THE liquidator for failed Merewether lender Funda, and related company Collaborating, claims the businesses may have traded whilst insolvent for years before their collapse, and has drawn into question allegations of a ponzi scheme, which have been strenuously denied by the directors.

A scathing statutory report to creditors from liquidator Bradd Morelli, of Jirsch Sutherland, alleges insolvent trading and director misconduct, among a host of concerns that will be lodged with the corporate regulator ASIC.

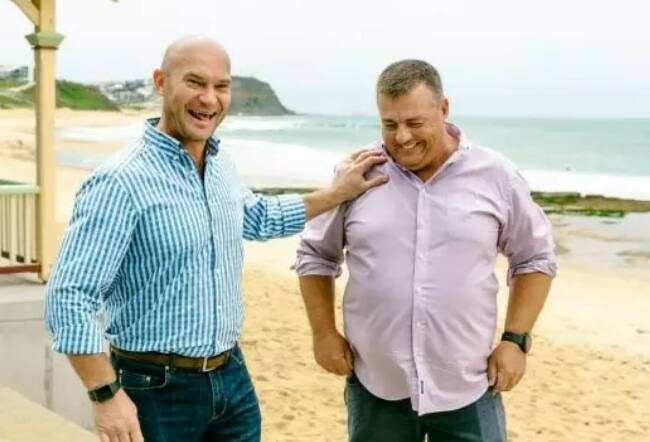

It means directors, Mark Owen and Nathan Wright, may be liable for debts incurred during any period of insolvent trading.

But Mr Morelli said he was unable to identify any property or significant assets owned by the pair.

Funda, or Ownright Pty Ltd, was founded in 2013.

Collaborating operated as its holding company.

The companies collapsed in December 2023 with combined debts of $11 million after failing to meet several creditors' demands for loans to be repaid.

Mr Morelli's report details allegations made by creditors about the operation of a possible ponzi scheme.

A ponzi scheme draws on money from investors to pay interest, and collapses when the flow of funds dries up or its operators spend the money too quickly.

"Whilst our detailed review has identified transactions which may have the characteristics of same, taken overall, further detailed investigation is required," the liquidator's report reads.

"I have raised this allegation with the directors, who strenuously refuse same. Given the seriousness of the allegation, further investigation is warranted with possible reporting to statutory bodies where necessary."

The report calls into question $3.49 million that was loaned by creditors to Collaborating between November 2018 and August 2022.

Of this, $1.232 million was used to make interest payments on loans, $580,000 went to paying out lenders and $1.677 million was paid to Funda to be used for small business loans.

Mr Morelli said he was concerned investor funds were used "to pay interest amounts due to existing creditors rather than utilising revenue generated in Ownright [Funda]".

The report says the directors state this was done for "ease of processing and proper accounting entries were made to reflect these transactions".

Mr Owen "strenuously denied" the allegation on Friday.

"I fully support any investigation required to clear these allegations," Mr Owen told the Newcastle Herald.

"I also intend to continue to work with the liquidator in defence of the possible breaches of director duties identified in the report."

Both directors blame the demise of the companies on the pandemic and said the business-focused, non-bank lending sector, including many of Funda's competitors, was struggling to survive.

They have both denied any wrongdoing.

Mr Morelli said it "did not appear that the directors set out to intentionally defraud creditors" but they may have committed numerous offences whilst operating the two companies.

These include allegations of continuing to have Funda trade whilst insolvent since mid-2019 amid "accumulated losses" and improperly using their position to gain an advantage at the company's expense.

The liquidation process has uncovered that from 2017 to 2023 Funda overpaid rent and strata fees by $185,811 for its Merewether offices, which were owned by two superannuation funds linked to the directors.

Funda was based at 5/91 Frederick St, Merewether.

The building was purchased by Frederick St Office Pty Ltd in October 2016 for $1,045,000 and sold in December 2022 for $1,550,000.

Mr Wright and Mr Owen were the sole directors of Frederick St Office Pty Ltd when the company owned the office space.

Mr Morelli said he had written to Frederick St Office, which now also has Mr Wright's wife Carol as a director, seeking repayment of the money.

At the heart of the tale, which has claimed more than $10.5 million in life savings and superannuation funds, is a series of accumulated annual losses that started for Funda in June 2018 at $317,165.

The next year the loss grew to $867,834, then $1.375 million in 2020, $1.662 in 2021, before it jumped to $4.583 million in 2022 and $6.513 million in June 2023.

Mr Morelli said the failure of Collaborating was directly due to the collapse of Funda.

He does not expect any creditors will see a return.

"The impact of the pandemic and subsequent subdued economic conditions, combined with a series of poor decisions made by the directors, significantly affected the company," he said.

"While our investigations to date suggest there were indications that Ownright [Funda] was not trading well, was facing solvency issues, and the directors may have made decisions based on the belief that things would turn around, it does not appear that the directors set out to intentionally defraud creditors.

"Investigations indicate that the directors are creditors in the amount of approximately $900,000."

When it was placed in liquidation, the company owed $10.5 million to 25 creditors.

Mr Morelli said it was possible that Collaborating had been insolvent since March 2020, triggered by notices to repay $3.6 million to a creditor.

But the directors dispute this date, saying a new agreement was put in place to continue the loan.

"Based on creditors' claims to date and the company's books and records, it is estimated that the quantum of an insolvent trading claim may be in the vicinity of $2.45 million," the report reads in relation to Collaborating.

The report also details a possible uncommercial transaction that took place on June 30, 2022.

At the time Collaborating was owed $10 million by Funda and the debt was reduced to $5 million in a debt-to-equity swap.

"This transaction may have been to the detriment of creditors given that at the time of the transaction the company may have been insolvent as was the related entity, Ownright [Funda]," the report reads.

Mr Morelli said the debt-to-equity swap could result in a series of breaches by the directors. These include failing to act with proper care, failing to act in good faith, and improperly using their position and information to gain an advantage at the company's expense.

Mr Wright did not respond to a request for comment.

- Know more? donna.page@newcastleherald.com.au