The Transport Workers Union has demanded that Qantas pay back $2.7 billion in government COVID-19 handouts, after Qantas told investors to expect a record before-tax annual profit of up to $2.5 billion.

And the Australian share market has edged down amid jitters over the US debt ceiling negotiations.

See how the trading day unfolds on our live blog.

Disclaimer: This blog is not intended as investment advice.

Key events

To leave a comment on the blog, please log in or sign up for an ABC account.

Live updates

Market snapshot at 4:30pm AEST

By Sue Lannin

- ASX 200: -0.05% to 7,260

- All Ordinaries: -0.05% to 7,447

- Australian dollar: flat at 66.53 US cents

- Nikkei 225: -0.4% to 30,958

- Shanghai Composite: -1% to 3,264

-

Dow Jones: -0.4% to 33,287 points

- S&P 500: flat at 4,193

- Nasdaq: +0.5% to 12,721

- STOXX Europe 600: flat at 469 points

- Spot gold: -0.4% to $US1,961.65/ounce

- Brent crude: +0.5% to $US76.34/barrel

- Iron ore: -3.4% to $US101.80/tonne

- Bitcoin: +1.6% to $US27,313

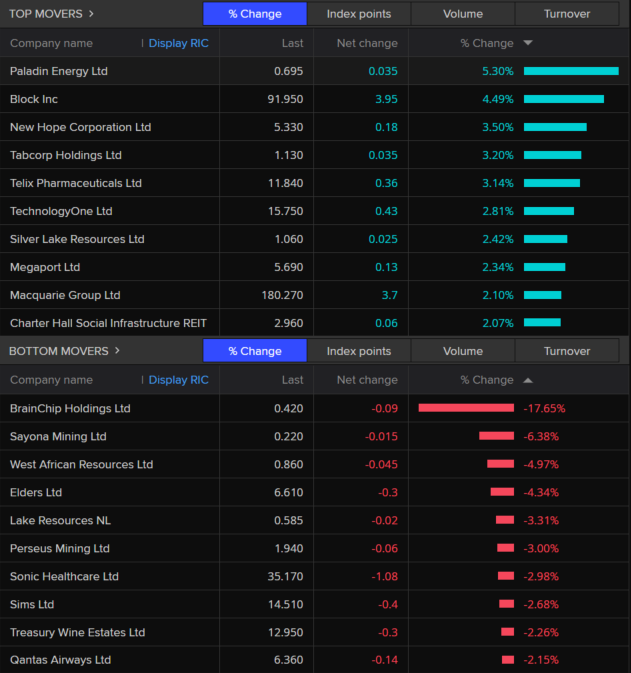

ASX movers and shakers

By Sue Lannin

The market ran out of steam by the close as the US debt ceiling negotiations dragged on for another day.

The ASX 200 index lost the day's gains and edged lower.

Big banks and energy stocks limited the losses, while consumer stocks and miners were in the red.

Qantas (-2.2 per cent) slipped despite predicting a record $2.5 billion before tax profit for the year.

Uranium firm Paladin Energy (+5.3 per cent) did the best, while artificial intelligence firm BrainChip Holdings (-17.7 per cent) did the worst on the ASX 200 index.

That's after more than half of investors voted against the company's executive pay plans at today's annual general meeting and on disappointing sales.

It's like watching an American film...

By Sue Lannin

Thanks to Ipek Ozkardeskaya, senior analyst, from Swissquote Bank for the last word for today on the US debt ceiling negotiations, which seem like groundhog day.

Overnight US president Joe Biden met House of Representatives speaker Kevin McCarthy for "productive" talks on lifting the US Government's borrowing limit.

There's no deal yet and negotiations look sent to go down to the wire on June 1, the deadline for when the US Government runs out of money.

"Yesterday was just another day with the same topics," Ms Ozkardeskaya noted.

"The US debt ceiling talks continued; US President Joe Biden expressed optimism about reaching a deal."

"US Treasury Secretary Janet Yellen said that the Treasury will soon be running out of money and won’t be able to service its debt. "

She notes that despite time running out, investors are not turning to the safe haven of gold and markets have not crashed.

That's probably because most people expect a last minute deal, as has happened during past US debt ceiling standoffs.

"The stronger US dollar and higher yields weigh on gold appetite at a time investors would be ready to take on higher opportunity costs due to rising default risk. "

"But the fact that equities remain strong despite the rising yields, and that gold sees limited safe-haven inflows point that investors watch the US debt ceiling saga as an American film knowing that there will eventually be a happy ending… "

ASX ends flat as US debt talks drag on

By Sue Lannin

The Australian share market has ended slightly lower as negotiations continue in the US over a deal between US president Joe Biden and Republican leaders to lift the $US31.4 trillion debt ceiling.

The ASX 200 index fell 0.05 per cent to 7,260 with banks and energy stocks limiting the losses.

The Australian dollar is trading sideways at around 66.51 US cents.

ACTU slams Qantas $2.5 billion profit forecast

By Sue Lannin

The Australian Council of Trade Unions has also criticised Qantas after it forecast an up to $2.5 billion before tax profit for the 2023 financial year.

Qantas says strong demand for travel is putting the airline back in the black.

However, ACTU president Michele O'Neil says the predicted record profit is being paid for by workers and the public.

"Qantas workers know that a huge share of this profit is the result of outsourcing their jobs to multiple companies, and that Qantas has set up labour hire companies, enabling the airline to drive down wages and conditions for the benefit of outgoing chief executive Alan Joyce and Qantas shareholders."

"Qantas customers know that standards have fallen dramatically, with constant flight delays and lost luggage, all because good, secure jobs were outsourced to drive down wages and conditions, hurting both workers and customers."

Market snapshot at 2:50pm AEST

By Sue Lannin

- ASX 200: +0.1% to 7,271

- All Ordinaries: +0.1% to 7,458

- Australian dollar: flat at 66.51 US cents

- Nikkei 225: -0.4% to 30,968

- Shanghai Composite: -0.6% to 3,277

-

Dow Jones: -0.4% to 33,287 points

- S&P 500: flat at 4,193

- Nasdaq: +0.5% to 12,721

- STOXX Europe 600: flat at 469 points

- Spot gold: -0.3% to $US1,963.57/ounce

- Brent crude: +0.2% to $US76.12/barrel

- Iron ore: -3.4% to $US101.80/tonne

- Bitcoin: +0.6% to $US27,060

Virgin says some Velocity points are expiring

By Sue Lannin

Staying on the airlines, some members of Virgin Australia's Velocity Frequent Flyer program need to start using their accounts again before the end of June, otherwise their balances will expire.

That's for customer accounts that have been inactive for three years.

Virgin Australia says it extended the value of points balances in July 2022 to at least 30 June 2023, because of the difficulty faced by travelers during COVID-19.

A Virgin Australia spokesperson says customers need to earn or redeem points before the end of June to reactivate their accounts.

"Those impacted by the coming expiry will have had no activity on their accounts for three years."

"Members can extend the validity of their balances by earning or redeeming as little as a single point, which will automatically renew their balances for another two years."

Meanwhile, Bloomberg is reporting that Virgin Australia's owner Bain Capital wants to relist the airline on the stock exchange in November.

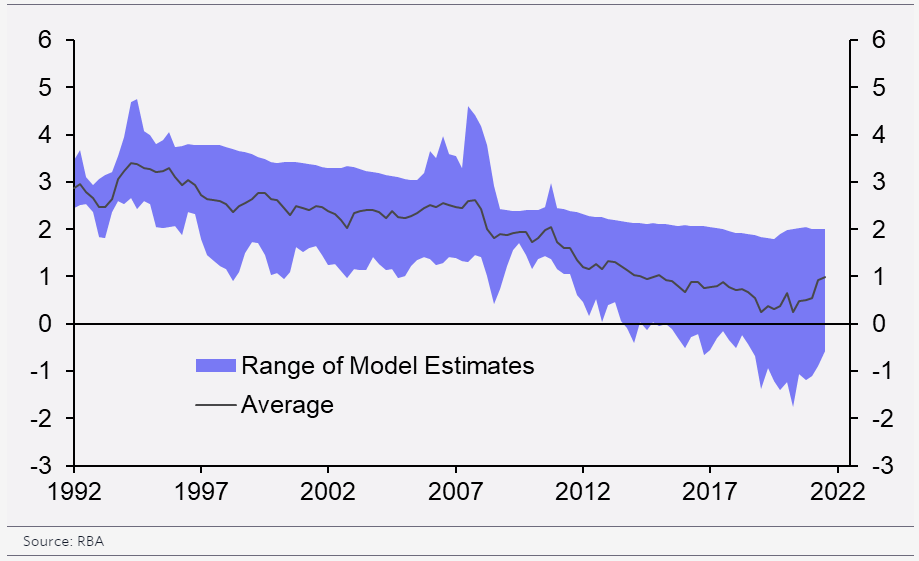

Capital Economics warns RBA interest rate likely to stay around 3.5 per cent long-term

By Michael Janda

Many borrowers are feeling the pinch, with the Reserve Bank's cash rate having rising 11 times over the past year, from 0.1 to 3.85%.

Market pricing and economic consensus generally has the cash rate starting to fall from that peak sometime later this year or early next.

But new research from Marcel Thieliant at Capital Economics suggests that borrowers shouldn't count on rates falling too far from current levels for too long.

He finds that the cash rate is likely to average 3.5% in the longer term, an estimate that broadly tallies with previous statements by RBA officials, such as governor Philip Lowe.

The "neutral" interest rate is one that economists believe neither adds to or subtracts from demand in the economy or, as Mr Thieliant puts it:

"The neutral interest rate is the rate that allows economic activity to evolve in line with its potential and therefore ensures that inflation settles around the central bank’s target."

Mr Thieliant says his current estimates put that at around 0.5% in real terms, that is excluding the effects of inflation.

When you add in the RBA's targeted 2-3% level of inflation, that leaves the current 'nominal' neutral interest rate around 3%.

But Mr Thieliant expects that to rise to around 3.5% by 2050 as the real neutral cash rate edges up to 1%.

Given that the estimates for the real neutral interest rate are driven by econometric modelling, the results vary somewhat based on the data and assumptions used.

The RBA seems to think the real interest rate is already at least 1%, according to Mr Thieliant.

"The RBA estimated last year that the real neutral policy rate fell from around 3% in the early 1990s to just above 0% before the pandemic, though the RBA estimates that it has since edged up to around 1%," he observed.

"Documents that the RBA was forced to release in response to a Freedom of Information request show that RBA staff now think that the nominal neutral rate is nearly 4%, which implies a real neutral rate closer to 1.5%."

The good news from a rising neutral interest rate is that it is an indication the economy might escape the low-growth funk it has been in for the past decade or so.

"Arguably the main reason why the real interest rate has fallen in recent decades is the decline in potential GDP growth across advanced economies," Mr Thieliant wrote.

"According to OECD estimates, potential GDP growth in Australia slowed from 3.3% in the 1990s to only 1.7% on the eve of the pandemic. That matters because lower potential growth reduces the future returns on capital and therefore reduces investment demand."

Stronger economic growth, if distributed widely across the population, means that most borrowers should be able to cope with those slightly higher long-term interest rates.

TWU says Qantas should pay back pandemic support

By Sue Lannin

The Transport Workers Union has called on Qantas to pay back the $2.7 billion worth of government support it received during the COVID-19 pandemic.

That's after Qantas forecast a record before tax profit of nearly $2.5 billion for this financial year thanks to a rebound in demand for travel.

The TWU has also slammed a $100 million increase in the airline's share buyback scheme for investors.

Here is TWU national secretary Michael Kaine:

"This obscene profit forecast is the result of Qantas management bleeding dry workers, passengers and the tax paying public."

"The right thing to do would be to pay back every dollar of no-strings government handouts Qantas received from Scott Morrison before it trashed every essential section of the airline to prop up executives and shareholders."

"The $100 million increase to the share buyback scheme is a kick in the guts to illegally sacked workers who were told their jobs were sacrificed to save this amount of money," Mr Kaine said.

For more on the High Court battle between Qantas and TWU over the outsourcing of baggage handler jobs, here is my colleague, Elizabeth Byrne.

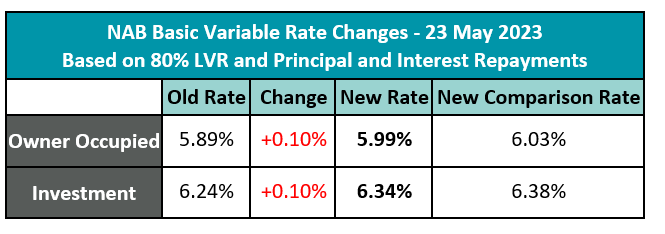

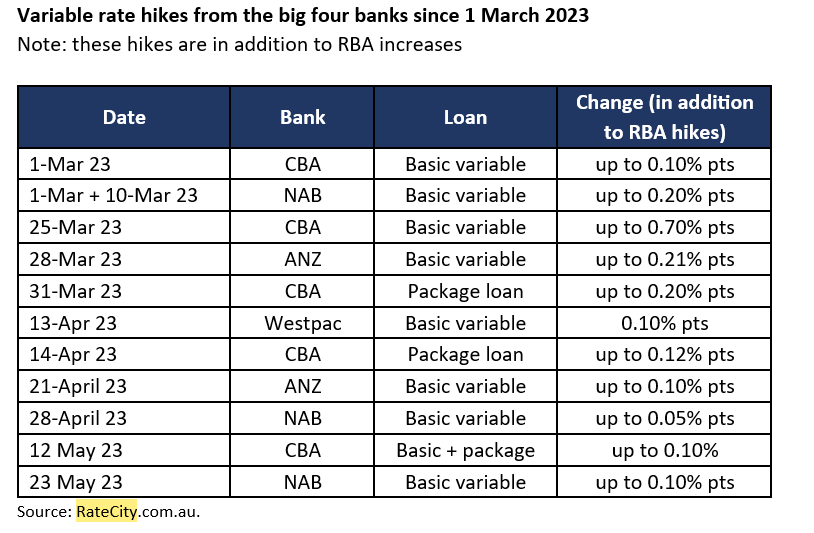

NAB raises mortgage rates for third time in three months

By Sue Lannin

National Australia Bank has increased mortgage rates on variable rate home loans for new customers for the third time in three months.

That is for owner occupiers and investors with a deposit greater than 20 per cent.

The 0.1 percentage point rise is on top of official rate rises by the Reserve Bank.

That means NAB's lowest variable rate home loan has increased by 0.75 per cent since March 1 for new customers, while existing customers have seen their rates increase by 0.5 percentage points.

Canstar says it is the second variable home loan rate increase from NAB in less than a fortnight.

It's also the fourth time the lender has increased variable rates out of cycle with the RBA's cash rate decisions according to Canstar.

Canstar’s finance expert, Steve Mickenbecker says it is bad news for borrowers as smaller lenders are also likely to follow suit.

“NAB’s second variable home loan rate increase in a fortnight will further disturb borrowers already shell-shocked after a year of rate hikes.”

“The Reserve Bank cash rate rise in May had already added $79 to the monthly repayment on a $500,000 basic variable loan at NAB, and the 0.10 per cent rise tops this up to $112.

“Bank margins are coming under pressure as depositors are finally starting to receive the full benefit of Reserve Bank cash rate increases, and other funding costs have already risen to more normal levels after the years of COVID support."

“Out of cycle increases by the big banks will ease the pressure on smaller lenders that are without large deposit bases, potentially allowing them to reprice their home loans to cover their higher cost of funding."

RateCity says all the big four banks have increased new customer rates in the last three months, in addition to the RBA rate hikes in March and May.

ASX market movers at lunchtime

By Sue Lannin

Most sectors are higher today on the ASX 200 with industrials, energy stocks, banks and miners among the gainers.

Going down are consumer and education firms.

Uranium firm Paladin Energy (+5.7 per cent) is doing the best today, while technology firm BrainChip Holdings (-15.2 per cent) is doing the worst.

Qantas (-2 per cent) has slipped despite predicting a record return to profit for 2023.

Market snapshot at 12:15pm AEST

By Sue Lannin

- ASX 200: +0.2% to7,276

- All Ordinaries: +0.2% to 7,466

- Australian dollar: -0.1% to 66.45 US cents

- Nikkei 225: +0.8% to 31,318

- Shanghai Composite: -0.3% to 3,288

-

Dow Jones: -0.4% to 33,287 points

- S&P 500: flat at 4,193

- Nasdaq: +0.5% to 12,721

- STOXX Europe 600: flat at 469 points

- Spot gold: -0.4% to $US1,960.79/ounce

- Brent crude: +0.5% to $US76.33/barrel

- Iron ore: -3.4% to $US101.80/tonne

- Bitcoin: +0.6% to $US27,060

ASX higher at midday as US debt deal talks continue

By Sue Lannin

The Australian share market is holding up at midday after US president Joe Biden met US House of Representatives speaker and top Republican Kevin McCarthy for more talks on lifting the US Government's borrowing limit.

The ASX 200 index is up 0.2 per cent to 7,277 with oil stocks among the gainers after a rise in oil prices overnight.

Mr Biden and Mr McCarthy both said they had a productive debt ceiling discussion, but there was no agreement as negotiators strained to raise the nation's borrowing limit in time to avert a potentially chaotic federal default.

“The time of spending, just spending more money in America and government is wrong,” Mr McCarthy said after the Oval Office meeting.

In a brief post-meeting statement, Mr Biden called the session productive and added that he, Mr McCarthy and their lead negotiators “will continue to discuss the path forward.” Mr McCarthy said their teams would work “through the night.”

with AP

The US deal that could supercharge Australia's critical minerals industry

By Sue Lannin

Australian energy and mining companies stand to benefit from billions of dollars worth of subsidies in an agreement between the US and Australia to develop critical minerals.

The climate, critical minerals and clean energy compact aims to expand and diversify Australia's clean energy supply and promote the sustainable supply and processing of critical minerals, and support the development of clean hydrogen, battery technologies and other clean energy products.

US president Joe Biden has pledged to ask Congress to treat Australia as a domestic supplier under the US Inflation Reduction Act.

Nicolette Boele from the Smart Energy Council says if passed the agreement will attract investment in the critical minerals sector.

ASX 200 movers and shakers

By Sue Lannin

Here are the best performers on the ASX 200 in mid morning trade.

Market snapshot at 10:20am AEST

By Sue Lannin

- ASX 200: +0.25% to7,281

- All Ordinaries: +0.25% to 7,469

- Australian dollar: +0.1% to 66.60 US cents

-

Dow Jones: -0.4% to 33,287 points

- S&P 500: flat at 4,193

- Nasdaq: +0.5% to 12,721

- STOXX Europe 600: flat at 469 points

- Spot gold: -0.3% to $US1,972/ounce

- Brent crude: +0.6% to $US76.06/barrel

- Iron ore: -3.4% to $US101.80/tonne

- Bitcoin: flat at $US26,892

ASX opens higher

By Sue Lannin

The Australian share market is making gains in early trade as the US debt ceiling negotiations continue in the US.

The ASX 200 index has put on 0.2 per cent to 7,276, while the All Ordinaries index is also up 0.2 per cent to 7,464.

Most sectors are higher on the benchmark index with energy stocks leading the gains after oil prices rose overnight.

Gaming firm Tabcorp (+5 per cent) is doing the best, while farming business Elders (-4.8 per cent) is doing the worst.

Qantas expects full-year profit of up to $2.48b

By David Chau

Qantas has told investors to expect another strong profit, driven by high demand from consumers wanting to travel.

The airline is anticipating an underlying profit before tax of between $2.43 billion and $2.48 billion for the current financial year.

It has also increased its existing share buyback by up to $100 million.

Flying activity increased in the second-half as new aircraft and more wide body jets returned from long-term storage, the company said in a statement.

Jet fuel prices remain elevated but recent falls will deliver a cost improvement in the second half, Qantas said.

The airline posted an annual underlying loss before tax of $1.86 billion in 2021-22 financial year. But it swung to a record first-half profit, earlier this year, as appetite for travel grew.

It also said:

"As forecast, the steady return of total market capacity has seen fare levels moderate from peaks reached in the first half of FY23, but yields are expected to remain materially above pre-COVID levels through FY24, particularly internationally."

In other words, airfares should get a little cheaper - but they'll still be much higher than they were prior to the coronavirus pandemic.

In addition, there will be some changes to management.

One of Qantas' directors Michael L'Estrange is retiring from the board.

He'll be replaced by Doug Parker - the former chairman and CEO of American Airlines, who has more than 35 years of experience in the aviation industry.

How batteries are made — and how the future of a new industry hangs in the balance

By David Chau

In the old fossil fuel heartlands of Australia, a new kind of industry is being built.

At Kwinana, south of Perth, land has been secured to produce highly refined battery minerals.

In Geelong, work is underway on a lithium-ion battery "gigafactory", while another gigafactory has just opened in the Hunter Valley.

And earlier this month, it emerged that lithium, a central ingredient for batteries, will soon be worth more to WA than oil, gas and coal combined.

It's clear the humble rechargeable battery has become a big deal, and global demand is forecast to increase tenfold over the next decade — and fortyfold by 2050.

Now, one question is being asked, and its answer could shape Australia's prosperity for generations. Who makes the batteries?

For more, here's the story by technology reporter James Purtill:

Penny Wong says prime minister won't visit China unless 'progress' is made

By David Chau

Australia's Foreign Minister Penny Wong has indicated Prime Minister Anthony Albanese won't travel to China unless "continued progress" is made to resolve trade and consular disputes.

The invitation from Chinese officials was made earlier this year and follows clashes between the two countries, which have in particular severely hindered Australian exporters.

China imposed trade sanctions on several items such as wine, rock lobsters, coal and barley in recent years which has cost exporters billions of dollars.

While some restrictions have been wound back there are still some bans in place.

Ms Wong suggested further progress on lifting trade sanctions was necessary before a visit to China could be scheduled.

For more on this, here's the story by Stephanie Borys:

ABC/Reuters