Stocks edged lower Wednesday as investors reviewed a flood of earnings reports and awaited more from major tech firms.

The S&P 500 lost 0.11%, and the tech-heavy Nasdaq Composite fell 0.2%. The Dow Jones Industrial Average added 0.07%, and the Russell 2000 Index rose 0.5%.

Meta Platforms and Microsoft will report earnings later today, while Apple is up on Thursday.

S&P 500 big stock movers today

Five S&P 500 stocks making big midday moves are:

- Garmin (GRMN) +23.8%

- Smurfit WestRock SW +12.2%

- Dayforce DAY +8.2%

- FMC (FMC) +8.1%

- Dell Technologies (DELL) +8.1%

The worst-performing five S&P 500 stocks with the largest midday drop are:

- Super Micro Computer (SMCI) -33.8%

- Qorvo (QRVO) -27.1%

- DaVita (DVA) -11.6%

- CDW (CDW) -10.2%

- Advanced Micro Devices (AMD) -9.8%

Stocks also worth noting include:

- Nvidia (NVDA) -1.3%

- Tesla (TSLA) +0.7%

- Mete Platforms (META) +0.2%

- Alphabet (GOOGL) +4.1%

- Eli Lilly (LLY) -8.8%

Super Micro Computer plunges after auditor resigns

Super Micro shares tumbled more than 30% after the company said that its auditor, Ernst & Young, had resigned following months of disputes over governance and board independence.

EY stated in its resignation letter that it was "unwilling to be associated with the financial statements prepared by management" and raised concern about the board's lack of independence from CEO Charles Liang.

Related: Veteran analyst delivers candid message about Super Micro stock

Super Micro, which supplies servers to AI heavyweights like Nvidia, AMD and Intel, has not yet filed its 2024 financial statements and is reportedly under federal investigation.

This follows a short-seller report from Hindenburg Research criticizing Super Micro's financial controls.

Alphabet pops on earnings beat

Alphabet gained 4% after the company delivered stronger-than-expected third-quarter earnings.

The search, advertising and cloud-services company reported earnings per share of $2.12, surpassing analysts' projection of $1.85. Revenue reached $88.27 billion, exceeding the forecast of $86.30 billion.

Related: Analysts overhaul Alphabet stock price targets as Google parent soars

Google Cloud stood out with a nearly 35% revenue increase year-over-year, reaching $11.35 billion, driven by heightened demand for its AI offerings. YouTube ad revenue outperformed expectations, hitting $8.92 billion.

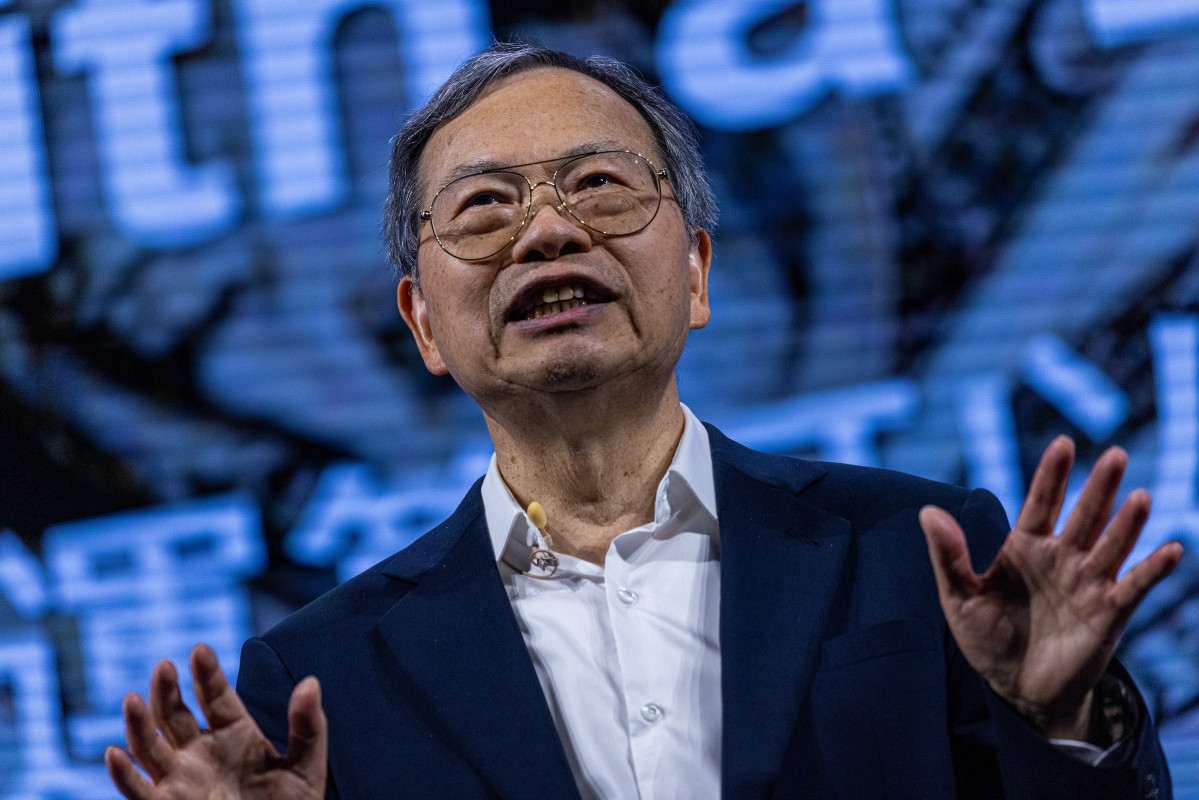

The company continues to benefit from its push into artificial intelligence, with CEO Sundar Pichai noting that Alphabet’s full stack of AI products is now operating at scale and driving results across its services.

"Our commitment to innovation, as well as our long-term focus and investment in AI, are paying off and driving success for the company and for our customers," Pichai said.

Eli Lilly falls after earnings miss

Eli Lilly shares dropped 9% on Wednesday after the company missed third-quarter profit and revenue estimates.

The company earned an adjusted $1.18 a share, falling short of analysts’ forecast of $1.47. Revenue for the period came in at $11.44 billion, below the anticipated $12.11 billion.

The company also slashed its full-year adjusted profit guidance, now expecting earnings of $13.02 to $13.52 per share, down from the previous $16.10 to $16.60.

More Tech Stocks:

- Analysts update Meta stock price target with Q3 earnings in focus

- Analyst updates Tesla stock price target ahead of key robotaxi event

- Analysts update outlook for Nvidia's Blackwell chips amid AI boom

Sales of Zepbound and Mounjaro, Lilly’s weight-loss drugs, were both lower than analysts' projections. CEO David Ricks said the lower sales stemmed from inventory declines among wholesalers rather than supply constraints, CNBC reported.

Despite these challenges, Eli Lilly expects production of these so-called incretin drugs to rise 50% in the second half of 2024, with further expansions planned for 2025.

Related: Veteran fund manager sees world of pain coming for stocks