Investors should have a lot to digest as Meta Platforms delivers its first earnings report featuring the company’s new name and reporting structure.

Currently, the consensus among analysts polled by FactSet is for the company formerly known as Facebook to report revenue of $33.36 billion (up 19% annually) and GAAP EPS of $3.85 (down 1%) for its seasonally big fourth quarter.

Meta typically provides quarterly sales guidance in its report. The company’s first-quarter revenue consensus currently stands at $30.18 billion (up 15%).

Eric Jhonsa, Real Money’s tech columnist, will be live-blogging Meta’s earnings report, which is expected after Wednesday’s close, along with an earnings call (expected to feature Mark Zuckerberg, COO Sheryl Sandberg and CFO Dave Wehner) scheduled for 5:00 P.M. Eastern Time. Please refresh your browser for updates.

6:11 PM ET: Meta's call has ended. Shares are down 22.8% after-hours to $249.33 after the company posted mixed Q4 results (revenue beat, but EPS missed) and guided for Q1 revenue of $27B-$29B (below a $30.18B consensus).

Meta attributed its Q1 outlook to ad impression headwinds caused by increased competition and a shift in user engagement towards short-form video services such as Reels (lightly monetized for now), along with ad pricing headwinds caused by iOS policy changes, supply chain/inflation pressures and currency swings. On the call, CFO Dave Wehner estimated the iOS changes will be a $10B revenue headwind in 2022, while adding the pressures are expected to decrease over the course of the year.

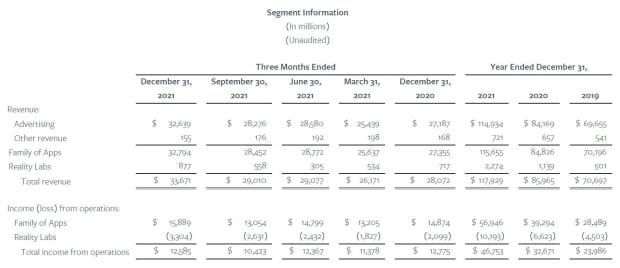

Meta also disclosed that its Family of Apps segment had a $15.89B operating profit in Q4, and that its Reality Labs segment, which covers its AR/VR efforts, had a $3.3B operating loss. For the whole of 2021, Family of Apps had a $56.95B op. profit and Reality Labs had a $10.19B op. loss.

Thanks for joining us.

6:03 PM ET: A question about Family of Apps margins, and one about sharing revenue with short-form video creators.

Wehner: G&A was up a lot in Q4, and it tends to be lumpy. We're also investing a lot in capex, mostly to support the Family of Apps business. Payments to short-form creators will grow over time. That's a part of our planned 2022 investments in Reels.

6:01 PM ET: One more question about Reels, and another one about improving ad targeting/measurement.

Zuck: We see a lot of potential with Reels. There's very clear product/market fit. There is a much bigger competitor in TikTok. But better tools/monetization for creators will help attract more creators and lead to more high-quality Reels content. Monetization is lower for now, but we think this is the right strategy to pursue.

Sandberg: We're rolling out new tools to improve measurement. Over the long-term, we need to develop new privacy-friendly ways to deliver targeted ads. At the same time, there are a lot of things that advertisers can do right now to fully take advantage of our existing ad tools. We think there's still a lot of performance improvement left in the system.

5:57 PM ET: Another question about Reels activity, and one about SMB ad spend.

Zuck: The interactions that happen through one content format will often differ a lot from the ones happening on another format. But we're seeing short-form video grow incredibly quickly. We've gone from text being the main way people to interact to photos and now videos. I think a more immersive format centered around AR and VR will be the next step. But video is seeing huge growth right now.

Sandberg: The iOS changes hurt advertisers across the board, but they've been especially hard on SMBs. Personalized ads are more important for them, since they have smaller budgets. We still believe our ad system has strong benefits for SMBs. We're working to get them to use things such as our commerce and business messaging tools. But the iOS changes remain a challenge.

5:52 PM ET: A question about driving user growth among younger users, and one about integrating AR/VR content into mobile apps.

Wehner: We're certainly seeing an impact from competition, particularly among younger audiences. We're seeing North American MAUs/DAUs bounce around. In the rest of the world, we've seen some headwinds. For example, higher data plan prices have been a headwind in India.

Zuck: We're already working to integrate VR content within the Facebook and Instagram apps. Also, we want our Horizon service to work on 2D devices.

5:48 PM ET: A question about addressing ESG concerns, and one about the expected $10B 2022 impact from iOS changes.

Wehner: The $10B figure is an estimate. But we think the iOS changes are a substantial headwind. I don't have anything specific on the ESG front.

5:47 PM ET: Another question about the Reels transition, and one about expected Reality Labs losses in 2022.

Zuck: We're only going to show Reels content if there's high-quality content to show. We believe the amount of high-quality Reels content will grow. The relative monetization rate of Reels will be lower than that of Feeds for the foreseeable future. But we think it'll drive a tremendous amount of engagement growth, and that it should monetize similar to feeds and stories in time.

Wehner: We're not providing expense guidance by segment. But we expect technical investments to be the biggest driver of expense growth. We think Family of Apps will continue driving the majority of expense growth, but we expect Reality Labs' operating loss to increase meaningfully in 2022.

5:43 PM ET: A question about feed content, and one about targeting/measurement will improve towards year's end.

Zuck: The balance of content within feeds is shifting more towards public content. Also, people are taking content they would've previously shared in feeds and sharing it in messaging apps.

Wehner: We're seeing incremental targeting/measurement headwinds from iOS 15, but they're much smaller than the headwinds caused by iOS 14.5. The biggest lapping effect will be in the first half of 2022.

5:40 PM ET: A question about engagement, and one about improving targeting/measurement.

Zuck: Reels and short-form video are very engaging. This isn't the first time we've gone through a major engagement transition. We're confident we'll be successful again. One difference with Reels is that TikTok is such a big competitor already and still growing fast. We're optimistic about the future with Reels, but there's a lot of work to do.

Sandberg: Improving targeting while having less data is a multi-year effort. AI investments will help us. Regarding measurement, we made real progress in addressing the under-reporting of conversions. Small businesses are being hurt more by Apple's changes. Also, the delayed availability of data to advertisers was an issue for ad campaigns during the holiday season.

5:34 PM ET: First question is about the Reels transition. Is there anything that makes you think it could be harder than prior transitions? Also a question about whether Facebook expects additional data signal loss for ads in Q1.

Wehner: We're really focused on making short-form video work on Facebook and Instagram. We think it's a format that'll work effectively for ads in time. But right now, there are relatively few ads in Reels.

Regarding iOS policy changes, he says the expected 2022 impact is $10B and notes pressures were significant for e-commerce ads. Wehner also points out Google reported seeing strong e-commerce ad growth, and suggests Google Search ads may have benefited from seeing fewer iOS policy headwinds.

5:30 PM ET: The Q&A session is starting.

5:29 PM ET: Wehner recaps the Q1 guidance shared in the Q4 report, noting iOS policy changes, macro, forex and an engagement shift towards Reels will be headwinds for ad sales.

5:28 PM ET: Wehner notes Facebook user growth was impacted by multiple factors, including competition and the pandemic-related pull-forward of user growth in Asia-Pac and the Rest of World region.

5:25 PM ET: Wehner: Asia-Pac was the region that saw the strongest ad growth (31% Y/Y) Forex was a most headwind in all international regions. Ad prices grew in all regions, but were pressured by macro headwinds and ad targeting/measurement challenges.

5:23 PM ET: Wehner: We had 3,700 net new hires in Q4, mostly related to technical functions.

5:22 PM ET: Wehner: Forex was a $307M headwind in Q4.

5:21 PM ET: Dave Wehner is talking.

5:20 PM ET: Sandberg: We're trying to make it easier to make purchases from a messaging chat. More than 160M users now view a business catalog on WhatsApp each month.

5:19 PM ET: Regarding Reels monetization, Sandberg compares the mix transition towards Reels ads to Facebook's prior successful mix transition towards Stories ads relative to feed ads. She also asserts Facebook is seeing good early traction with its efforts to provide new commerce tools within its social platforms.

5:17 PM ET: Sandberg: Apple policy changes affected both targeting and measurement. We're working to improve things, and we expect the impact of Apple changes to moderate in Q1 and over the course of 2022.

5:16 PM ET: Sandberg: In Q4, we lapped a period of strong growth for holiday shopping. We also had to contend with Apple's iOS policy changes, and we heard a number of advertisers voice concerns about inflation and supply chain challenges.

5:15 PM ET: Sheryl Sandberg is talking.

5:15 PM ET: Zuck: Our path ahead is not yet perfectly defined. But I'm confident that the investments I outlined are the right ones.

5:13 PM ET: Zuck: We believe our AI Research SuperCluster will be the world's fastest supercomputer when finished. We plan to make a number of infrastructure investments to support our AI investments.

He also takes a moment to highlight recent momentum for the Quest 2 headset and other VR offerings. He also says his company's metaverse investments will extend to the Facebook and Instagram mobile apps.

5:09 PM ET: Zuck: People still want to see relevant ads. We're rebuilding our ads infrastructure so that we can keep showing relevant ads in spite of Apple's policy changes.

5:08 PM ET: Zuck: We're seeing people want to share more things in messaging apps. We want to help people on WhatsApp better organize group chats and engage with communities.

He also says Meta estimates more than 1B users are engaging with business messaging accounts each week, and that the company will invest in providing new messaging tools to businesses.

5:06 PM ET: Zuck: Reels is our fastest-growing product by far. It's the biggest contributor to Instagram engagement growth.

5:06 PM ET: Zuck says 2022 will be a year focused on execution. Regarding the Q4 numbers, he admits competition from platforms such as TikTok is a factor. He also notes the ongoing transition to short-form video (for example, Instagram Reels) on Meta's platforms will weigh on ad impression growth in the short-term, while asserting that making this transition is in the company's interests.

5:02 PM ET: Mark Zuckerberg is talking.

5:02 PM ET: Meta is going over its safe-harbor statement. Typically, its call features prepared remarks from Mark Zuckerberg, COO Sheryl Sandberg and CFO Dave Wehner, after which the execs field questions from analysts.

5:00 PM ET: The call is starting.

4:58 PM ET: Meta's earnings call should start in a couple of minutes. Here's the webcast link, for those looking to tune in.

Shares remain down sharply ahead of the call: They're currently down 21.7% AH to $253.00, putting them near a 52-week low of $253.50 that was set 11 months ago.

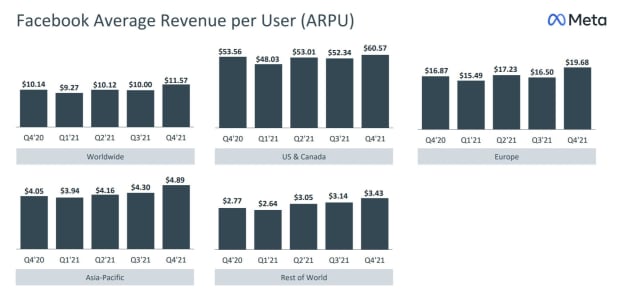

4:54 PM ET: Meta's global ARPU rose 14% Y/Y in Q4 to $11.57. ARPU for North America (still responsible for 47% of revenue) remains more than 3x that of any other region.

4:51 PM ET: The recent financial performance of Meta's Family of Apps and Reality Labs segments. Meta's AR/VR investments depressed its 2021 operating income by 18%

This is something that definitely needs to be taken into account when valuing the company, since it means that (much like Waymo or Google Cloud for Alphabet) a business that's far from worthless is currently a profit drag.

4:45 PM ET: Boosting costs/expenses: Meta's GAAP G&A spend rose 107% Y/Y to $3.31B. Also, R&D spend rose 35% to $7.05B and sales/marketing spend rose 34% to $4.39B.

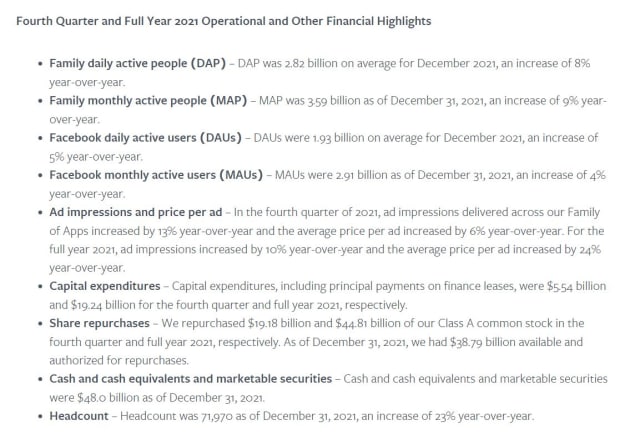

4:41 PM ET: Notably, Meta's ad impression growth (benefiting from efforts to monetize Instagram Stories/Reels) accelerated to 13% in Q4 from Q3's 9%. But ad price growth (affected by the impact of iOS policy changes on targeting/measurement) slowed to 6% from Q3's 22%.

4:37 PM ET: Alphabet is down 1.9% AH following Meta's report, but that still leaves it up more than 5% since it reported yesterday afternoon. Meta's numbers suggest Google Search (not significantly affected by iOS policy changes) is an online ad share-gainer in the current environment.

4:32 PM ET: Boosting Q4 EPS: Meta spent $19.18B on buybacks, up from $14.37B in Q3.

On the flip side, EPS was hurt by a 38% Y/Y increase in costs/expenses (even with Q3's rate and well above revenue growth of 20%) and a 19% effective tax rate (up from Q3's 13% and the year-ago period's 14%).

4:30 PM ET: Some key numbers from Meta's Q4 report. Facebook/Messenger MAUs of 2.91B (+4%) Y/Y missed a 2.95B consensus, while DAUs of 1.93B (+5%) missed a 1.95B consensus.

As was the case in recent quarters, app family MAUs/DAUs, which include Instagram and WhatsApp users who don't use Facebook or Messenger, are growing faster than Facebook/Messenger MAUs/DAUs.

4:25 PM ET: Some other casualties of Meta's report: Pinterest is down 10.7% AH, Roku is down 5.1% and Amazon is down 2.5%. The Invesco QQQ Trust is down 1.8%.

4:20 PM ET: Meta has added to its losses: It's now down 20.7% AH. Between Netflix, PayPal and Meta, this earnings season has produced some truly massive post-earnings drops in the shares of big tech companies.

4:19 PM ET: Revenue rose 20% Y/Y in Q4, and is forecast to grow 3%-11% in Q1.

Meta's Family of Apps segment posted Q4 revenue of $32.79B (up 20%), the lion's share of which involved ad revenue of $32.64B. Family of Apps operating income rose 7% to $15.89B.

The Reality Labs segment, which covers VR headset sales and other AR/VR activities, posted revenue of $877M (+22%) and posted a $3.3B op. loss. (up from $2.1B a year earlier). Strong echoes of Alphabet's "Other Bets" segment.

4:14 PM ET: Here's the earnings release.

4:13 PM ET: Snap, which reports tomorrow, is down 14.3% AH following Meta's report. Twitter, which reports on 2/10, is down 8.5%.

4:11 PM ET: Full-year capex guidance remains at $29B-$34B. Full-year cost/expense guidance has been narrowed to $90B-$95B from $91B-$97B.

4:10 PM ET: Also disclosed: The company's ticker will be changing from FB to META in 1H22.

4:09 PM ET: Regarding the Q1 guide, Meta says it expects continued ad-impression headwinds "from both increased competition for people's time and a shift of engagement within our apps towards video surfaces like Reels, which monetize at lower rates than Feed and Stories."

The company also says ad pricing will be negatively impacted by iOS policy changes, macro challenges related to inflation/supply chain disruptions (said to be weighing on ad budgets) and forex.

4:07 PM ET: Shares are down 14.4% after-hours to $276.58.

4:06 PM ET: Meta guides for Q1 revenue of $27B-$29B, below a $30.18B consensus.

4:05 PM ET: Results are out. Q4 revenue of $33.67B beats a $33.36B consensus. GAAP EPS of $3.67 misses a $3.85 consensus.

4:00 PM ET: Meta closed up 1.2%. Results should be out any minute.

3:55 PM ET: With an assist from fellow online ad giant Alphabet's Q4 report, Meta's stock is up 1.2% today heading into its report. Shares are down 4% YTD (less than many tech peers) and up 21% over the last 12 months.

3:51 PM ET: Of note: The Q4 report will be the first earnings report in which Meta separately breaks out the financial performance of its AR/VR operations (widely believed to be losing money) from that of its highly profitable social media app operations.

3:49 PM ET: The FactSet consensus is for Meta to post Q4 revenue of $33.36B and GAAP EPS of $3.85.

For Q1 (Meta typically provides sales guidance), the revenue consensus stands at $30.18B).

3:46 PM ET: Hi, this is Eric Jhonsa. I'll be live-blogging Meta's Q4 report and call.