A marketing company owned by Ja’Mal Green, one of eight challengers trying to unseat Mayor Lori Lightfoot in Chicago’s Feb. 28 election, steered small businesses seeking COVID-19 relief loans to three lenders that were faulted in a congressional report last year for having turned a blind eye to fraud.

Green says his Majostee Marketing — which also rents out coach buses — was paid a fee by those lenders for each of the hundreds of applicants it helped with a loan request under the federal Paycheck Protection Program.

“We probably [were] getting $50 or $100 per person,” says Green, 27. “It was very minimal. We didn’t make a lot of money from them at all. It was about supporting our business folks.”

Green also got two PPP loans — apparently the only one of the candidates in the mayoral race who took money under the program.

He got one loan for $20,833, the maximum available to a sole proprietor, for pandemic-related losses he said he faced in his consulting and public speaking work.

Majostee Marketing got a separate PPP loan of $15,000.

Green says the PPP money helped him and other owners of small businesses survive the pandemic financially.

Others in Chicago and elsewhere have fallen under scrutiny as the program has been found to have been rife with fraud. By some estimates, 40% or more of the $800 billion-plus in PPP loans were based on phony applications. Hundreds, if not thousands, of public employees working for Chicago and Cook County governments — including police officers, court system employees and people with access to taxpayer information in the county assessor’s office — are now under investigation for what authorities have said were suspicious PPP loans, officials have said.

Green says the federal government’s PPP lending rules turned out to be too lax but says he thinks financial-technology lenders, so-called fintechs, such as those he sent clients to, still provided a valuable service to applicants — especially Black owners of small businesses— who had been turned away by traditional banks.

“They were redlining a lot of our people,” Green says. “The fintechs came as, ‘Hey, guys, don’t worry about the banks denying everybody. We’re pushing people through, and we’re helping people out.’ Those things were going through, and folks were getting their money. We didn’t know much about these institutions. They partnered with the federal government in some way, and the money is coming through.

“My viewpoint, in hindsight, is there was a lot of corruption there,” Green says. “The only people who suffered were the small businesses who weren’t able to access that capital who needed it. It’s unfortunate to see all the different things that have now come out. The federal government made some bad decisions working with these guys, especially having no oversight.“

Majostee partnered with Womply, Cross River Bank and Bluevine.

In a congressional report released in December, Womply was accused of engaging in questionable business practices — while generating more than $2 billion in net revenue in 2021 from fees paid by the federal government for handling PPP loans. The report prompted the federal Small Business Administration, which administered PPP loans in 2020 and 2021, to suspend Womply from working with the agency “in any capacity.”

Also, the SBA launched an investigation into Cross River Bank, which gave more than 930 loans to people who said they operated single-person “miscellaneous crop farming” businesses — in the city of Chicago. Many of the addresses were for apartments, according to a study by researchers at the University of Texas.

Bluevine did a better job than Womply and Cross River Bank in putting fraud controls in place but “faced difficulties in facilitating timely reporting of fraud to law enforcement,” the congressional report said.

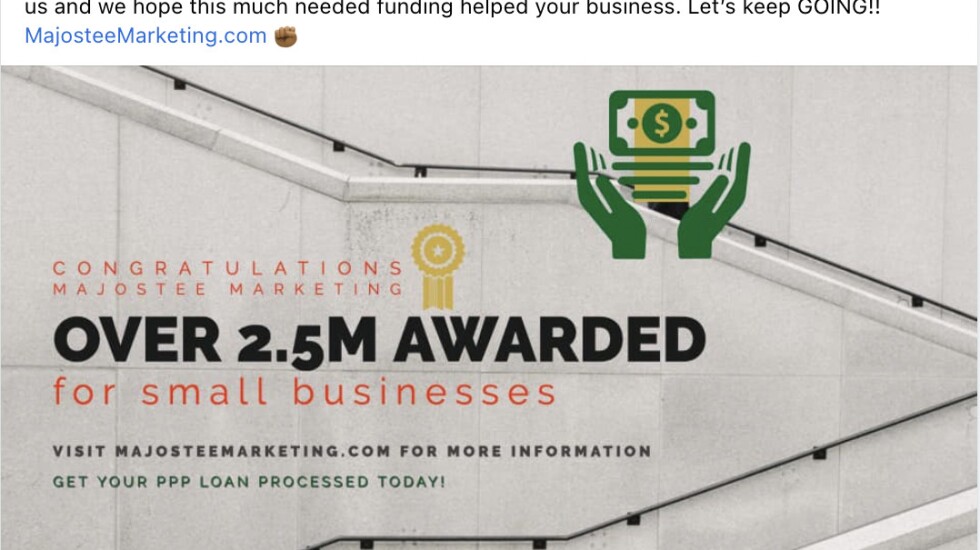

Green, who has made a name for himself as a community activist, has founded and operated several businesses, including Majostee Marketing, which promoted its PPP-related services on social media and on its website, now inactive.

“Our team is proud to announce a partnership with a local and national bank to process PPP applications quicker!” Green posted on Facebook on Jan. 8, 2021. “Fill out our form on majosteemarketing.com to get in line for funding. We’re starting Monday and funds will be in your bank account within 1-3 days.”

A month later, Green touted his firm’s successes:

“SO PROUD OF MY TEAM & Our partner bank for funding all SMALL businesses. We’re on our way to getting 10 million in funding during this hard Covid time.”

He later used the same Facebook page to tout his run for mayor.

Paycheck Protection Program data released by the SBA shows Green was the sole mayoral candidate who got such loans.

A loan was awarded in the name of Roderick Sawyer, but Ald. Roderick Sawyer (6th), who is running for mayor, says it was issued to his son, an artist with the same name.

Records show two Chicago City Council members obtained PPP loans.

Ald. Tom Tunney (44th), who plans to retire when his term ends in May, got two loans totaling $944,000 for Thomas M. Tunney Enterprise Ltd., the corporate name for his Ann Sather restaurants. The loans, approved in 2020 and 2021, have been forgiven, meaning they don’t need to be repaid, as was common for loans used for allowable purposes, keeping businesses running and employees getting paid during the pandemic.

Ald. Howard Brookins (21st), also stepping down in May, says he got $5,052 for his law practice, though he says somehow it was listed incorrectly in the name of one of his campaign committees.

Sun-Times Media Productions, LLC, the newspaper’s former parent company, got two loans totaling $4.7 million. Approved in 2020 and 2021, the loans have been forgiven.