/Micron%20Technology%20Inc_billboard-by%20Poetra_RH%20via%20Shutterstock.jpg)

Recent information strongly indicates that Micron Technology (MU) is well-positioned to continue benefiting tremendously from the explosive growth of artificial intelligence (AI) for at least the next two years. Meanwhile, the Street is clearly quite bullish on the name, and despite the stock's huge run, its valuation remains low. Finally, board member Teyin Liu recently bought 23,200 shares of MU stock for $7.8 million, demonstrating that Micron's outlook looks very positive to an insider.

In light of these points, investors may want to consider buying shares of Micron. Let's take a closer look.

About Micron Technology

Micron specializes in providing computer-memory solutions that are utilized by data centers and computers, including PCs. One key component of the company's recent growth has been the powerful, rapidly growing demand for its high-bandwidth memory (HBM) offerings, which are extensively utilized in AI chips. Micron is a major supplier of HBM to Nvidia (NVDA) and AMD (AMD), two of the leading makers of these semiconductors. Micron's upcoming HBM product, HBM4, offers “industry-leading bandwidth and power efficiency, ” as Zacks reported last month. Further, the company should be boosted in 2026 by powerful demand for servers that utilize its “high-capacity server DRAM, and data center solid-state drives (SSDs)."

In Micron's quarter that ended in November, revenue jumped 21% versus the same period a year earlier to $13.64 billion. Meanwhile, net income soared a huge 64% year-over-year (YOY) to $5.24 billion.

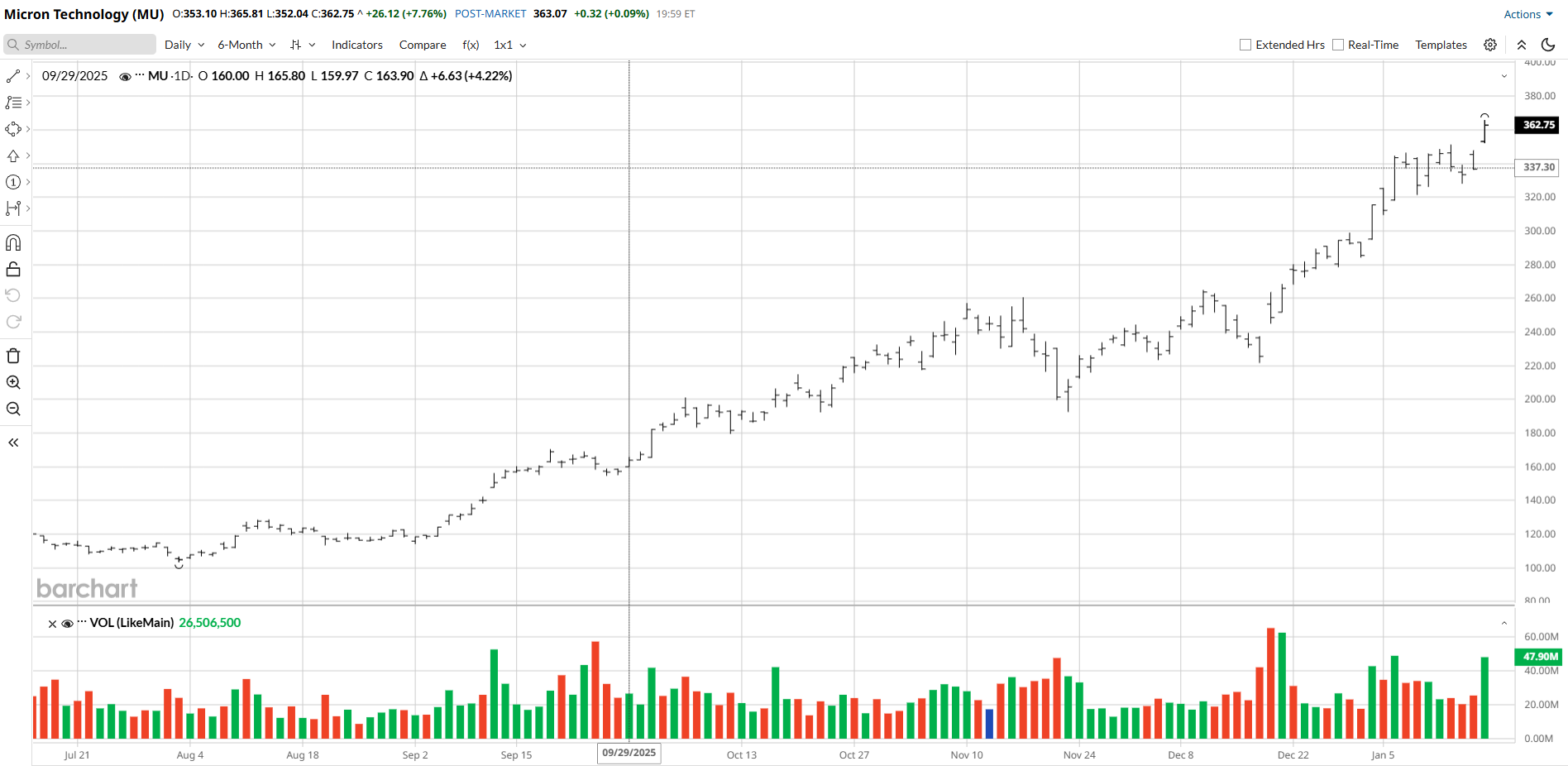

Over the past 52 weeks, MU stock has soared an incredible 264%. Meanwhile, over the past month, shares have climbed a very impressive 44%. Despite MU stock's huge rally, though, the name is still changing hands at an extraordinarily low forward price-to-earnings (P/E) ratio of 11.3 times. Given the tremendous growth of Micron's profits and its ability to continue to capitalize on explosive AI growth, MU is still extremely cheap.

Micron Is Poised to Keep Growing Rapidly

The shortage of memory chips is likely to continue into 2027, as companies in the sector are focusing on meeting the tremendous demand for HBMs, Micron Executive Vice President of Operations Manish Bhatia told Bloomberg recently. “The shortage we are seeing is really unprecedented,” said Bhatia. Meanwhile, the shortage caused HBM prices to jump as much as 60% in 2025, helping Micron's profits and margins to climb dramatically.

Meanwhile, Micron Vice President of Marketing, Mobile and Client Business Unit, Christopher Moore, recently stated that global memory shortages won't be alleviated until 2028. Consequently, with the AI boom expected to continue in the coming years, Micron should continue to benefit from rising prices for its core products and extremely high profit growth for at least the next two years.

Providing evidence backing Micron’s contentions, an executive at tech research firm IDC predicted in December that the impact of the shortage would last “well into 2027” and could result in “a potentially permanent, strategic reallocation of the world’s silicon wafer capacity.” Moreover, he called hyperscalers' demand for HBM “voracious.”

What Do Analysts Think of MU Stock?

The massive price gains of MU stock indicate that the Street has become very bullish on the name. Additionally, many sell-side analysts are clearly jumping on the Micron train. Wells Fargo recently hiked its price target on MU to $410 from $335. Likewise, Citi increased its price target to $385 from $330, while Barclays weighed in with an increase to $450 from $275. Currently, shares of Micron trade around the $397 level, so these price target increases suggest that analysts believe Micron will continue to benefit prolifically from strong industry dynamics in the near-to-medium term.

The recent large insider purchase is also bullish for MU stock. As noted earlier, Micron director Teyin Liu recently spent $7.8 million on shares of the company. As a board member, Liu probably knows much more about the firm's outlook and prospects than those not directly involved with the firm. Therefore, this rather large purchase certainly bodes well for the future performance of MU stock.