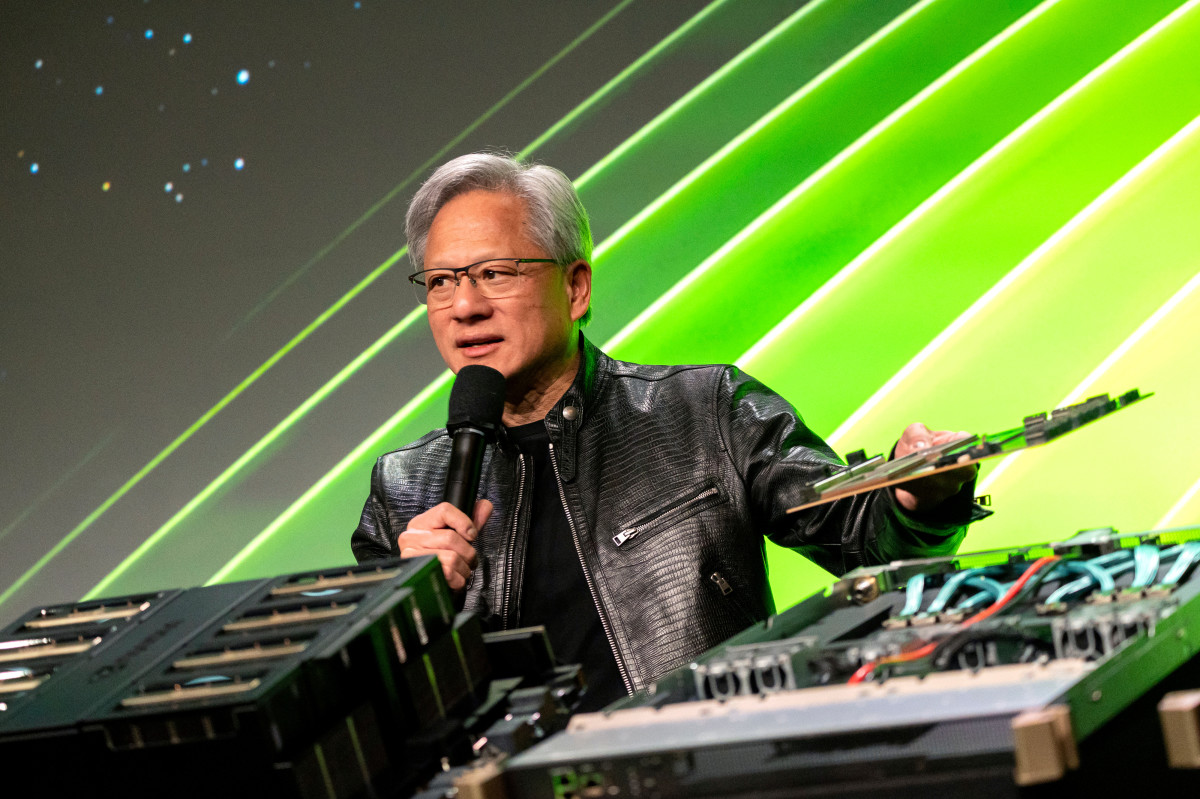

“Hopper demand remains strong, and the anticipation for Blackwell is incredible,” said CEO Jensen Huang, “Blackwell samples are shipping to our partners and customers.” Earlier this month, The Information reported a potential delay in Blackwell's delivery due to design flaws.

Nvidia expects the revenue for the current quarter to be $32.5 billion, topping the $31.7 billion estimated by analysts. However, Bernstein analyst Stacy Rasgon said that the buy-side was expecting a higher range of $33 billion to $34 billion, according to CNBC.

Morgan Stanley said that although the stock’s negative reaction to a strong quarter could fuel cautious sentiment, the upcoming Blackwell launch is expected to be a positive driver throughout the next year, according to thefly.com.

Dollar General stock tumbled after sluggish earnings

Dollar General slumped 30% midday after the company’s earnings and revenue both missed analysts’ forecasts.

The company earned $1.7 per share, a decrease of 20% and missing the $1.79 expected. Revenue for the quarter was $10.21 billion, compared with analysts’ forecast of $10.37 billion. Operating profit decreased 20% to $550 million.

Related: Analyst is "increasingly pessimistic" about Dollar General stock

Dollar General has lowered its FY24 EPS guidance to a range of $5.5 to $6.2, down from the previous range of $6.8 to $7.55.

“We are not satisfied with our financial results, including top-line results below our expectations for the quarter,” said CEO Todd Vasos. “While we believe the softer sales trends are partially attributable to a core customer who feels financially constrained, we know the importance of controlling what we can control.”

On August 13, Loop Capital lowered Dollar General’s price target to $130 from $140 and kept a hold rating ahead of earnings. The analyst is "increasingly pessimistic" about Dollar General's short-term prospects, citing growing macroeconomic pressure on the company's core low-income customers.

Best Buy surged following updated guidance

Best Buy stock jumped 15% after the retailer posted revenue and earnings that beat analysts’ estimates and raised earnings guidance.

The company earned $1.34 per share, up 10% from the expected $1.16. Revenue of $9.29 billion also topped the expected $9.24 billion but represented a 3% decline. Comparable sales dropped 2.3%, the company's best performance on this metric since the fourth quarter of fiscal 2022, CEO Corie Barry said during the earnings call.

More Retail Stocks:

- Costco shares secrets of its treasure hunt plans

- Target delivers unexpected retail sales, fights back against Walmart

- Walmart, Walgreens theft prevention measures causing major issue

The retailer now anticipates full-year adjusted earnings per share between $6.10 and $6.35, up from the earlier range of $5.75 to $6.20. However, the company has reduced the upper end of its guidance for full-year revenue and comparable sales.

“We see a consumer who is seeking value and sales events, and one who is also willing to spend on high price point products when they need to or when there is new compelling technology,” Barry said in a press release.

Related: Veteran fund manager sees world of pain coming for stocks