- Earnings per share (EPS) of $5.16, up 60%

- Revenue of $81.3 billion, up 17%

- Operating income was $38.3 billion and increased 21%

- Earnings per share: $4.14 adjusted vs. $3.97 expected

- Revenue: $81.27 billion vs. $80.27 billion expected

Microsoft went through its second quarter fiscal year 2026 results today. The company discussed Azure cloud computing and its investments.

We did not learn more about Windows 10 End of Life or the push to get more users to upgrade to Windows 11. Xbox was briefly mentioned.

Earnings calls aren’t typically the most exciting events unless you’re an industry insider or an analyst. However, we picked out the key info from Microsoft’s Q2 results and shared it here.

Microsoft shared its financial numbers before the call, showing that revenue has gone up for Cloud services and AI, and decreased for Xbox. However, reality didn't meet expectations, and the stock did fall by 4%.

We’ll be here with all the latest from Microsoft ahead of and after the earnings call, so keep an eye on this page as we’ll be updating it regularly with our own insights, observations and takes on today’s big news.

What time is the Microsoft earnings call?

The call started at 5:30 p.m. ET, 4:30 p.mm CT and 2:30 p.m. PT and was hosted by Microsoft CEO Satya Nadella and CFO Amy Hood.

How to listen to the earnings call

You can listen along to the earnings call yourself on Microsoft's website, but we'll break it all down right here so you can follow along without listening.

Microsoft earnings call — live updates

All eyes on Microsoft’s stock

Microsoft’s Q2 fiscal earnings today could make or break its current stock price. The software giant’s stock has underperformed compared to the rest of the tech sector over the last six months and is currently down by around 14% at $478 since its all-time high off $555 at the end of last year.

If Microsoft can show its massive investment in AI has paid off in terms of revenue, its stock could jump up.

What’s next for Xbox

Xbox has seemingly fumbled the ball this console generation with Sony currently holding the reins as the PS5 has continued to outsell both the Xbox Series X and Series S.

Given that those consoles are now five years old after launching back in 2020, Microsoft is already working on a follow-up. However, the question remains what the company is planning to do to set its next console apart from the competition.

There’s been talk of integrating PC game stores like Valve’s Steam and the Epic Games Store and the next Xbox may end up being more PC than console which will certainly carry a more premium price. It will also have to compete against Valve’s upcoming Steam Machine too. Hopefully we learn a bit more about the state of Xbox and Microsoft’s gaming plans in today’s call.

Previous earnings call focused on AI

The last Microsoft earnings call was held on October 29, 2025.

There's a lot to go through in the hourlong discussion, but a big chunk of the call is focused on AI and Microsoft Azure, the company's cloud computing service.

Satella also discussed Copilot and a deal with OpenAI.

Nadella is excited about Agentic AI

During the Q&A portion of the last earnings call, Nadella was asked about agentic AI and he seems quite excited about the future of AGI.

"I feel actually, pretty good about both the progress in AI. I don’t think AGI, as defined, at least, by us in our contract, is ever going to be achieved anytime soon, but I do believe we can drive a lot of value for customers with advances in AI models by building these systems. It’s the real question that needs to be well understood, and I feel very, very confident about our ability to make progress."

Are we in a bubble?

Hood and Nadella were asked if we're in an AI bubble and how Microsoft is ensuring that it can both meet current demand but also that it's sustainable (financially).

"Those are very long-lived assets, as we’ve talked about, 15 to 20 years. And over that period of time, do I have confidence that we’ll need to use all of that? It is very high," Hood said.

"When I look at the entirety of these high value agent systems, and when we look at the efficiency of and fungibility of our fleet, that’s what gives us the confidence to invest both the capital and the R&D talent to go after this opportunity," Nadella added.

A question of hardware

As we enter a new year, the question will be whether or not Microsoft discusses any future hardware plans for 2026.

We are several months from Microsoft Build (which is also moving to a new city), so it's not clear if hardware will be top of mind for the tech giant.

Now is the time for future prognostication from the company, which I do expect we'll hear today.

What do you want to hear form Microsoft?

These earnings calls are mostly for investors and interested financial institutes. But they do sometimes reveal plans about the company's future.

Let us know if there's anything you hope to learn about Microsoft's 2026 plans?

Not off to the best start

Microsoft has been pushing AI and Copilot as integral to the Windows experience but people have not been responding.

And it doesn't help that the recent January patch to fix things ended up stirring even more bugs in Windows 11.

We doubt they'll mention this on the call.

Azure and infrastructure

Last week, Microsoft suffered a massive 365 and Outlook outage that lasted nearly 48 hours. Like many of the major outages in the last couple of years, it's all based around infrastructure and the failure.

As my colleague Jason England points out, companies need a backup plan and to bolster their infrastructure.

I'm curious if any investors will ask about the outage.

Xbox goes ARM on Windows 11

Recently, the Xbox app finally arrived on Arm-based Windows 11 PCs.

“Windows and Xbox continue to collaborate across the gaming community, OEMs, silicon innovators and game studios to expand catalog compatibility and deliver a consistently great Windows gaming experience—whether you’re on a powerful desktop, a purpose‑built handheld, or an Arm‑based Windows 11 laptop," the company said.

But is it enough for Microsoft to hold on to its PC gaming dominance.

Copilot vulnerability

Microsoft recently patched a major Copilot vulernability that could have resulted in personal data being stolen.

We expect the company to discuss the AI tool in today's earnings call, most likely in terms of its growth and integration into Windows systems.

Expect reports of major growth

CNBC is reporting that Microsoft is expected to report major growth in several areas including Microsoft Azure cloud infrastructure.

It's also expected that expenditures, especially around data center builds and leasing will be up by nearly 50%.

Microsoft's stock fell 10% in the last quarter, so we're certain that will come up.

Did you know there's a boycott against Microsoft and Xbox

Despite the Xbox Ally and Game Pass, Xbox has had a seemingly poor recent run.

Plus, the company faces an ongoing boycott over the alleged "complicity in Israel's genocide in Gaza."

Here's more information if you're curious.

Microsoft Maia

Recently, Microsoft announced the new Maia 200 chip, meant for scaling AI inference.

The new chip is supposed to take on Google and Nvidia when it comes to AI. As TechCrunch reports, the Maia 200 chip is supposed to be more power efficient and use less power compared to competitor chips and the older Maia 100 chip.

I expect we'll hear about this new chip during the earnings call today.

We are one hour out from today's earnings call

Microsoft's 2026 Q2 earnings call kicks off at 2:30 pm Pacific and should last until 3:30 pm.

We'll be following along with the webcast. If you want to listen in you can go here but we'll also be listening and posting information that will be relevant to customers and not just the money people.

Numbers for Microsoft have been released

Microsoft just released its financial year 2026 quarter two numbers. As expected, cloud services and AI are the headliners.

“We are only at the beginning phases of AI diffusion and already Microsoft has built an AI business that is larger than some of our biggest franchises," CEO Satya Nadella said in a press release. “We are pushing the frontier across our entire AI stack to drive new value for our customers and partners.”

Microsoft Cloud revenue hit over $50 billion in Q2. Despite that stock shares fell as Cloud growth was slower than expected.

Additionally, Xbox content and services took a hit, with the company noting that decreased 5%

Xbox continues to lag behind

As mentioned, most of the numbers released by Microsoft reflect on investment and revenue from AI and Cloud.

However, buried in there are numbers regarding personal computing.

Surprisingly, Windows OEM and devices stayed relatively stagnant but Xbox decreased again.

·"Xbox content and services revenue decreased 5% (down 6% in constant currency)"

The previous earnings call Xbox was bolstered by the release of the Xbox Ally handheld Pcs, but nothing new has happened since then despite the holiday season just passed.

10 minute countdown

The Microsoft Q2 earnings call kicks off in 10 minutes.

While we have the numbers already, Nadella and Hood are expected to go into more detail as part of the call. Plus, there will be a Q&A section where investors can ask questions. We may learn more about Microsoft's quarter and future plans from those inquiries.

Microsoft's stock up today

Microsoft's stock ended the day at $481.63, an increase of $1.05. It seems investors were optimistic going into the numbers coming out and based on the massive revenue of $81.3 billion (an increase of 17% year-over-year) generated by Microsoft in the quarter, it seems they were right.

The call begins

We're officially into Microsoft's earnings call where we will hopefully learn some new information about the company's plans going forward, how intends to deal with Xbox lagging behind and other news.

Satya Nadella, Chairman and CEO, presenting

Satya Nadella started the call by discussing Microsoft's $50 billion in cloud revenue, a first for the firm. He also talked about the AI business being larger than some of the company's other business areas, where the company has spent many years working.

He also discussed improvements to the performance of its AI models. He said Cobalt 200 is a big leap forward, delivering 50% better CPU performance for the Cloud.

Nadella on agents

"You can think of agents as the new apps."

Microsoft's CEO talked about offering lots of models for users based on their needs, though this is based more around enterprise, not as much for the average computing user running CoPilot on their laptop.

Copilot for consumers

Microsoft's CEO says it has seen a 3X increase in users to its CoPilot AI platform thanks in part to integration into Windows. He also talked about Microsoft 365 Copilot accuracy with AI and daily users increasing 10X per year.

In total, he said it was a record quarter for Copilot within Microsoft 365, which means we can expect to see the company push advancements with it more, whether we like it or not.

Positive spin on Xbox

While Microsoft reported that Xbox content and services revenue decreased 5%, the company's CEO cited some positives in game streaming. "We saw record PC players and paid streaming hours on Xbox."

After hours stock drop

While the end of market stock price was up, once the numbers came out, there was a big drop. As of this post, it's down $22.86, which is a 4.75% dip.

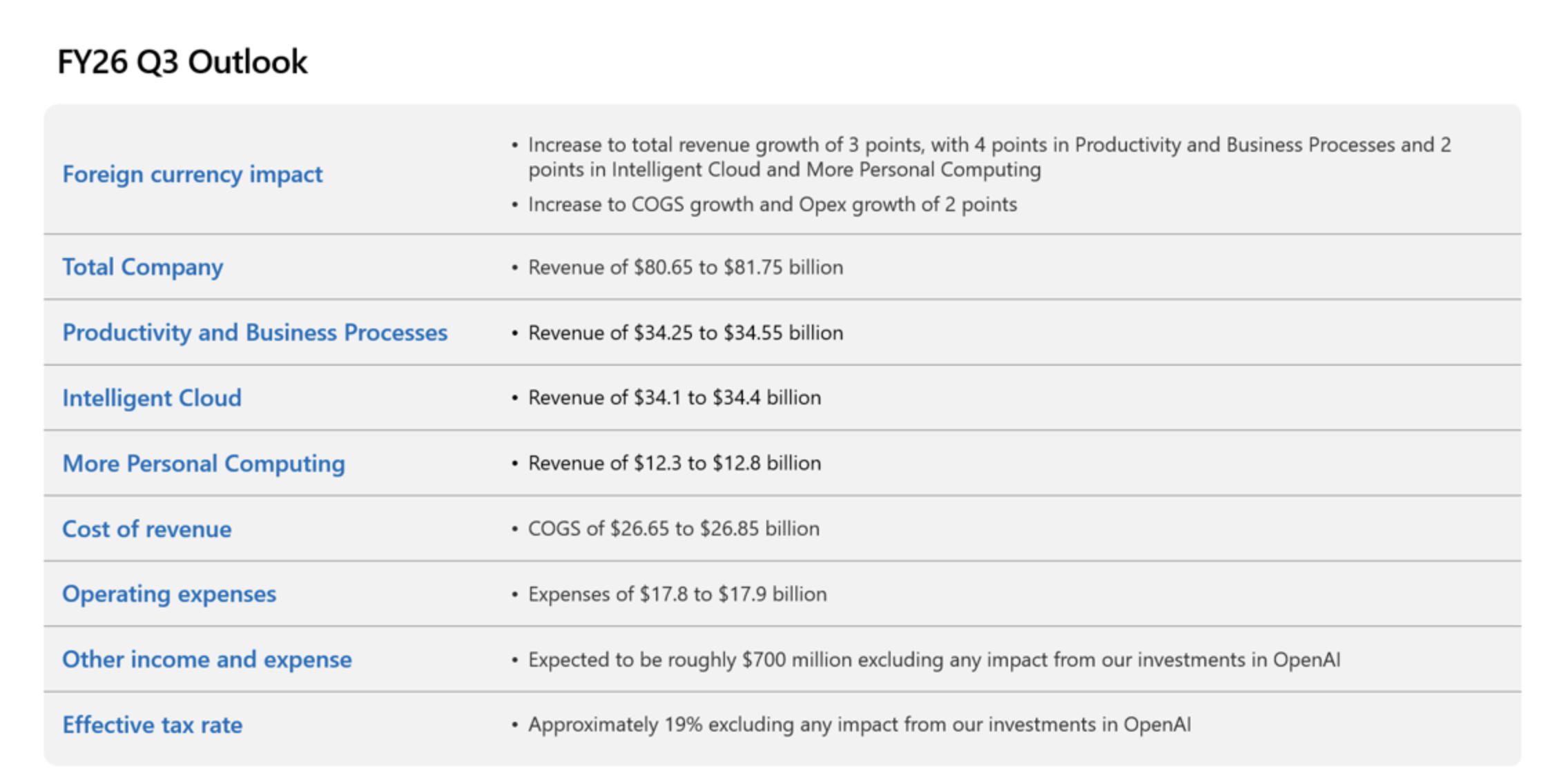

Looking ahead to Fiscal Year 2026 Q3

Microsoft shared some of its outlooks for its earnings in the next quarter. You can see it all at the company's investor relations website (and some of the key info above), but the key thing that's most interesting is that the company expects to see revenue of $80.65 billion to $81.75 billion.

Microsoft Q&A starting now

The company is beginning the Question & Answer portion of the call. Hopefully, the company gives us some interesting tidbits about the future, but we'll see.

Microsoft in a good spot

In a statement, John Belton, Portfolio Manager, Gabelli Funds, said "Microsoft is well positioned to distribute AI technology through their productivity apps. And on Copilot, the sentiment in the market is very negative. I think that’s going a little bit better than people give it credit for.

Historically, it’s taken Microsoft some time to figure these things out, but they have the distribution in the end. They have a lot of built-in advantages, and a lot of times they do end up coming out on top," Belton said.

"Microsoft, in terms of the return on all the spend, I view them as more the adults in the room. They’re going at a more measured pace in building out infrastructure. The market would clearly like them to go even faster, and I think that’s been the constraint around Azure.

But by and large, the biggest companies are already generating pretty decent returns, trading at relatively digestible multiples, especially in the context of the broader market, and they’re going at a nice pace," Belton explained.

OpenAI deal was huge

An important thing to note from Microsoft's earnings report is that the company's net income increased by $7.6 billion from its investment in OpenAI. That deal was obviously huge for the success the company saw during the quarter. It would be interesting see where the company would be if it weren't for this massive deal.

Microsoft talked around the RAM crisis

During the Q&A, Hood and Nadella were asked about investing and the return on investment for some the company's AI efforts and Azure cloud computing.

Hood discussed GPUs and CPUs for Azure and the investment, but did not directly address the ongoing RAM crisis that is largely led by memory hungry data centers.

It makes sense that Microsoft wants GPUs for its data centers but what about its consumer products like Windows 11 laptops especially made by partners like Lenovo or Dell who are hoarding RAM. It's a question I haven't seen asked or answered yet.

That's all the news out of Microsoft

We've pulled out everything we could from today's earnings call. Did we miss anything? Let us know.