With a market cap of $7.5 billion, Match Group, Inc. (MTCH) operates a global portfolio of dating and social connection platforms across four segments: Tinder, Hinge, Evergreen and Emerging, and Match Group Asia. The company owns well-known brands such as Tinder, Hinge, Match, OkCupid, and Plenty of Fish, offering services in over 40 languages to users worldwide.

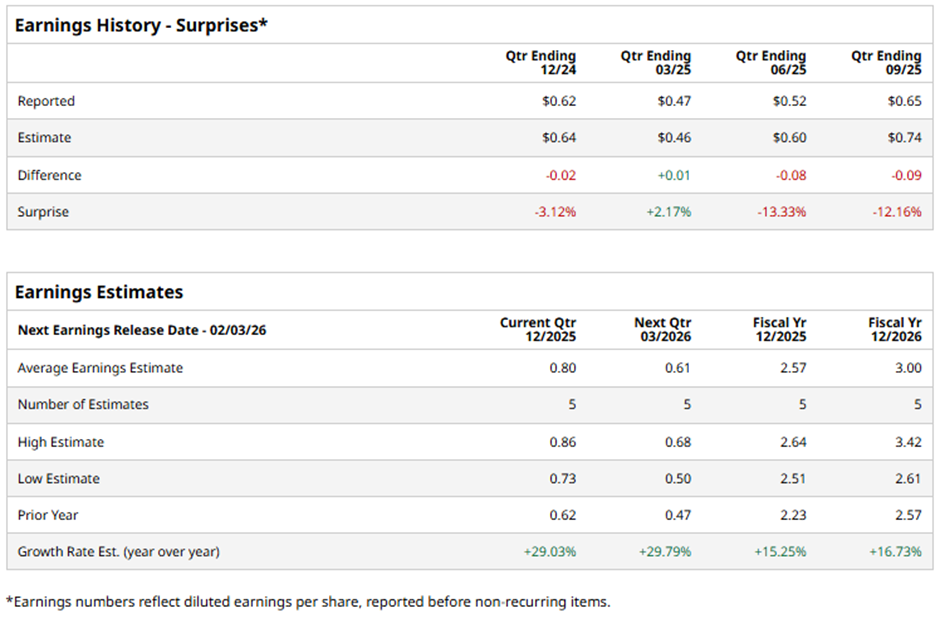

The Dallas, Texas-based company is expected to announce its fiscal Q4 2025 results soon. Ahead of this event, analysts predict MTCH to report an EPS of $0.80, up 29% from the previous year's $0.62. It has surpassed Wall Street's bottom-line estimates in one of the past four quarters while missing on three other occasions.

For fiscal 2025, analysts forecast the media and internet company to post an EPS of $2.57, a rise of 15.3% from $2.23 in fiscal 2024. Moreover, the company’s EPS is projected to increase 16.7% year-over-year to $3 in fiscal 2026.

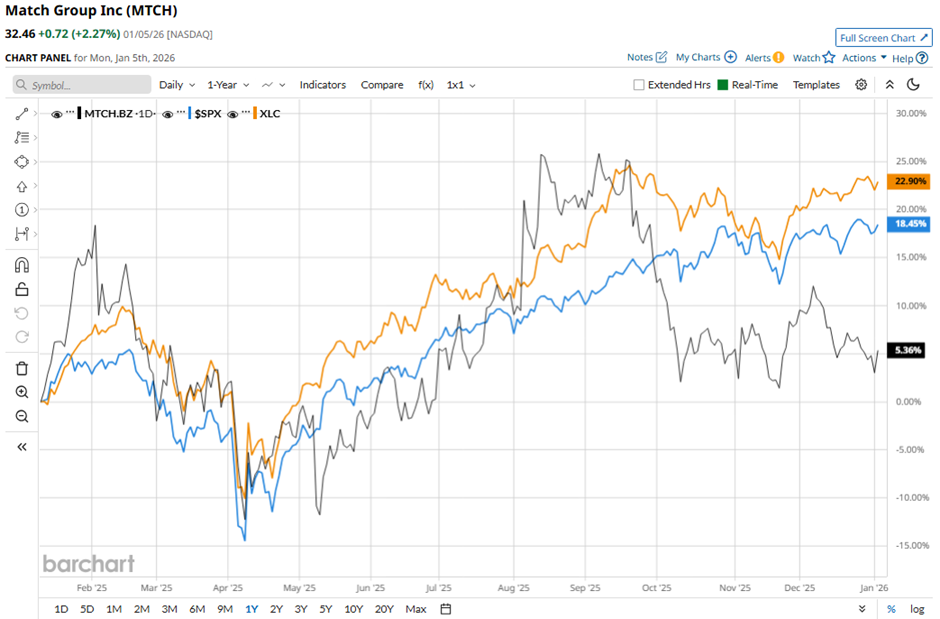

MTCH stock has decreased 2.9% over the past 52 weeks, lagging behind the S&P 500 Index's ($SPX) 15.9% gain and the State Street Communication Services Select Sector SPDR ETF's (XLC) 18.6% return over the same period.

Despite reporting weaker-than-expected Q3 2025 adjusted EPS of $0.82 and revenue of $914.3 million on Nov. 4, Match Group shares rose 5.2% the next day. Investors were encouraged by net income growth of 18% year-over-year to $161 million and successful execution of its $50 million reinvestment plan to accelerate product innovation and international expansion. Positive momentum from Tinder’s Chemistry and Face Check features, Hinge’s AI enhancements, and ongoing cost-savings initiatives further boosted confidence.

Analysts' consensus view on MTCH stock is cautiously optimistic, with a "Moderate Buy" rating. Out of 22 analysts covering the stock, seven give a "Strong Buy," one has a "Moderate Buy," and 14 give a "Hold" rating. The average analyst price target for Match Group is $38.37, indicating a potential upside of 18.2% from the current levels.