KEY POINTS

- Saylor holds 17,732 BTC, worth around 175,227,624

- His BTC investment turned into a more than $600 million pot of gold as Bitcoin surged to $45,620 last week

- Saylor was an early adopter of Bitcoin

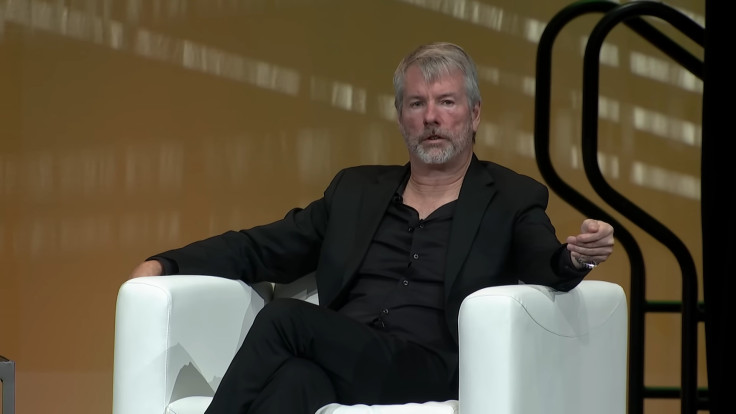

Michael Saylor, the co-founder and executive chairman of MicroStrategy, has achieved an important financial milestone by making over $600 million profit from his Bitcoin investment. It coincided with the inaugural trading of the newly approved spot Bitcoin exchange-traded funds (ETFs) on U.S. exchanges, marking a pivotal moment in MicroStrategy's investment strategy and the broader cryptocurrency market.

Last week, Saylor's Bitcoin investments of 17,732 BTC, worth around 175,227,624 (acquired at $9,882 per coin in 2020), turned into a more than $600 million pot of gold as the world's largest crypto asset by market capitalization surged to $45,620 when spot BTC ETFs officially became available on various exchanges across the U.S.

That is in case the Bitcoin bull has not acquired more Bitcoin between 2020 and 2023.

Saylor, who is a known Bitcoin maximalist, is among the few executives in the traditional financial world who saw an opportunity in Bitcoin investing long before others realized its potential.

He led MicroStrategy's strategic move into cryptocurrency amid a challenging economic landscape marked by government-induced inflation and tech-driven deflation, a period when growth was largely dominated by a few major companies.

Saylor, in his previous interviews, had spoken about how MicroStrategy sought a high-potential digital asset for investment, ultimately identifying Bitcoin as the most promising option at the time.

"We realized Bitcoin is like a high-tech dominant digital network growing at 40% or 50% a year, and so we bought it," Saylor said. "It's kept growing at 40% to 50% a year, and now we're using our balance sheet to grow the company."

MicroStrategy, under Saylor's leadership, marked a significant financial achievement when Bitcoin reached $45,620. Holding 174,530 Bitcoins, acquired at an average price of $30,252 each, the company's unrealized profits totaled approximately $2.68 billion.

While opinions vary on the impact of Bitcoin ETFs on MicroStrategy's investment approach, Saylor views their approval as a major financial development, potentially the most significant one on Wall Street in the last 30 years.

The $BTC Spot ETF may be the biggest development on Wall Street in the last 30 years. My discussion of #Bitcoin in 2024, Spot ETFs vs. $MSTR, and the emergence of bitcoin as a treasury reserve asset with @KaileyLeinz on Bloomberg @Crypto. pic.twitter.com/QtPdBOhMDr

— Michael Saylor⚡️ (@saylor) December 19, 2023

"It's not unreasonable to suggest that this may be the biggest development on Wall Street in 30 years," Saylor said last week. "The last thing that was this consequential was the creation of the S&P index and the ability to invest in all 500 S&P companies via one trade at the same time."