A day after Alphabet (GOOGL) and Microsoft (MSFT) delivered better-than-feared numbers, investors are hoping Meta Platforms undefined does the same.

Among analysts polled by FactSet, the consensus is for the Facebook, Instagram and WhatsApp parent to report Q2 revenue of $28.91 billion (down 1% annually) and GAAP EPS of $2.54 (down 30%). If Meta's revenue proves to be in-line with consensus or below, it would be down annually for the first time in Meta's history as a publicly-traded company.

For Q3 – Meta has been providing quarterly sales guidance in its reports – the revenue consensus stands at $30.36 billion (up 5%).

Eric Jhonsa, Real Money’s tech columnist, is live-blogging Meta’s report, along with an earnings call scheduled for 5 P.M. Eastern Time.

(Please refresh your browser for updates.)

6:15 PM ET: Meta's Q2 call has ended. Shares are down 4.4% after-hours to $162.23 after Meta slightly missed Q2 estimates and (more importantly) guided for Q3 revenue of $26B-$28.5B (below a $30.36B consensus and implying a 2%-10% Y/Y revenue decline), while blaming the impact of macro headwinds on ad demand.

Meta also cut its full-year expense guidance again, albeit while slightly upping the low end of its full-year capex guidance. And it disclosed CFO Dave Wehner will transition to the role of chief strategy officer in November, with finance VP Susan Li succeeding Wehner as CFO.

On the call, Mark Zuckerberg indicated Meta's headcount growth rate will steadily slow in the coming quarters, and said he expects the company to "get more done with fewer resources" going forward. He also disclosed Reels is now on a $1B+ annual revenue run rate.

Thanks for joining us.

6:07 PM ET: A question about investments in using AI for content moderation. And one about click-to-message ads.

Zuck says much of Meta's content moderation is now handled by AI, and that metrics continue trending in the right direction. Adds that a lot of Meta's AI investments are now related to content discovery.

Sandberg reiterates click-to-message ads are seeing strong growth, and says their ability to drive direct connections between consumers and businesses are particularly valuable at a time when businesses have access to less data from other sources. Also highlights success stories involving businesses that have used the ads to generate leads/customers.

6:02 PM ET: A question about work on ad products that could strengthen Meta's hand against social media rivals.

Wehner notes different headwinds affect various social media platforms and ad verticals in different ways, while saying Meta remains confident in building differentiated products.

5:58 PM ET: A question about how quickly Reels monetization could match stories monetization. And one about the FTC's opposition to Meta's planned acquisition of VR startup Within.

Wehner notes it took a while to ramp Stories monetization, and that Meta is still "very early" when it comes to Reels monetization. Notes each platform has unique features that make comparing them difficult.

Regarding Within, he says Meta disagrees with the FTC's stance and that M&A will remain a part of Meta's strategy.

5:54 PM ET: Another question about Reels monetization. And one about Meta's competitive positioning.

Sandberg says Meta has a history of building products that are both popular with consumers and monetize well. Notes it takes time to help small businesses effectively use new ad tools.

Zuck argues Meta's competitive advantages come from its product investments rather than its social graph, noting a phone book can provide a social graph as well. Says investments in AI-based recommendation systems will benefit a number of Meta's platforms.

5:50 PM ET: A question about whether Meta can bring its targeting/measurement back to where it was before Apple's policy changes. And one about future growth.

Sandberg asserts Meta is still early when it comes to improving targeting/measurement. Says both AI investments and work with other ad industry players will play roles.

Wehner reiterates the current macro environment is difficult, while adding Meta is confident it can return to healthy levels of growth in time.

5:46 PM ET: A question about how Facebook/Instagram's content discovery features will be differentiated relative to rival platforms, and one about buybacks dropping Q/Q.

Wehner says there's no real change in Meta's capital-return policy, and will continue buying back stock when considered appropriate.

Zuck says content from followed accounts/friends will remain important on Meta's platforms, but that (as AI keeps improving) discovering content from non-followed accounts is taking on a bigger role. Notes investments in using AI to gain a deep understanding of content and argues supporting a variety of content types on its platforms will be a differentiator.

5:41 PM ET: A question about how much spending cuts impact Family of Apps vs. Reality Labs.

Wehner says Meta plans to continue increasing its Reality Labs investments, while becoming more disciplined about spending company-wide.

5:39 PM ET: A question about Reels' current revenue impact.

Wehner notes Reels is an "overall headwind" on revenue for the time being since monetization is in its early stages, while reiterating Meta thinks it will be a positive for revenue long-term. Adds that macro is a bigger headwind right now.

5:37 PM ET: The Q&A session is underway. First question is about if Reels growth is additive to total engagement. Also one about whether headcount could drop next year.

Wehner says Reels is additive to time spent, even if there's some cannibalization of time spent on other services. Says Meta isn't providing 2023 headcount guidance for now, and will provide more color about its hiring plans for next year as it draws closer.

5:35 PM ET: Regarding the Q3 guide, Wehner reiterates it accounts for macro and forex headwinds. Also notes Meta expects full-year tax rate that's in the high teens and above the Q2 rate of 18%.

5:32 PM ET: Wehner says ad growth slowed throughout Q2, and that the pressures are broad-based. Also reiterates forex and Apple policy changes are headwinds. Notes revenue rose in the Asia-Pac and Rest of World regions, while declining in North America and Europe.

Impression growth was driven by Asia-Pac and Rest of World. Price per ad was hurt by lower ad demand and a mix shift in ad impressions to regions with lower ad prices.

5:29 PM ET: Dave Wehner is now talking. He starts by recapping Meta's Q2 financials, while reiterating headcount growth will slow going forward.

5:27 PM ET: Meta has pared its losses a bit since the call started: Shares are now down 2.3% AH. The comments about Reels growth/revenue might be helping.

5:26 PM ET: Sandberg goes over efforts to improve ad measurement/conversion-tracking as it contends with the loss of data caused by Apple policy changes, including work on AI-based solutions.

"We're facing a cyclical downturn, but over the long run, the digital ad market will continue to grow," she says.

5:23 PM ET: Sandberg says Meta estimates more than 1B users are now messaging businesses, and that its click-to-message ads are still seeing strong double-digit growth.

5:22 PM ET: Sheryl Sandberg (in her last Meta earnings call) is talking. She starts by going over the impact of macro headwinds such as inflation, forex, Russia/Ukraine, etc.

Regarding Reels, Sandberg says it'll take time to improve monetization, but that Meta has a monetization playbook it can leverage.

5:20 PM ET: Zuck once more defends Meta's giant metaverse investments, while highlighting work on solutions such as the Horizon collaboration platform and the upcoming Project Cambria high-end headset. "The experience here is getting pretty awesome," he says.

He also takes a moment to thank the departing Sheryl Sandberg for her work at Meta over the years, and says he's looking forward to working with Dave Wehner as he transitions from CFO to Chief Strategy Officer.

5:16 PM ET: Regarding the impact of Apple policy changes, Zuck says more work needs to be done to address them, while asserting Meta's efforts to do so will leave its ad business in a stronger competitive position than before.

5:14 PM ET: Zuck also notes Reels now makes up more than 50% of all content shared on Instagram via private messages, while arguing such sharing creates a "flywheel" of content consumption and creation.

He also reiterates that for now, Reels isn't monetizing at the same rate as more established ad services, while expressing confidence this will change in time. Reels ads are said to now be on a $1B+/year revenue run rate.

5:11 PM ET: Zuck notes social media consumption is shifting from content from followed accounts to content from non-followed accounts pushed by AI-driven algorithms. He expects this trend to continue, while asserting it will increase Meta's monetization opportunity.

He also says Reels saw a 30%+ Q/Q increase in time spent across Facebook and Instagram.

5:09 PM ET: Zuck says Meta is being "rigorous" about measuring returns on its investments. Says Meta plans to steadily reduce the pace of headcount growth over the next year, and that some teams will shrink in size, even as large investments in "priority areas" continue.

"I expect us to get more done with fewer resources," he says.

5:06 PM ET: Mark Zuckerberg is talking. Starts off by noting Meta's app family user base continues growing. Also says engagement trends for Facebook have been stronger than expected, while noting macro conditions look worse than they did a quarter ago.

5:05 PM ET: The call is starting. Meta's call typically features prepared remarks from Mark Zuckerberg, COO Sheryl Sandberg and CFO Dave Wehner, after which the execs field questions from analysts.

5:02 PM ET: Shares are down 3.7% AH going into the call. Look for any commentary Meta shares about ad-spending trends -- and particularly about how much it thinks current headwinds could ease in seasonally big Q4 -- to get close attention.

4:58 PM ET: Meta's Q1 call is about to start. Here's the webcast link, for those looking to tune in.

4:56 PM ET: Amid plans to slow hiring (and reportedly, to "transition out" some existing workers), Meta ended Q2 with 83,553 employees. That's up 7% Q/Q and 32% Y/Y.

Meanwhile, capex (fueled by giant investments in cloud data centers) rose to $7.75B from $5.55B in Q1 and $4.74B in Q2 2021.

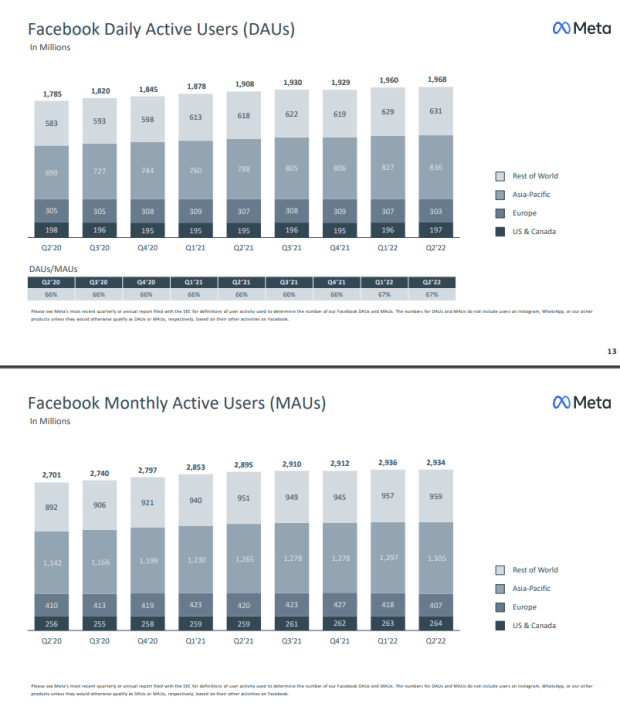

4:52 PM ET: Facebook daily active users (they cover core Facebook and Messenger) rose by 8M Q/Q and 60M Y/Y to 1.97B, while monthly active users fell by 2M Q/Q and rose by 39M Y/Y to 2.9B.

Notably, Facebook DAUs and MAUs fell by 4M and 9M Q/Q in Europe, while seeing modest growth elsewhere. Meta cautioned on its Q1 call that the blocking of its services in Russia would weigh on its Q2 user counts for Europe.

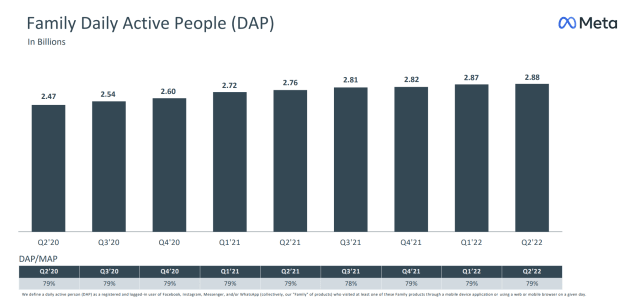

4:46 PM ET: Daily active people for Meta's app family rose by 10M Q/Q and 120M Y/Y to 2.88B, while monthly active people rose by 10M Q/Q and 140M Y/Y to 3.65B.

Q/Q growth for both numbers was much lower than it was a year ago. But (given worries about TikTok and broader social media engagement pressures) some investors might be pleased that DAPs/MAPs are still growing.

4:38 PM ET: Though its ad revenue fell, Meta's ad impressions grew 15% Y/Y in Q2, matching Q1's growth rate.

On the other hand, average price per ad (hurt by macro pressures, Apple user-tracking policy changes, and for now by Meta's efforts to grow its Reels short-form video platform) fell 14%, a bigger increase than Q1's 8% drop.

4:33 PM ET: Meta spent $5.1B on stock buybacks in Q2. That's down from $9.4B in Q1.

Following the buybacks and $4.45B in free cash flow (down from $8.51B a year earlier), Meta finished Q2 with $40.49B in cash and no debt.

4:24 PM ET: The Family of Apps segment (covers Facebook, Instagram, etc.) posted GAAP op. income of $11.16B, down 25% Y/Y.

The Reality Labs segment (covers Meta's AR/VR efforts) posted a $2.81B op. loss, up from $2.43B a year earlier and more than 6x its quarterly revenue.

4:22 PM ET: Meta's revenue was down 1% Y/Y in Q2, and its Q3 guide implies revenue will be down 2%-10% Y/Y.

Ad revenue fell 2% Y/Y in Q2 to $28.15B. Reality Labs revenue (driven by VR headset sales) rose 48% to $452M. All other revenue (payments, in-app transactions, etc.) rose 14% to $218M.

4:16 PM ET: Meta is now down 2.6% AH. The subdued reaction to the light Q3 guide (for now, at least) says a bit about how low pre-earnings expectations were, particularly in the wake of Snap and Twitter's reports.

4:13 PM ET: Meta on its Q3 guide: "This outlook reflects a continuation of the weak advertising demand environment we experienced throughout the second quarter, which we believe is being driven by broader macroeconomic uncertainty. We also anticipate third quarter Reality Labs revenue to be lower than second quarter revenue. Our guidance assumes foreign currency will be an approximately 6% headwind to year-over-year total revenue growth in the third quarter, based on current exchange rates."

4:11 PM ET: Meta is cutting its full-year expense guidance for the second time this year: It now stands at $85B-$88B, down from $87B-$92B.

At the same time (in what's perhaps a positive for Meta's chip and hardware suppliers), Meta's capex guidance is now at $30B-$34B, slightly tweaked from a prior $29B-$34B.

Meta: "We have reduced our hiring and overall expense growth plans this year to account for the more challenging operating environment while continuing to direct resources toward our company priorities."

4:08 PM ET: Meta also announces long-time CFO Dave Wehner "will take on a new role as Meta's first Chief Strategy Officer, where he will oversee the company's strategy and corporate development," effective Nov. 1. Finance VP Susan Li will succeed Wehner as CFO.

4:07 PM ET: Meta guides for Q3 revenue of $26B-$28.5B, below a $30.36B consensus.

Shares are down 3.8% AH.

4:06 PM ET: Results are out. Q2 revenue of $28.82B is slightly below a $28.91B consensus. GAAP EPS of $2.46 is below a $2.54 consensus.

4:00 PM ET: Meta closed up 6.6%. The Q2 report should be out shortly.

3:58 PM ET: Aside from Meta's sales/EPS figures, any commentary shared about spending cuts will be closely watched. Recent reports suggest job cuts could be on the way.

3:55 PM ET: With an assist from Alphabet's Q2 report, Meta's stock has risen 6% today. But shares are still down about 50% YTD and slightly below where they traded 5 years ago.

3:49 PM ET: The FactSet consensus is for Meta to report Q2 revenue of $28.91B and GAAP EPS of $2.54, and to post Q3 revenue of $30.36B (the Q2 report should feature Q3 sales guidance). But given Snap/Twitter's Q2 reports and other data pointing to a weak environment for social media ad spend, informal expectations might be lower.

3:47 PM ET: Hi, this is Eric Jhonsa. I'll be live-blogging Meta's Q2 report (expected shortly after the close) and earnings call.