/Micron%20Technology%20Inc_logo%20and%20website-by%20Mojahid%20Mottakin%20via%20Shutterstock.jpg)

Valued at a market cap of $251.4 billion, Micron Technology, Inc. (MU) is a semiconductor company that designs, develops, manufactures, and sells memory and storage products. The Boise, Idaho-based company serves a wide range of markets, including cloud data centers, mobile devices, infrastructure, automotive and industrial applications.

This semiconductor giant has significantly outperformed the broader market over the past 52 weeks. Shares of MU have surged 115.2% over this time frame, while the broader S&P 500 Index ($SPX) has gained 17.4%. Moreover, on a YTD basis, the stock is up 166.2%, compared to SPX’s 16% rise.

Zooming in further, MU has also notably outpaced the Invesco Semiconductors ETF’s (PSI) 36.3% return over the past 52 weeks and 33.7% surge on a YTD basis.

On Sep. 23, MU released stronger-than-expected Q4 results, yet its shares plunged 2.8% in the following trading session. Due to a strong 213.5% rise in its cloud memory business unit revenues, the company’s overall revenue improved by a notable 46% year-over-year to $11.3 billion, surpassing consensus estimates by a slight margin. Moreover, on the earnings front, its adjusted operating margin expanded by a robust 1250 basis points, while its adjusted EPS grew 156.8% from the year-ago quarter to $3.03, topping analyst expectations by 5.9%.

For fiscal 2026, ending in August, analysts expect MU’s EPS to grow by a staggering 101.6% year over year to $15.48. The company’s earnings surprise history is promising. It surpassed the consensus estimates in each of the last four quarters.

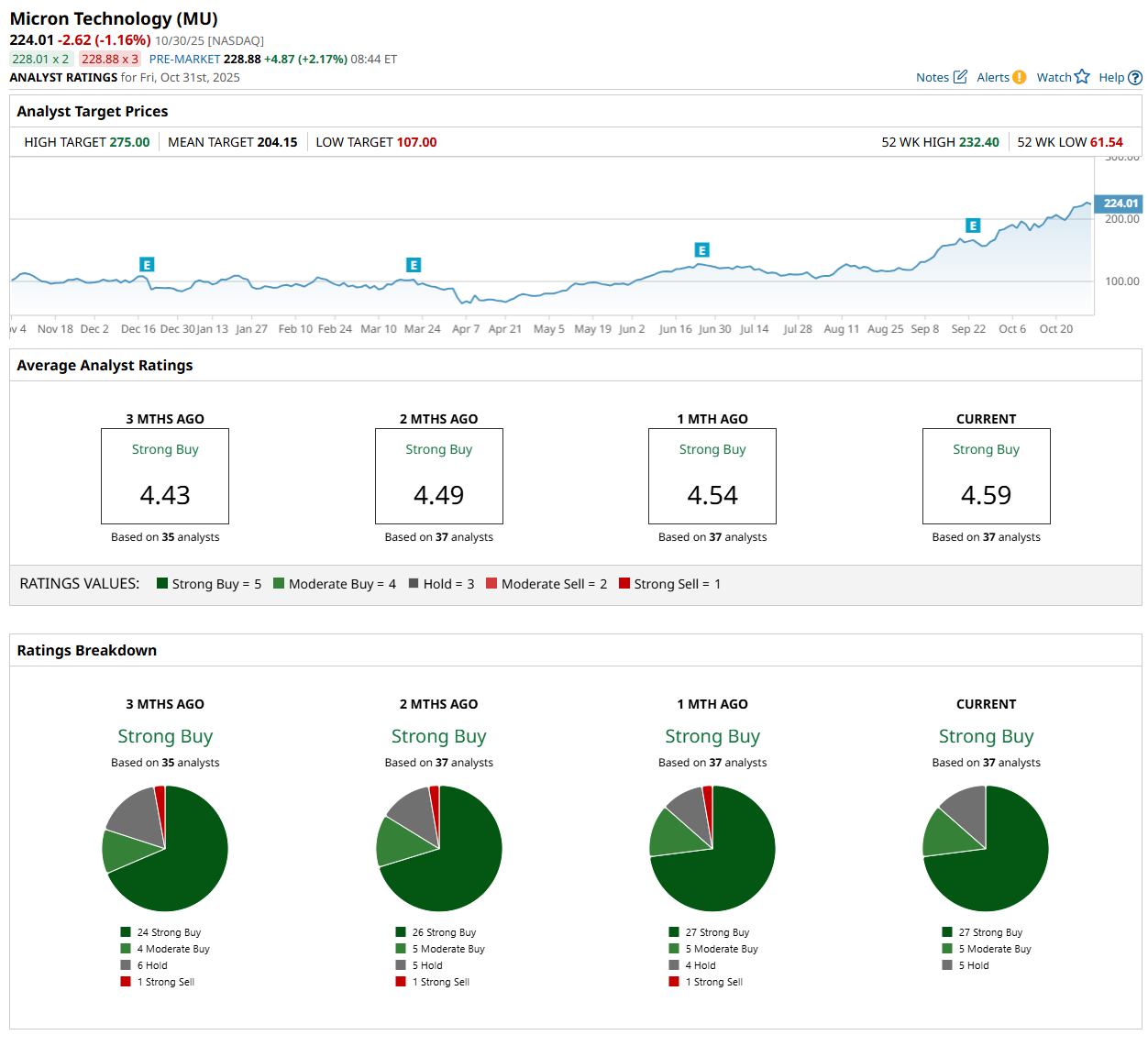

Among the 37 analysts covering the stock, the consensus rating is a "Strong Buy,” which is based on 27 “Strong Buy,” five "Moderate Buy,” and five “Hold” ratings.

This configuration is more bullish than a month ago, with one analyst suggesting a “Strong Sell” rating.

On Oct. 28, Mizuho Financial Group, Inc. (MFG) maintained an "Outperform” rating on MU and raised its price target to $265, implying an 18.3% potential upside from the current levels.

While the company is trading above its mean price target of $204.15, its Street-high price target of $275 suggests an ambitious upside potential of 22.8%.