The high price of commodity memory will inevitably affect the prices — and, eventually, shipments — of inexpensive consumer electronics (CE), as makers of entry-level products are less likely to absorb increased costs. As a result, fabless developers of chips are revising their orders to foundries in order to adjust their inventory, in accordance with what they believe the market needs, said co-chief executive of SMIC, China's top foundry. Interestingly, he also mentioned memory overbooking as a factor affecting memory prices, according to a report from the Wall Street Journal.

"The combined effect of these factors [related to increased memory prices] has resulted in a decline in mid to low-end [smartphone processor] orders received by foundries," said Zhao Haijun, co-CEO of SMIC, during an earnings call with financial analysts and investors. "End user companies in these segments are facing pressure from both tight supply and rising prices for memory chips. Even if end user companies can pass on these cost increase to consumers via end-product price rises. Such moves will lead to a decline in demand for end products."

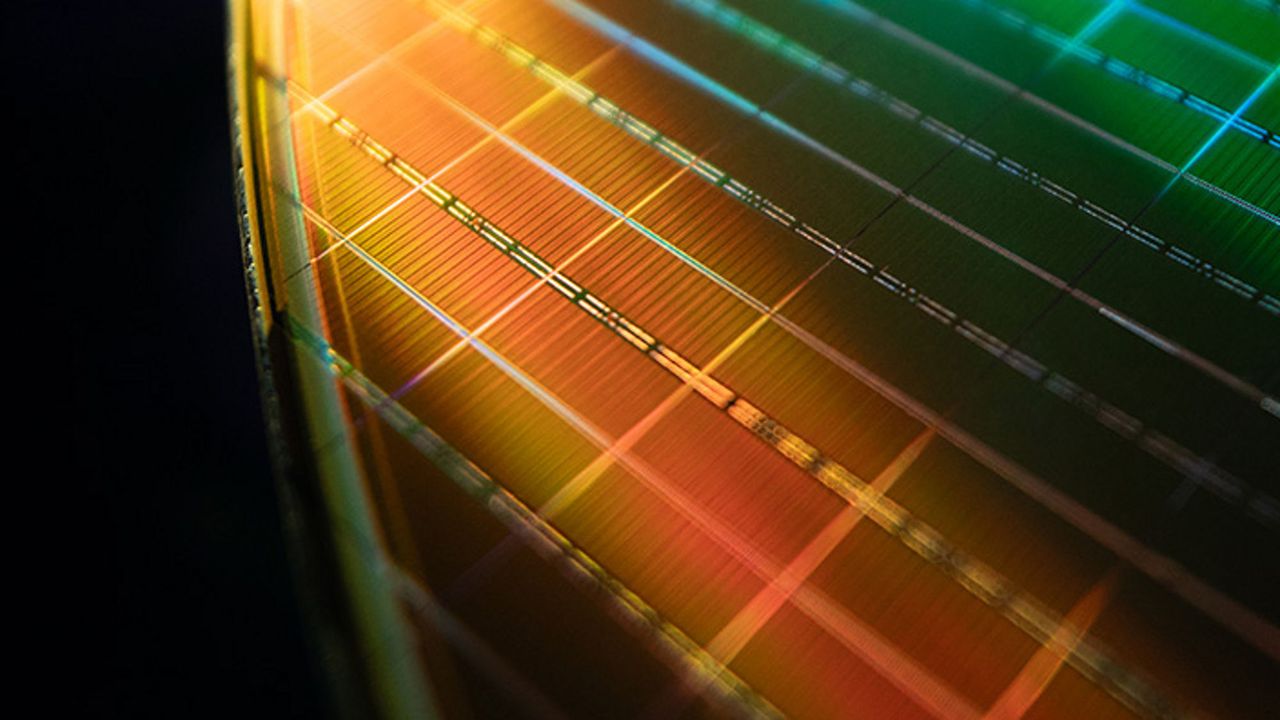

Zhao mentioned overbooking as one of the factors that contributed to the sharp rise of 3D NAND and DRAM prices, as many makers of PCs and smartphone tried to order more memory than they needed — which caused prices to skyrocket, and forced many of them adjust their business outlook.

SMIC's executive already discussed this situation back in November, claiming that, as makers of inexpensive CE and smartphones struggle to obtain memory and face excessive prices, they adjust their inventory of entry-level and mid-tier application processors so they don't sit on stocks full of system-on-chips (SoC) while being unable to produce handsets. As a result, SMIC's clients among developers of mobile SoCs also altered their orders accordingly.

More recently, executives of TSMC confirmed that they expected minimal smartphone processor unit growth, primarily due to volume declines of entry-level and mainstream SoCs. TSMC is somewhat immune to such demand drops, however, as the majority of application processors it produces are aimed at high-end, mainstream smartphones, which are less sensitive to fluctuations of DRAM and 3D NAND prices.

"As for PC or the smartphone, to tell the truth, we expect a higher memory price, so we expect the unit growth will be very minimal," C.C. Wei, chief executive of TSMC, told analysts and investors. "But for TSMC, we did not feel our customers changed their behavior. […] We supply most of the high-end smartphones. The high-end smartphone is less sensitive to the memory price. So, the demand is still strong."

It's worth noting that despite declining sales of SoCs for inexpensive handsets, SMIC does not expect its revenues to decline sharply — as, for now, SMIC has some 'protection' against such drops. The company believes that as China adopts more and more chips that are developed and made domestically, it will have enough orders to maintain its growth.

" In 2026, the effects of industrial chain reshoring from overseas and domestic customers, new products, replacing legacy overseas products will persist, creating sustained incremental growth opportunities for the domestic industrial chain," Zhao said.

Follow Tom's Hardware on Google News, or add us as a preferred source, to get our latest news, analysis, & reviews in your feeds.