It might not be Monday, but it feels like Merger Monday with Microsoft (MSFT) plunking down $68.7 billion to acquire Activision Blizzard (ATVI).

Seeing as though it’s the first trading of the week, it seems even more like Merger Monday even though it's a Tuesday.

Regardless, this deal is important. Not only is it giving a big jolt to the rest of the video game space, but it comes at a time where sentiment is quickly souring.

Growth stocks have been in the toilet, and Activision stock hasn't been trading all that well either. Could a deal like this help turn things around?

Coming into this week, Activision shares were 37% off the 52-week high. Even from today’s high, shares are still down about 17% from the high.

That has some wondering if investors should buy more stock or look to take profits.

For Microsoft’s part, the stock is only down 2%, which isn’t bad considering the size of the deal. That said, it’s hitting its lowest level since October.

Trading Microsoft Stock

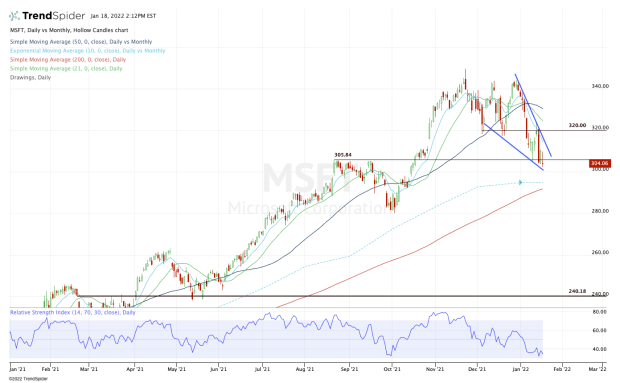

Chart courtesy of TrendSpider.com

Mega-cap techs like Apple (AAPL), Microsoft and Alphabet (GOOGL) (GOOG) have started to take a hit lately.

They’re not getting mowed down like high-growth tech stocks, but they are starting to take on some losses.

For Microsoft’s part, the stock is working on its third-straight weekly decline. On the plus side, it’s also putting in a falling wedge pattern, which bulls tend to look at as consolidation.

The hope from traders is that the stock will break up-and-out of the wedge, giving them a low to measure against and a breakout to ride higher.

Microsoft may need a bit more time for that to happen.

At its stands, I have my eye on a few different areas. First, I’m watching the $306 level, which was resistance in August and September but the breakout level in October.

Earlier this month, it served as support, but Microsoft stock is below this level now.

If it can climb back above it, the $310 area is the next spot to watch. This level was support early last week, but has been resistance over the past two sessions.

Above $310 and the 10-day moving average opens the door for a larger rally, potentially to the $320 to $325 zone, which recently turned from support to resistance (are you sensing a theme here?)

Should Microsoft stock continue lower, keep an eye on the 10-month and 200-day moving averages. These measures should generate a bounce for a quality stock like this.