KEY POINTS

- MicroStrategy will now focus on accumulating more BTC for its shareholders, Saylor said

- He previously predicted that the next 15 years will be a "high growth period" for Bitcoin

- MicroStrategy, which describes itself as the world's largest corporate BTC holder, now has 190,000 total Bitcoin holdings

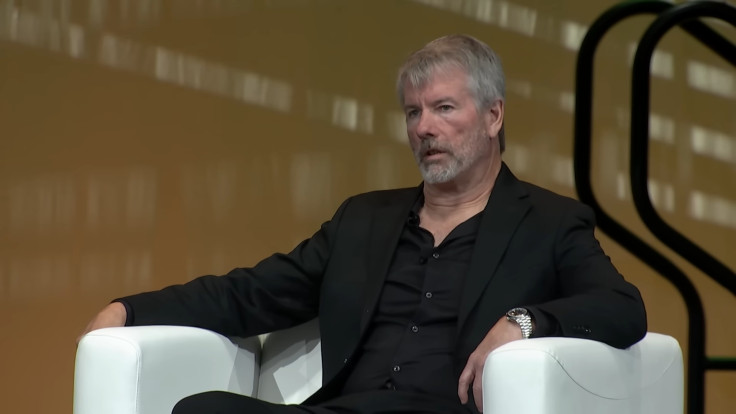

MicroStrategy's move of rebranding itself as a "Bitcoin development company" is only "natural," MicroStrategy co-founder and executive chairman Michael Saylor said in an interview with CNBC's "Closing Bell Overtime" on Monday.

The Tysons, Virginia-based business intelligence firm, which calls itself the world's largest public company holder of Bitcoin, announced the move last week. Saylor said it was only a "natural decision for us, given the success of our Bitcoin strategy."

MicroStrategy announced in its fourth quarter 2023 earnings call that it now has total holdings of 190,000 BTC, worth $8.1 billion, based on the holdings' market value last week.

The company's President and CEO Phong Le said at the time that among the key drivers of MicroStrategy's "extraordinary year" in 2023 was its Bitcoin strategy.

Saylor explained that the business software firm, in its rebranding, will "develop software," generate cash flow, and leverage capital markets "all in order to accumulate more Bitcoin for our shareholders, and also to promote the growth of the Bitcoin network."

It only "makes sense for us to call ourself a Bitcoin development company in the same way that you see a real estate development company" since majority of MicroStrategy's enterprise value is now based on its Bitcoin-related activities, he explained.

Saylor has been a vocal believer in Bitcoin's potential over the years. During the company's Q4 2023 earnings presentation, Saylor said this year is "the year of the birth of Bitcoin as an institutional-grade asset class," adding that he sees the next 15 years as a "high growth period" for decentralized cryptocurrency.

Saylor himself is a huge Bitcoin investor as he acquired 17,732 Bitcoin in 2020, way before other corporate executives made BTC investments. At the time of their acquisition, Saylor's Bitcoin were worth around $9,882 per coin. When spot BTC exchange-traded funds (ETFs) became available on various U.S. exchanges, Saylor's BTC investments became worth more than $600 million.

When the Securities and Exchange Commission (SEC) approved 11 spot Bitcoin ETFs last month, Saylor said it "may be the biggest development on Wall Street in the last 30 years."

The $BTC Spot ETF may be the biggest development on Wall Street in the last 30 years. My discussion of #Bitcoin in 2024, Spot ETFs vs. $MSTR, and the emergence of bitcoin as a treasury reserve asset with @KaileyLeinz on Bloomberg @Crypto. pic.twitter.com/QtPdBOhMDr

— Michael Saylor⚡️ (@saylor) December 19, 2023

He has also defended Bitcoin against BTC bears such as JPMorgan Chase CEO Jamie Dimon, who said during the World Economic Forum in Davos last month that Bitcoin was a cryptocurrency "which does nothing." He said it was a "pet rock" and warned people against acquiring it.

Saylor took to X to jab at Dimon's remark, saying if investors discover a "strange new asset ('Pet Rock')" that "does nothing" other than allow people to have ownership of something they can trade among themselves without fear of getting robbed, then they've "just discovered digital money."