The stock market is optimistic as investors await the Fed's rate decision. The S&P 500 is up 1.6%, and the Nasdaq Composite is up 2.4% midday. The Dow Jones Industrial Average adds 0.7%, and the Russell 2000 is up 1.1%.

AI has influenced tech stocks in various ways. Nvidia shares surged over 1% midday, boosted by rival AMD, which is up 4% after strong financial results and an improved outlook. But Microsoft slid 2% midday due to its significant spending on AI and unattractive growth in its Cloud segment.

Related: Top analyst puts Nvidia stock on key list after $500 million slump

Investors are also waiting for Meta and Qualcomm's earnings results after Wall Street's closing bell today. The stocks are up 2% and 5% midday, respectively.

S&P 500 big stock movers today

Five S&P 500 stocks making big midday moves are:

- Match Group Inc (MTCH) +14.8%

- Vistra Corp (VST) +13.6%

- Caesars Entertainment Inc (CZR) +12.2%

- Constellation Energy Corp (CEG) +11.5%

- NVIDIA Corp (NVDA) +10.9%

The worst-performing five S&P 500 stocks with the largest midday drop are:

- Humana Inc. (HUM) -9.3%

- Verisk Analytics Inc (VRSK) -8%

- Bunge Global SA BG -7.8%

- CDW Corp (CDW) -5.8%

- Skyworks Solutions Inc (SWKS) -5.2%

Stocks also worth noting with significant moves include:

- Tesla (TSLA) +3.9%

- Advanced Micro Devices (AMD) +4.1%

- Super Micro Computer (SMCI) +5%

- PayPal (PYPL) +3.5%

- Microsoft (MSFT) -1.9%

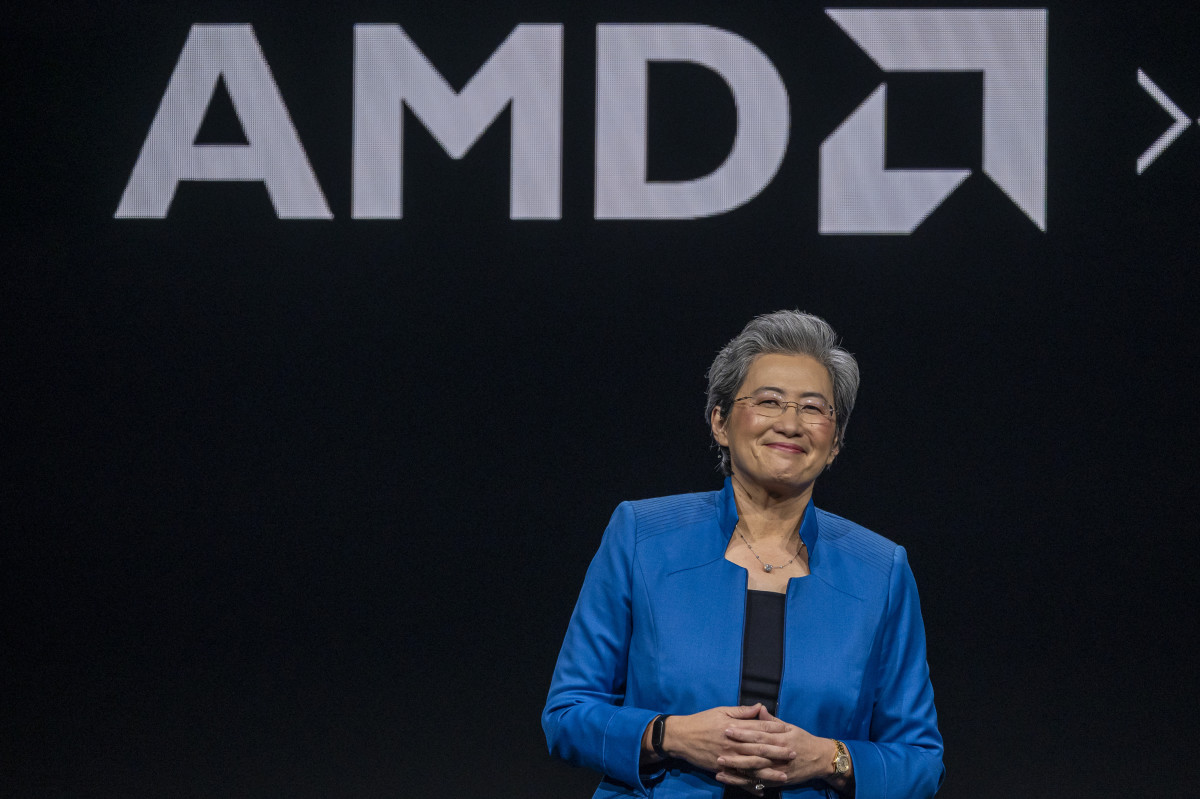

AMD shares rally after positive earnings

Advanced Micro Devices (AMD) shares are up 4% on Wednesday after the company’s strong second-quarter financial report.

Related: Analysts revamp AMD stock price target on AI deal

The chipmaker’s adjusted earnings were $0.69 per share, exceeding the forecasted $0.68. AMD's total revenue reached $5.84 billion, topping the anticipated $5.72 billion. It also provided a stronger-than-expected third-quarter revenue forecast of $6.7 billion, higher than the consensus estimate of $6.6 billion.

AMD said the performance was driven by solid growth in the Data Center and Client segments. It also plans to increase investments in AI.

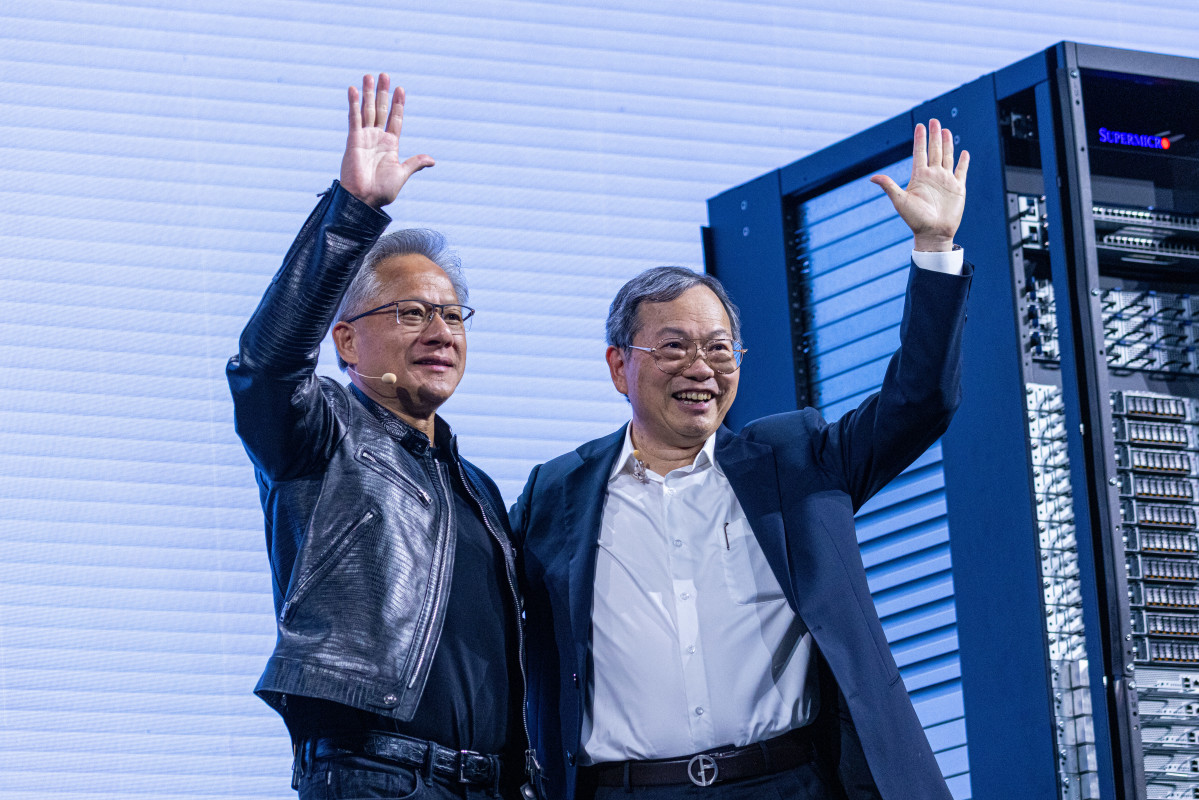

“The rapid advances in generative AI are driving demand for more compute in every market, creating significant growth opportunities as we deliver leadership AI solutions across our business,” said AMD CEO Lisa Su.

Marlboro cigarette maker slumps on earnings miss

Altria Group (MO) stock dropped 4% in morning trading after disappointing second-quarter earnings and full-year guidance.

The Marlboro cigarette maker posted second-quarter adjusted earnings of $1.31 a share on Wednesday, flat from a year earlier and lower than the expected $1.34 a share. The adjusted revenue of $5.28 billion also missed the anticipated $5.4 billion.

The tobacco giant also narrowed its full-year guidance range. It now expects to deliver adjusted diluted earnings in a range of $5.07 to $5.15 per share, compared with its prior outlook of $5.05 to $5.17.

The company wants to lead the transition of adult smokers to "a smoke-free future" while keeping the traditional tobacco business in shape.

"In the second quarter, our companies’ innovative smoke-free products delivered strong share and volume performance, and we hit meaningful milestones that we believe set us up for future success," said Altria CEO Billy Gifford in a press release.

Altria's stock price is up over 15% year-to-date.

Microsoft down despite earnings beat

Microsoft released its fiscal fourth-quarter earnings after the closing bell on Tuesday, beating expectations for earnings and revenue but falling short on cloud revenue.

Related: Microsoft exec warns of an ongoing problem

The $3-trillion tech giant reported earnings per share of $2.95 on revenue of $64.7 billion, higher than the predicted EPS of $2.94 on revenue of $64.4 billion.

Microsoft’s Cloud gross margin decreased by 2% year over year to 69%, driven by a shift in the sales mix to Azure, its cloud computing platform. The company said in the earnings call that Azure AI growth is “the first place to look at” and has been a large driver of capital expenditure.

During the quarter, the company spent $19 billion on cash capital expenditures and equipment purchased under finance leases, an amount equivalent to its annual spending five years ago, according to The Wall Street Journal.

Microsoft's stock is down 1.6% midday. Year-to-date, it is up 12%, while the tech-heavy Nasdaq is up 19%.

Related: Veteran fund manager sees world of pain coming for stocks