Investors with a lot of money to spend have taken a bullish stance on MicroStrategy (NASDAQ:MSTR).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with MSTR, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 14 uncommon options trades for MicroStrategy.

This isn't normal.

The overall sentiment of these big-money traders is split between 50% bullish and 42%, bearish.

Out of all of the special options we uncovered, 3 are puts, for a total amount of $89,059, and 11 are calls, for a total amount of $1,149,110.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $0.5 to $710.0 for MicroStrategy during the past quarter.

Analyzing Volume & Open Interest

In terms of liquidity and interest, the mean open interest for MicroStrategy options trades today is 3964.77 with a total volume of 3,523.00.

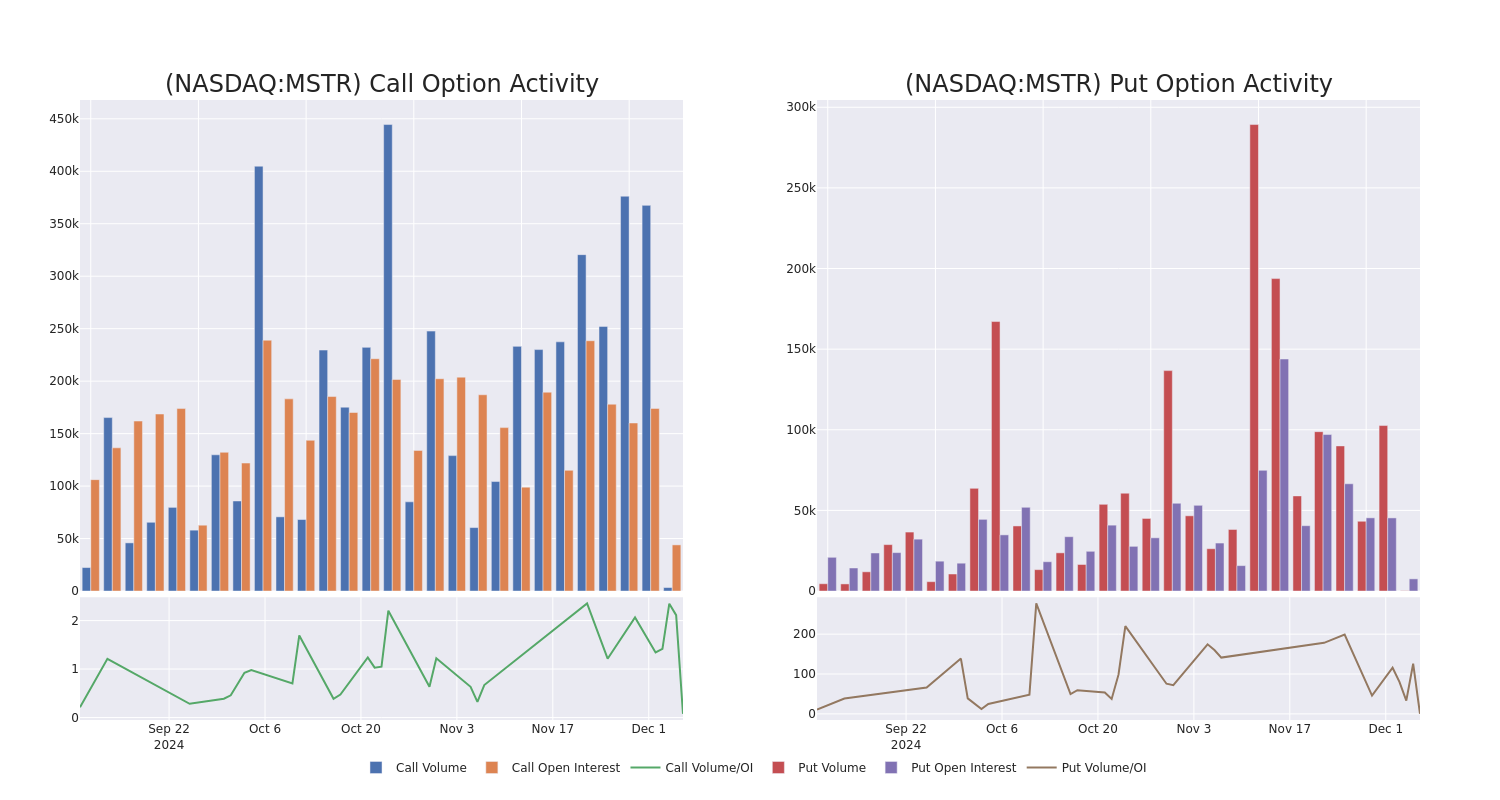

In the following chart, we are able to follow the development of volume and open interest of call and put options for MicroStrategy's big money trades within a strike price range of $0.5 to $710.0 over the last 30 days.

MicroStrategy Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MSTR | CALL | TRADE | BEARISH | 01/16/26 | $404.85 | $394.1 | $395.63 | $0.50 | $395.6K | 7.8K | 0 |

| MSTR | CALL | SWEEP | BULLISH | 12/06/24 | $15.0 | $14.95 | $15.0 | $385.00 | $237.0K | 1.3K | 19 |

| MSTR | CALL | TRADE | BEARISH | 01/16/26 | $166.85 | $164.8 | $165.45 | $500.00 | $99.2K | 1.4K | 29 |

| MSTR | CALL | TRADE | BEARISH | 12/13/24 | $7.75 | $7.0 | $7.0 | $500.00 | $70.0K | 13.9K | 485 |

| MSTR | CALL | TRADE | BULLISH | 01/16/26 | $139.0 | $129.75 | $139.0 | $710.00 | $69.5K | 41 | 0 |

About MicroStrategy

MicroStrategy Inc is a provider of enterprise analytics and mobility software. It offers MicroStrategy Analytics platform that delivers reports and dashboards and enables users to conduct ad hoc analysis and share insights through mobile devices or the Web; MicroStrategy Server, which provides analytical processing and job management. The company's reportable operating segment is engaged in the design, development, marketing, and sales of its software platform through licensing arrangements and cloud-based subscriptions and related services.

After a thorough review of the options trading surrounding MicroStrategy, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is MicroStrategy Standing Right Now?

- With a volume of 1,518,742, the price of MSTR is up 2.7% at $396.82.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 60 days.

What The Experts Say On MicroStrategy

In the last month, 5 experts released ratings on this stock with an average target price of $571.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * An analyst from TD Cowen persists with their Buy rating on MicroStrategy, maintaining a target price of $525. * Consistent in their evaluation, an analyst from Canaccord Genuity keeps a Buy rating on MicroStrategy with a target price of $510. * Maintaining their stance, an analyst from Benchmark continues to hold a Buy rating for MicroStrategy, targeting a price of $650. * Consistent in their evaluation, an analyst from BTIG keeps a Buy rating on MicroStrategy with a target price of $570. * Consistent in their evaluation, an analyst from Bernstein keeps a Outperform rating on MicroStrategy with a target price of $600.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for MicroStrategy with Benzinga Pro for real-time alerts.