Deep-pocketed investors have adopted a bearish approach towards MercadoLibre (NASDAQ:MELI), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in MELI usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 8 extraordinary options activities for MercadoLibre. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 0% leaning bullish and 37% bearish. Among these notable options, 4 are puts, totaling $185,708, and 4 are calls, amounting to $146,115.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $1800.0 to $2260.0 for MercadoLibre over the last 3 months.

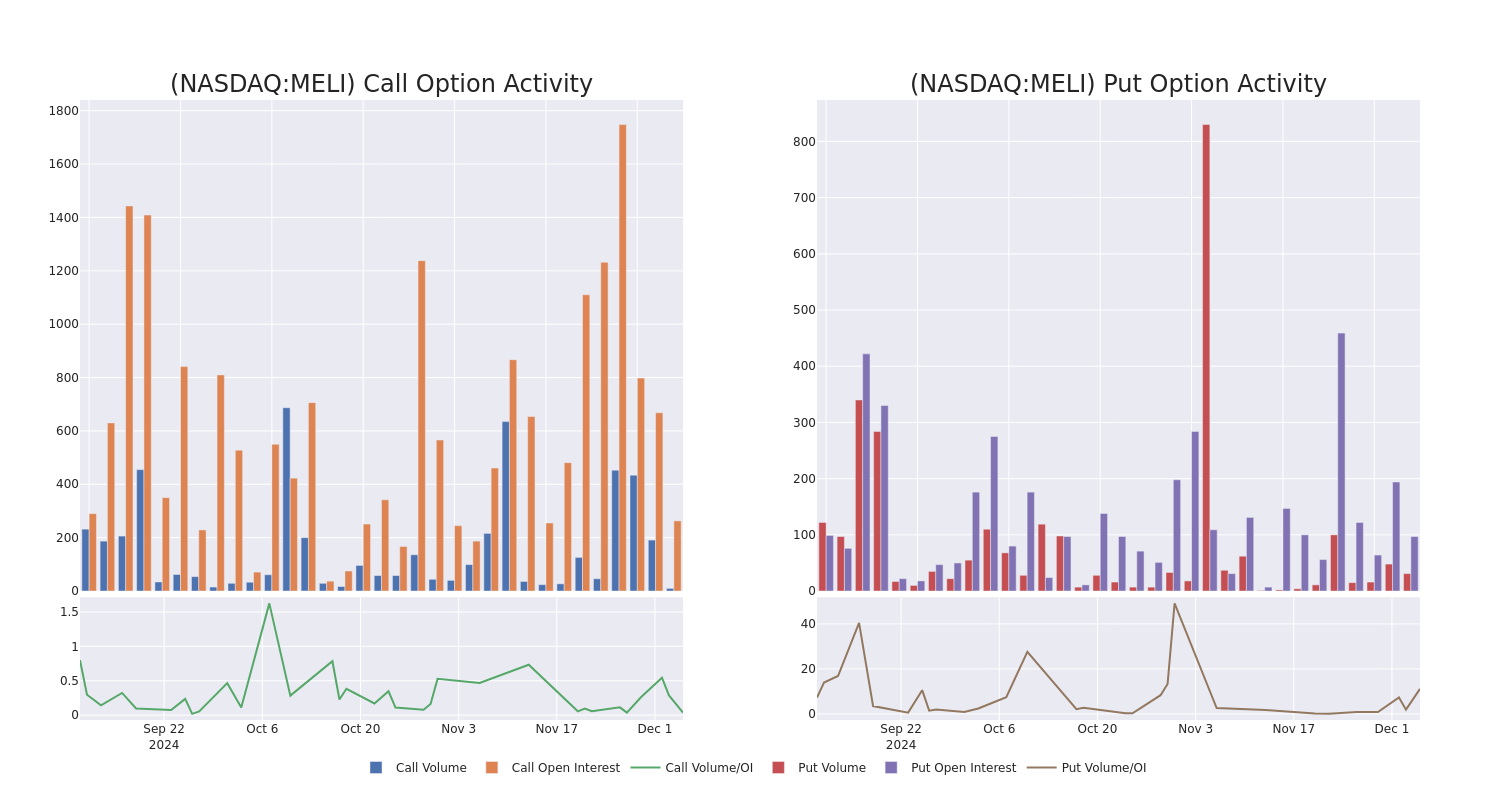

Volume & Open Interest Development

In today's trading context, the average open interest for options of MercadoLibre stands at 51.43, with a total volume reaching 35.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in MercadoLibre, situated within the strike price corridor from $1800.0 to $2260.0, throughout the last 30 days.

MercadoLibre Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MELI | PUT | TRADE | BEARISH | 12/27/24 | $139.4 | $127.4 | $135.0 | $2090.00 | $67.5K | 2 | 15 |

| MELI | PUT | TRADE | NEUTRAL | 12/27/24 | $134.0 | $120.2 | $127.0 | $2090.00 | $63.5K | 2 | 5 |

| MELI | CALL | TRADE | NEUTRAL | 01/16/26 | $456.0 | $438.0 | $446.95 | $1800.00 | $44.6K | 164 | 1 |

| MELI | CALL | TRADE | BEARISH | 01/24/25 | $92.7 | $86.9 | $86.9 | $2000.00 | $43.4K | 0 | 5 |

| MELI | CALL | TRADE | NEUTRAL | 03/21/25 | $159.4 | $150.7 | $155.15 | $2000.00 | $31.0K | 91 | 4 |

About MercadoLibre

MercadoLibre runs the largest e-commerce marketplace in Latin America, with more than 218 million active users and 1 million active sellers across 18 countries stitching into its commerce network or fintech solutions as of the end of 2023. The company operates a host of complementary businesses to its core online shop, with shipping solutions (Mercado Envios), a payment and financing operation (Mercado Pago and Mercado Credito), advertisements (Mercado Clics), classifieds, and a turnkey e-commerce solution (Mercado Shops) rounding out its arsenal. MercadoLibre generates revenue from final value fees, advertising royalties, payment processing, insertion fees, subscription fees, and interest income from consumer and small-business lending.

After a thorough review of the options trading surrounding MercadoLibre, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

MercadoLibre's Current Market Status

- With a volume of 161,173, the price of MELI is down -0.22% at $1983.02.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 77 days.

What The Experts Say On MercadoLibre

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $2320.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for MercadoLibre, targeting a price of $2200. * Consistent in their evaluation, an analyst from Cantor Fitzgerald keeps a Overweight rating on MercadoLibre with a target price of $2300. * An analyst from Morgan Stanley has decided to maintain their Overweight rating on MercadoLibre, which currently sits at a price target of $2450. * An analyst from BTIG persists with their Buy rating on MercadoLibre, maintaining a target price of $2200. * Maintaining their stance, an analyst from Citigroup continues to hold a Buy rating for MercadoLibre, targeting a price of $2450.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for MercadoLibre with Benzinga Pro for real-time alerts.