Tech investors are hoping Microsoft will help calm the nerves of jittery markets by once more posting strong sales and earnings figures.

Among analysts polled by FactSet, the consensus is for the software giant to report March quarter (fiscal third quarter) revenue of $49.02 billion (up 17.5% annually), GAAP EPS of $2.18 and non-GAAP EPS of $2.19.

Microsoft typically shares revenue guidance for its 3 business segments on its earnings call. The company’s June quarter revenue consensus stands at $52.75 billion (up 14%).

Eric Jhonsa, Real Money’s tech columnist, will be live-blogging Microsoft’s earnings report, which is expected after the bell, along with an earnings call scheduled for 5:30 P.M. Eastern Time. (Please refresh your browser for updates.)

6:43 PM ET: Microsoft's call has ended. After heading into the earnings call down slightly in spite of FQ3 sales and EPS beats, shares are up 4.9% after-hours to $283.40, aided by the better-than-feared sales guidance shared on the call.

Microsoft guided for its three business segments to collectively post FQ4 revenue of $52.4B-$53.2B vs. a $52.75B consensus. At its midpoint, the guidance implies 14% Y/Y revenue growth.

FQ3 revenue rose 18% Y/Y in dollars and 21% in constant currency, aided by 46% Azure revenue growth, 34% LinkedIn growth, and double-digit growth for Microsoft's Office and Windows businesses. In addition, Microsoft's commercial bookings rose 35% Y/Y (30% excluding Nuance), which in turn helped its commercial RPO (contract backlog) rise 32% to $155B.

Thanks for joining us.

6:35 PM ET: A question about the durability of the Windows business.

Nadella: Windows is the socket for Microsoft 365. We feel good about commercial Windows adoption. On the consumer side, usage has gone up. PCs remain an important category within peoples' lives. There will be cyclicality, but demand has structurally increased.

Hood notes Windows demand has shifted from being consumer-driven during the middle of the pandemic to being more commercial-driven, and that this is expected to continue.

6:32 PM ET: A question about Nuance's strategic value.

Nadella: Nuance is a platform layer for AI-driven apps in places like healthcare and enterprise contact centers. We're very excited about Nuance being part of the Microsoft family. Tackling healthcare issues like physician burdens are an opportunity.

6:28 PM ET: A question about where Microsoft really has room to take share in the tech stack.

Nadella says value is being created at 3 layers in the tech stack: The infrastructure layer, the AI layer and the UI layer. Argues Microsoft is creating differentiated solutions at all 3 layers.

6:24 PM ET: A question about the factors driving Azure strength.

Nadella says Azure demand is strong across customer types and workloads, while suggesting "tier-1" enterprise workloads are a particular area of strength. Also says Azure's end-to-end "data fabric" will be a key differentiator going forward. Says there will be some cyclicality as businesses optimize their Azure resource usage, but there's still a lot of growth ahead.

6:21 PM ET: A question about on-prem server software pressures. Is that Microsoft-specific or a broader issue?

Hood says the tilt from on-prem to cloud didn't feel any different than recently. Notes recent changes to Microsoft's partner program that went into effect on Jan. 1 are having a short-term impact.

6:19 PM ET: A question about how far along Microsoft is in its Office 365 upsell opportunity (from E3 plans to E5 plans). Also one about Office's opportunity with front-line workers.

Hood: Seat growth was especially strong with front-line workers and SMBs. That tends to weigh on ARPU growth a bit. There's still a lot of room for both seat and ARPU growth. E5 provides a lot of value to customers in terms of security, compliance, analytics, etc.

Nadella adds that emerging markets have also become a growth driver for Office. Also says that usage data shows new peaks being hit everywhere.

6:16 PM ET: A question about whether Microsoft is changing its guidance methodology.

Hood says Microsoft's methodology hasn't changed, while adding that if manufacturing shutdowns in China continue into May, it would affect Microsoft's More Personal Computing revenue.

6:14 PM ET: The Q&A session has started. First question is about Microsoft's confidence in the durability of current growth.

Nadella: The competitiveness of our tech stack gives us confidence, as does our ability to monetize our consumer base. Also, we have price leadership in many businesses. Providing more value for less price helps you win in this environment.

He also says that businesses aren't looking to slash IT budgets in this environment, and reiterates his view that software/automation investments can help businesses deal with inflationary pressures.

Hood adds that Microsoft still has a lot of room to grow sales within its total addressable market (TAM).

6:14 PM ET: Hood also said Microsoft expects constant-currency Azure revenue growth (49% in FQ3) to drop by 2 points in FQ4, and for on-prem server software revenue to be down by a low-single-digit % due to a tough comp. Windows OEM revenue is expected to grow by a low-to-mid single-digit %.

6:08 PM ET: FQ4 revenue guidance by segment:

Productivity & Business Processes - $16.65B-$16.9B vs. a $16.68B consensus

Intelligent Cloud -$21.1B-$21.35B vs. a $20.88B consensus

More Personal Computing - $14.65B-$14.95B vs. a $14.95B consensus

Markets like the guidance. Shares are now up 6.1% after-hours.

6:05 PM ET: Hood: Commercial bookings should see "healthy growth" against a strong prior-year comp. Capex will continue to grow.

6:03 PM ET: Hood forecasts forex will have a 2-point impact on Microsoft's total FQ4 revenue growth. Also says Russia/Ukraine is expected to have a $110M revenue impact.

6:00 PM ET: Hood says Windows Commercial revenue benefited from Microsoft 365 subscriptions and a greater mix of in-period contract revenue recognition. Also mentions Xbox hardware revenue was better than expected thanks to increased supply.

5:58 PM ET: Hood notes Intelligent Cloud revenue was ahead of expectations even after accounting for Nuance's impact. Also says Nuance didn't affect constant-currency growth rates for Azure or server products revenue.

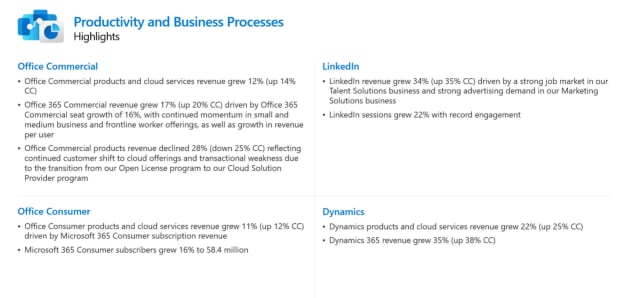

5:56 PM ET: Microsoft 365 consumer subscriptions rose 16% to 58.4M. LinkedIn saw better-than-expected Talent Solutions revenue.

5:55 PM ET: Hood is now recapping Productivity & Business Process' performance. She notes Microsoft now has nearly 345M Office 365 commercial seats (+16% Y/Y).

5:54 PM ET: Hood notes Microsoft's headcount rose 20% Y/Y, or 16% excluding Nuance's impact. Operating margin rose 2 points Y/Y.

5:52 PM ET: Investors like the call so far. Shares are now up 1.6% after-hours.

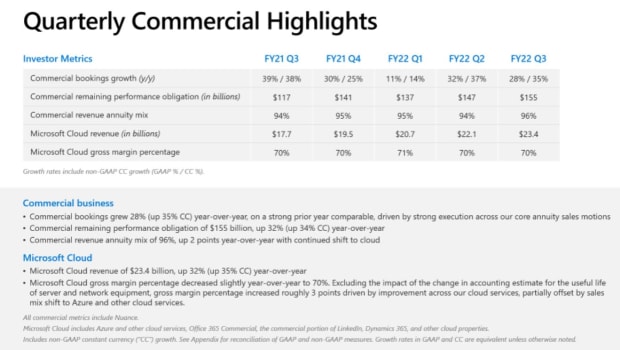

5:52 PM ET: Hood: Commercial bookings were much better than expected. We benefited from strong annuity sales motions and Azure long-term contracts. Nuance provided a 5-point benefit to bookings.

5:50 PM ET: Hood notes the Nuance acquisition (closed in March) boosted FQ3 revenue by $111M and slightly hurt EPS. Says Nuance will be minimally dilutive to FY22 non-GAAP EPS and accretive to FY23 EPS.

She also notes forex was a bigger headwind than expected, and that there was a $0.01 EPS hit from suspending operations in Russia.

5:48 PM ET: Amy Hood is now talking.

5:48 PM ET: Nadella claims Xbox Series S/X have taken console share over the last 2 quarters, and that more than 10M people have used Microsoft's cloud gaming services to stream games to date. Azure gaming revenue is up 66% year-to-date in fiscal 2022.

5:46 PM ET: Regarding security, Nadella argues Microsoft's multi-cloud efforts are a competitive strength. Also notes Azure Active Directors now has more than 550M MAUs.

5:45 PM ET: Nadella: More than 500M people now use Microsoft's Start news feed monthly.

5:43 PM ET: Nadella asserts Teams usage "has never been higher" and is growing within every segment. Also says Microsoft's Viva employee engagement platform (integrated with Teams) now has more than 10M users.

5:40 PM ET: Nadella: More than 830M professionals use LinkedIn. Its Talent Solutions revenue rose 43% Y/Y. 28M users subscribe to at least one newsletter on LinkedIn.

5:38 PM ET: Nadella says Microsoft's Power platform surpassed $2B in revenue over the last 12 months. The Power BI data visualization platform is said to have over 200K customers.

5:37 PM ET: Nadella: Visual Studio has over 31M monthly users. 90% of the Fortune 100 use GitHub.

5:36 PM ET: Nadella highlights triple-digit usage growth for Microsoft's Azure Cosmos DB and Synapse cloud databases. Also says inference requests rose 86% Y/Y for Azure's machine learning services.

5:35 PM ET: Nadella asserts Microsoft is expanding its opportunity and taking share across the tech stack, and that the company is seeing "larger, more strategic, Azure commitments." $100M+ Azure deals more than doubled Y/Y.

5:33 PM ET: Nadella is talking.

5:31 PM ET: Microsoft is going over its safe-harbor statement. Its calls typically feature prepared remarks from CEO Satya Nadella and CFO Amy Hood, with the execs then taking questions from analysts. Hood shares Microsoft's quarterly guidance towards the end of her prepared remarks.

5:30 PM ET: The call is starting.

5:29 PM ET: One correction: Microsoft ended March with $104.7B in cash and short-term investments, and $49.9B in debt. The previously-stated figures are for Microsoft's year-ago quarter.

5:25 PM ET: Hi, I'm back to cover Microsoft's earnings call, which should kick off in a few minutes.

5:05 PM ET: I'm taking a short break, but will be back to cover Microsoft's earnings call, which kicks off at 5:30 ET and should feature the company's FQ4 sales guidance. Shares are currently down 1.5% after-hours in spite of Microsoft topping FQ3 sales and EPS expectations.

5:03 PM ET: Microsoft ended March with $125.4B in cash and short-term investments, and $58.1B in debt, with $20B in free cash flow (+17% Y/Y) partly offset by $7.8B worth of buybacks. As a reminder, the company is set to pay $68.7B in cash (provided regulators sign off) to acquire Activision Blizzard.

Correction: Microsoft ended March with $104.7B in cash and short-term investments, and $49.9B in debt.

4:58 PM ET: Also: Microsoft noted that Windows OEM revenue (grew 11% vs. guidance for high-single-digit growth) benefited from continued commercial PC strength (the company's revenue/license is higher for commercial PCs than for consumer PCs).

This was notable given how much back-and-forth there's been lately about PC demand -- a lot of signs right now that low-end consumer PC demand is softening, but business PC demand seems to be holding up well for now.

4:53 PM ET: One interesting disclosure from Microsoft's slide deck: Office commercial products revenue (it covers traditional Office licenses rather than Office 365 subscriptions) fell 28% Y/Y, worse than FQ2's 17% drop and guidance for a high-teens decline.

Nonetheless, Microsoft's total Office commercial revenue rose 12% (compares with 14% in FQ2). This points to a faster-than-expected Office 365 transition.

4:46 PM ET: Microsoft is back to trading lower AH: Shares are now down 1.2%. Alphabet's Q1 report, which has led the Google parent's stock to drop 6%, is generally weighing on tech stocks after-hours.

We'll see if Microsoft's sales guidance (expected to be shared on the earnings call) can once more give the stock a boost.

4:41 PM ET: On a GAAP basis, Microsoft's operating expenses rose 15% Y/Y to $13.4B. That compares with revenue growth of 18%. Sales hires and Azure R&D have been major contributors to opex growth.

4:39 PM ET: Microsoft's bookings/RPO numbers for recent quarters. These are pretty impressive numbers for a company of Microsoft's size. Long-term Azure contracts have been a big tailwind for bookings/RPO growth.

4:36 PM ET: Relative to the guidance it shared in January, Microsoft topped revenue expectations for Office Consumer, LinkedIn, search/news ads, Windows Commercial and Windows OEM, and slightly missed its guidance for Dynamics and Xbox content/services.

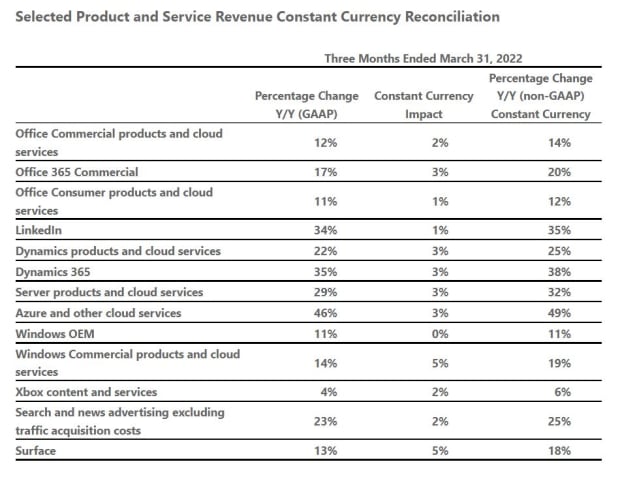

Azure was in-line -- Microsoft guided for constant currency Azure growth to improve, and it rose to 49% from FQ2's 46%. In dollars, Azure growth remained at 46%.

4:28 PM ET: $6.3B was spent on capex (much of it likely involving Azure data centers). That compares with $6.8B in FQ2 and $6B a year ago.

4:26 PM ET: Boosting EPS: Microsoft spent $7.8B on buybacks during FQ3. That's up from $6.2B in FQ2.

4:24 PM ET: Microsoft's FQ3 performance for its reported product/service lines. Aside from Xbox content/services, every reported business posted double-digit growth.

4:20 PM ET: On note: forex was a 3-point headwind to Microsoft's FQ3 revenue growth, 1 point more than what the company guided for in January. Revenue rose 18% Y/Y in dollars and 21% in constant currency.

4:15 PM ET: Here's the earnings report, for those interested.

4:14 PM ET: The see-saw continues: Microsoft's stock is now up 0.6% AH.

4:13 PM ET: Microsoft's commercial bookings rose 28% Y/Y in spite of a tough comp (bookings were up 39% in the year-ago period). That helped Microsoft's commercial RPO (contract backlog) rise 32% to $155B.

In constant currency, bookings rose 35% and RPO rose 34%.

4:11 PM ET: Microsoft's FQ3 revenue by segment:

Productivity & Business Processes - $15.79B, +17% Y/Y and slightly above a $15.75B consensus

Intelligent Cloud - $19.05B, +29% and above an $18.89B consensus

More Personal Computing - $14.52B, +11% and above a $14.3B consensus

4:08 PM ET: Shares have reversed course: Microsoft is now down 2.5%. For the moment at least, markets are maintaining the take-no-prisoners mood they should during regular trading.

4:06 PM ET: Azure and other cloud services revenue rose 46% Y/Y, matching FQ2's growth rate.

4:04 PM ET: Shares are up 1% after-hours.

4:04 PM ET: Results are out. FQ3 revenue of $49.36B beats a $49.02B consensus. GAAP EPS of $2.22 beats a $2.18 consensus.

4:00 PM ET: Microsoft closed down 3.7%. The FQ3 report should be out shortly.

3:54 PM ET: Microsoft's stock is down 3.5% to $270.80 heading into its FQ3 report, amid a 3.7% drop for the Nasdaq. Shares are down 20% YTD and up 3% over the last 12 months.

3:52 PM ET: The FactSet consensus is for Microsoft to report FQ3 revenue of $49.02B, GAAP EPS of $2.18 and non-GAAP EPS of $2.19. The FQ4 revenue consensus stands at $52.75B.

3:51 PM ET: Hi, this is Eric Jhonsa. I'll be live-blogging Microsoft's earnings report and call.