The stock market kicked off the week with a big tumble, with the S&P 500 down 2.7% and the Nasdaq Composite down 3.2%. The Dow Jones Industrial Average lost 2.3%. Russell 2000 Index dropped 2.7%. All Mag 7 stocks are down.

Friday’s weak job market data continues to weigh on the market and trigger recession fear. The slump in Nasdaq also reflects investors' doubts about the AI boom and uncertainty about this year's election.

Related: Stock Market Today: Stocks in meltdown as Fed triggers global rout

While the Olympics is on the run, the global market is down, indicating investors' concerns about geopolitical risks and global economic growth. London's FTSE 100 dropped by 2%, while Europe’s Stoxx 600 benchmark fell over 2.5%, marking its largest three-day decline since June 2022. In Japan, the Nikkei index declined by more than 12%.

TheStreet/Shutterstock

S&P 500 big stock movers today

Five S&P 500 stocks making big midday moves are:

- Kellanova (K) +14.5%

- ON Semiconductor Corp (ON) 4.4%

- Tyson Foods Inc (TSN) +3.8%

- Dexcom Inc (DXCM) +3.8%

- Advanced Micro Devices Inc (AMD) +3.7%

The worst-performing five S&P 500 stocks with the largest midday drop are:

- Bath & Body Works Inc (BBWI) -6.4%

- Walgreens Boots Alliance Inc (WBA) -5.8%

- NVIDIA Corp (NVDA) -6.3%

- Intel Corp (INTC) -5.2%

- VeriSign, Inc (VRSN) -5.2%

Stocks also worth noting with significant moves include:

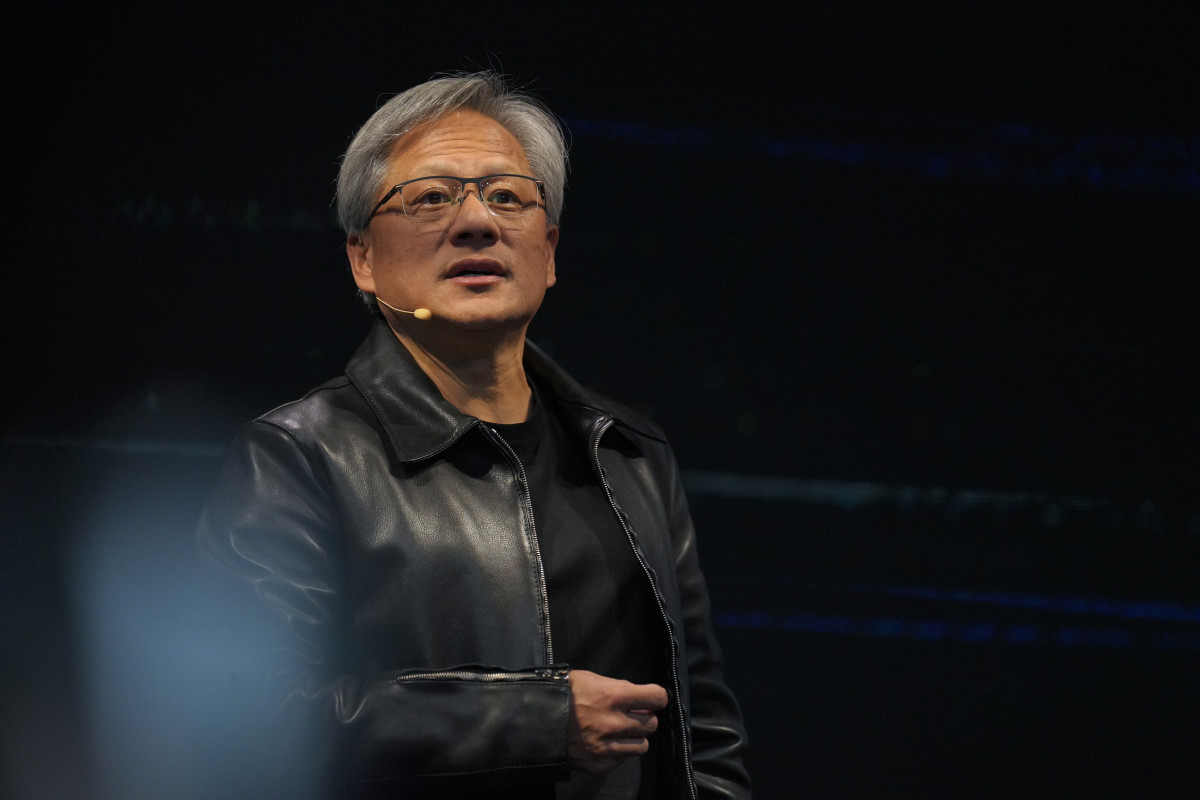

Nvidia shares tumble after chip delivery delay

Nvidia stock traded 6.3% lower in the morning after a potential delivery delay.

Related: Nvidia stock tumbles in tech slump amid questions over key chip

The chip giant had informed its clients, including Microsoft, that a design flaw had been found in the Blackwell architecture, which could delay its production ramp and delivery dates by around three months, according to The Information.

Deutsche Bank analyst Ross Seymore noted that Nvidia faces minimal financial risk in the short term for its upcoming earnings report on August 28, citing "still-strong demand" from its cloud customers. The analyst believes that the demand for artificial intelligence remains robust.

Apple falls after Berkshire cuts stake

Apple shares lost 4% after Berkshire Hathaway halved its stake.

Warren Buffett's conglomerate announced on Saturday that it sold almost half its Apple shares in the second quarter.

The company sold $75.5 billion worth of stocks during this period, including Apple and Bank of America, its top two holdings. Berkshire’s cash boosted to a record $276.94 billion.

Related: What Buffett's huge Apple sale really means

Buffett informed shareholders at Berkshire’s annual meeting in May that the company was reducing its stake in Apple due to the significant capital gains. But he also said he loves what Apple does.

Pringles' maker soars following potential acquisition

Kellanova stock added 14% in morning trading, topping the S&P 500 amid the market slump.

Packaged food giant Mars, known for its candy brands M&M's and Snickers, is considering a potential acquisition of Kellanova K.N, the maker of Cheez-It and Pringles, according to Reuters.

More Warren Buffett:

- What Buffett's huge Apple sale really means

- Warren Buffett's Berkshire sheds stock of major bank

- Analysts revamp Berkshire stock outlook after Warren Buffett meeting

The source told Reuters that it is uncertain whether Kellanova will proceed with a deal with Mars. But the acquisition would be one of the biggest deals in the packaged food sector, given Kellanova's market value of about $24 billion.

Stifel analyst Matthew Smith commented that the transaction would "further validate the power of Kellanova's brands and growth potential, both in North America and internationally." The analyst keeps a Hold rating on Kellanova shares.

Related: Veteran fund manager sees world of pain coming for stocks