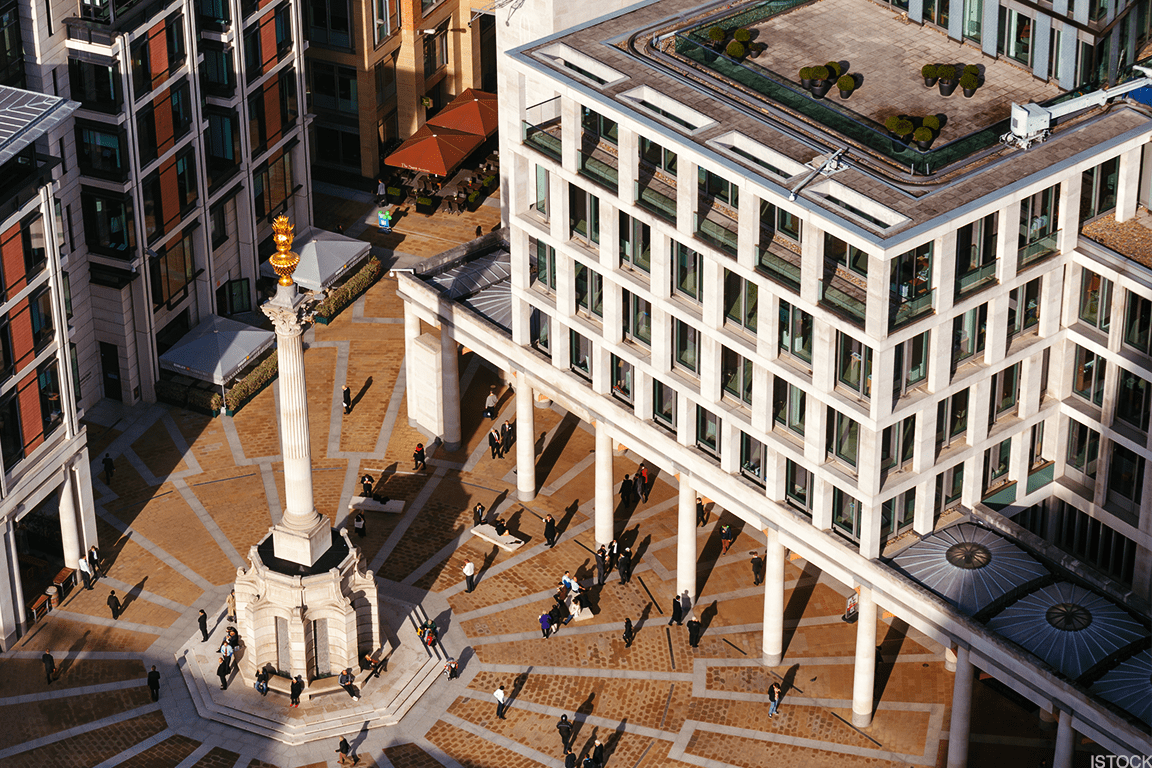

Microsoft (MSFT) shares moved higher Monday after the world's second-largest tech company said it would take a 4% stake in the London Stock Exchange as part of a deal to move its data platform into its Azure cloud computing structure.

The London Stock Exchange Group, which recently completed a $27 billion deal with Blackstone and a consortium lead by Thomson Reuters to buy the Refinitiv data platform, agreed to pay Microsoft a minimum of $2.8 billion in fees over the life of a ten year contract to migrate onto the cloud - as well as surrendering the 4% equity stake valued at around $2 billion. That stake is currently held by consortium partners Blackstone, the Canada Pension Plan Investment Board, GIC Special Investments, Thomson Reuters and former Refinitiv shareholders.

The migration will make it easier to use current LSEG workstations within Microsoft tools such as Teams, Excel and Powerpoint, the companies said, creating what they called and an "all-in-one data, analytics, workflow, and collaboration solution, specifically designed to help finance and investment professionals improve communications and productivity while maintaining regulatory compliance."

Microsoft said earlier this fall that revenues for Azure, its flagship cloud division, rose 35% from last year, slowing notably from its prior quarter gains as companies pulled back on investment spending. That rate will slow further into the three months ending in December, Microsoft's fiscal second quarter, even after stripping away the impact of the stronger U.S. dollar.

"Advances in the cloud and AI will fundamentally transform how financial institutions research, interact, and transact across asset classes, and adapt to changing market conditions," said CEO Satya Nadella. "Our partnership will bring together the industry leadership of the London Stock Exchange Group with the trust and breadth of the Microsoft Cloud -- spanning Azure, AI, and Teams -- to build next-generation services that will empower our customers to generate business insights, automate complex and time-consuming processes, and ultimately, do more with less."

Microsoft shares were marked 1.6% higher in early Monday trading to change hands at $248.84 each. LSEG group shares were up 2% in London trading.

"We are delighted to welcome Microsoft as a shareholder," said LSEG CEO David Schwimmer. "We believe our partnership with Microsoft will transform the way our customers discover, analyze, and trade securities around the world, and create substantial value over time. We look forward to delivering on that potential."