It has not been a good year for Meta (META) -- although the social-media giant is hardly alone.

Tech and growth stocks have come under the most pressure so far in 2022, as a bear market continues to roil equities.

At one point, megacap tech stocks like Apple (AAPL) and Microsoft (MSFT) were holding up pretty well relative to the mess in tech and in FAANG. But even these names have started to crack.

When we look at Meta, the shares are down 62% in 2022 and 67% from their all-time high.

This once-dominant tech stock is now trying to fight off lackluster growth while investors' patience with the company’s bet on the metaverse is growing thin.

To ponder where the bottom is for Meta stock, we need to look at prior bottoms.

Trading Meta Stock

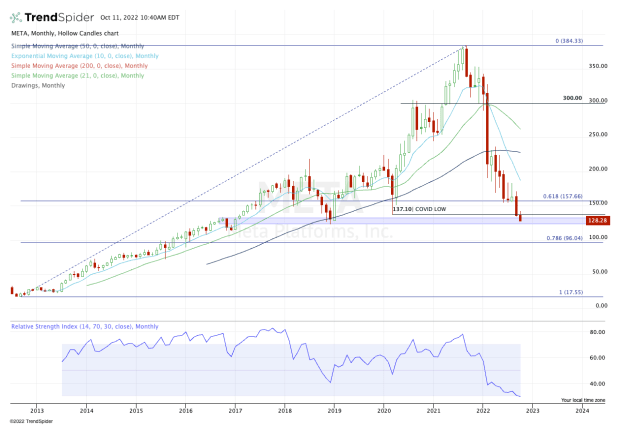

Chart courtesy of TrendSpider.com

Down 67% from the high is Meta stock’s worst drought since it went public. It suffered a 61% decline in 2012 shortly after the IPO, then largely enjoyed the next five years until a ~44% correction in 2018 and a 38.5% correction in 2020.

It’s now trading below its covid low of $137.10 and into a key zone of the past several years. This zone encompasses $123 to $133 and marks where Meta stock bottomed in 2018 and where it broke out in 2017.

In short, we have a prior FAANG darling that’s lost two-thirds of its value and now trades at just 13 times earnings.

If this $123 to $133 area ultimately holds as support, the bulls will want to see it power up through the covid low and toward $150-plus.

On the downside, a break of this zone could usher in a test of the $95 to $100 area, although that would require a decline of roughly 75% from the high.

If we see that zone, the 78.6% retracement could be in play, as measured from the all-time high down to the all-time low.

This feels like a bit of an extreme view and is not necessarily something that I’m expecting.

But with Meta stock already trading in a key area, the bulls need to see the stock make a stand here. A break lower may not usher in $100, but it would firmly entrench the stock in no man’s land for the time being.