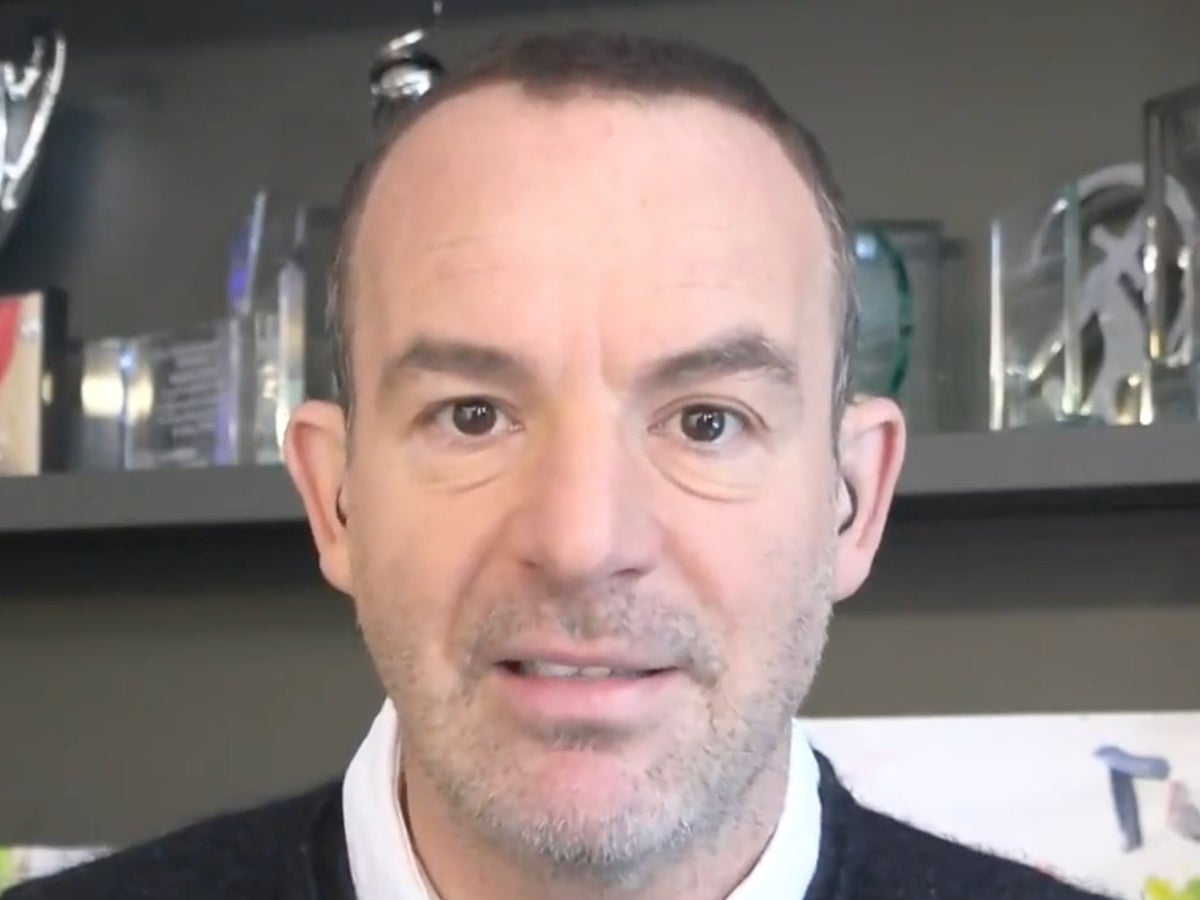

Finance expert Martin Lewis has revealed “the one miss” in the government’s expansion of childcare funding, announced in yesterday’s Budget.

Chancellor Jeremy Hunt promised to offer 30 hours of free childcare for all children aged over nine months old in a bid to boost economic growth by encouraging parents back to work.

He also confirmed that childcare costs will be paid upfront for those who receive universal credit.

The maximum amount that parents on universal credit can claim for childcare will also increase from £646 to £951 for one child, and from £1,108 to £1,630 for two – an increase of just under 50 per cent.

However, in a video posted on Twitter, Mr Lewis warned that it would not cover all benefits.

He said: “The one big miss on this is this does not apply to legacy benefits, in other words, those who get tax credits for childcare, you will not see the equivalent uplift.

“My suspicion is many who have higher child care costs and are on tax credits will be better off shifting to universal credit.”

However, Mr Lewis clarified that shifting to universal credit was “not a simple decision, especially because universal credits are eligible to what’s called deductions, which many on tax credits aren’t”.

“You should always get one-on-one help before making that decision”, he said.

Currently, parents on universal credit can claim back 85 per cent of their childcare costs – but they have to pay upfront first. This will change under the new plans so people are not left out of pocket.

Speaking about the changes, which will come into force in the summer, Mr Hunt said: “Many remain out of work because they cannot afford the upfront payment necessary to access subsidised childcare.

“So for any parents who are moving into work or want to increase their hours, we will pay their childcare costs upfront.

The Budget also included up to 30 hours a week of free childcare for eligible households in England with children as young as nine months, instead of three and four-year-olds under the current policy.

The phased plan aimed at removing barriers to work, which will be fully introduced by September 2025, will be worth up to £6,500 a year for working families.

The chancellor also pledged an expansion in wrap-around care at the start and finish of the school day for parents with older children and changes to staff-to-child ratios in England to expand supply of childcare.