The Australian share market has ended its day lower, while the Reserve Bank warned there may be further interest rate hikes.

Consumer confidence, meanwhile, has sunk to its lowest levels since the early days of the COVID-19 pandemic and the 1990s recession.

See how the trading day unfolded on our live blog.

Disclaimer: this blog is not intended as investment advice.

Key events

Live updates

Market snapshot at 4:20pm AEST

By David Chau

-

ASX 200: -0.5% to 7,235 points

- All Ords: -0.5% to 7,424 points

- Australian dollar: -0.5% to 66.7 US cents

- Spot gold: -0.7% at $US2,007/ounce

- Brent crude: +0.2% to $US75.39/barrel

- Iron ore:+5% to $US104.40/tonne

- Bitcoin: -1.1% at $US27,060

- Nikkei: +0.7% to 29,843 points

- Hang Seng: -0.2% to 19,935 points

- Shanghai Composite: -0.6% to 3,290 points

ASX falls 0.5% at close of trade

By David Chau

It was a quiet day for the Australian share market, which ended its day with modest losses.

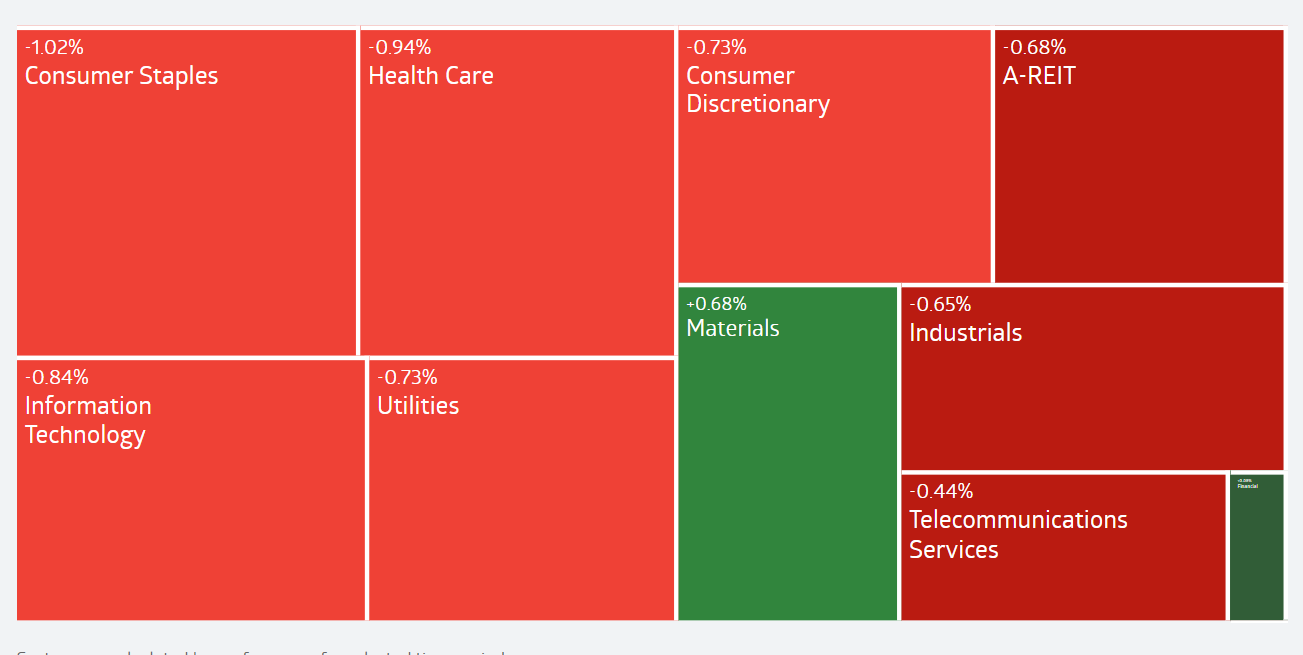

The ASX 200 closed 0.5% lower at 7,235 points — with 150 out of 200 stocks in the red (so most of them, in other words).

The sectors which experienced the steepest losses were consumer staples (-1.1%), healthcare (-1%) and technology (-0.9%).

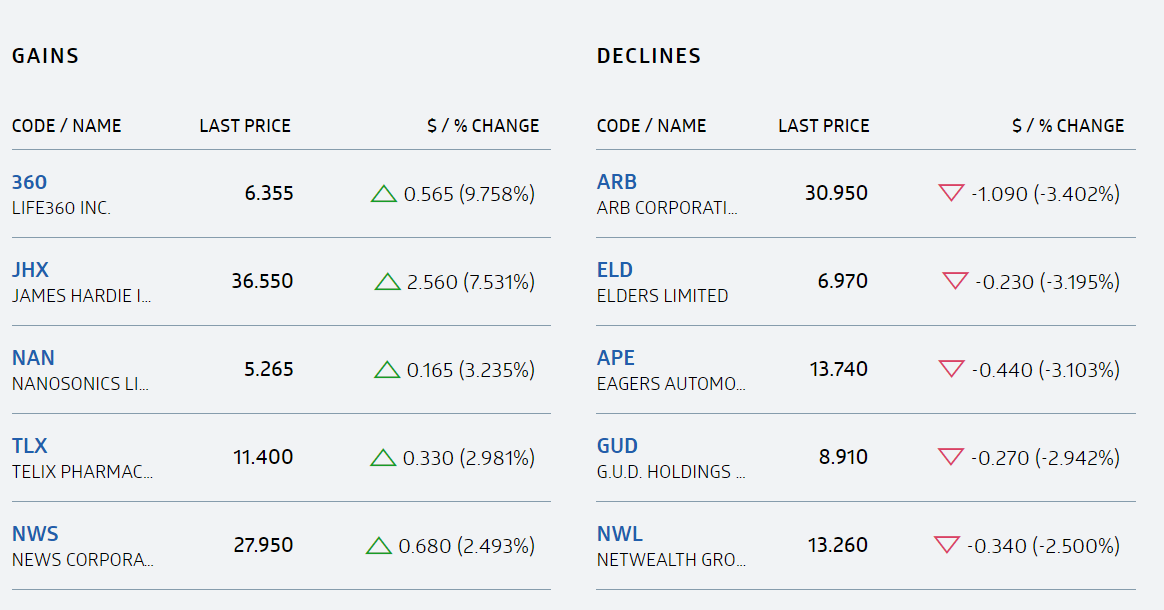

Some of today's worst performing stocks were Eagers Automotive (-5.9%), Hub24 (-4.9%), Netwealth Group (-4.3%), Elders (-4.2%) and GUD Holdings (-3.9%).

On the flip side, shares of Life360 (+11.7%), Telix Pharmaceuticals (+2.6%), Nanosonics (+2.6%) and News Corp (+2.3%) rose sharply.

James Hardie shares jumped 8.3% after the company forcast a higher quarterly profit.

The Australian dollar fell 0.5%, to 66.67 US cents.

ACCC to probe retailers' gas prices

By David Chau

Australia's competition watchdog has confirmed it will look into natural gas retailers' market behaviour and expects them to pass through cheaper supplies to consumers.

The government has ramped up scrutiny of the gas industry, introducing price caps and proposing to expand powers to curb liquefied natural gas (LNG) exports from east coast plants to ensure sufficient supply for domestic consumers at affordable prices.

Gas producers, however, have said the measures would deter investment in new supply crucial for the east coast, home to most of the country's population and gas-dependent manufacturers.

The objective of the government's intervention is to have enough supply for east coast markets at a reasonable price, Anna Brakey, commissioner of the Australian Competition & Consumer Commission (ACCC), told the APPEA industry conference.

"We will now turn our focus to retailers," she said.

Retailers are expected to pass on cheaper gas prices to consumers and if this does not happen, it will provide further recommendations to the government, Ms Brakey said.

The country's top gas retailers are Origin Energy, AGL Energy and EnergyAustralia (owned by Hong Kong's CLP Holdings).

"What we really want to see is a thriving market that can serve both the domestic and international market commitments," she said.

"We are projecting a (gas supply) shortfall from 2027, (but) we do hope that new supply will come in to fill that gap."

In a January report, the ACCC said forecast gas production is insufficient to meet forecast demand in the east coast from 2027.

ANZ tips one final RBA rate hike in August

By David Chau

ANZ's economics team is expecting "one final rate hike" from the Reserve Bank in August, after reading the minutes of the bank's May board meeting.

The final paragraph of the RBA minutes says: "Members also agreed that further increases in interest rates may still be required, but that this would depend on how the economy and inflation evolve."

In that context, ANZ economist Adam Boyton wrote in a note to clients that "the use of the plural ... does (again) raise the prospect that rates may rise by more and/or earlier than we expect."

"We see the risks around our expectation of one final 25 basis point rate hike in August being that the RBA hikes more and/or sooner than we anticipate.

"Easing remains some considerable time off."

Simply put, ANZ is not expecting rate cuts to happen for a while (basically suggesting the market's expectations are a little too optimistic).

Aussie dollar slips on weaker-than-expected China data

By David Chau

The Australian dollar has slipped 0.3% to 66.8 US cents.

The local currency fell after the latest economic data from key trading partner China fell short of analysts' forecasts, adding to evidence of a sputtering COVID recovery.

China's industrial output grew 5.6% in April (from a year earlier), according to official data. This missed expectations by a large margin, as economists were expecting a 10.9% increase.

But it was still the quicket growth since September 2022, largely due to the recoil effect from the contraction suffered last April when the commercial hub Shanghai was under stringent COVID lockdown.

Meanwhile, China's retail sales jumped 18.4% (missing forecasts for a 21% increase).

But it was still much faster retail growth, comapred to the 10.6% increase in March.

Fixed asset investment expanded 4.7% in the first four months of 2023 (from the same period a year earlier).

Again, it missed analysts' expectations for a 5.5% rise.

Former RBA governor says financial turmoil set to continue

By Sue Lannin

Former Reserve Bank governor Glenn Stevens has been speaking at the APPEA oil and gas conference in Adelaide.

He says higher interest rates have hit the values of a range of assets including US regional banks, UK pension funds, and crypto currency investments.

“I think it was inevitable that as interest rates began to rise, there would be financial strategies and structures that would come under pressure," Mr Stevens says.

"That's especially so because interest rates were so low around the world for so long."

The recent banking crisis in the US and Europe saw governments and regulators intervene to stem contagion as in the takeover of Swiss banking giant Credit Suisse by UBS.

“Some of those events have necessitated public sector interventions as we saw recently, when the US government guaranteed deposits in Silicon Valley Bank and extended quite generous liquidity facilities for US regional banks, with the traditional practice of dealing with weaker players by having a stronger player absorb them, but leave some of the risk with the public purse," Mr Stevens says.

Mr Stevens warns the financial turmoil may led to more financial regulation globally in what could be a rocky road ahead.

"It would be wise to watch out for more episodes of financial turbulence in markets."

"It's probably a bit optimistic to think that all the problems have yet emerged."

"It's unlikely we will see a repeat of 2008, but things can happen that are not that scale, but still material."

Glenn Stevens says not much budget impact on inflation

By Sue Lannin

Speaking at the APPEA oil and gas conference, former RBA governor Glenn Stevens was also asked about the impact of the federal budget on the economy, which saw a return surplus for the first time in 15 years.

Mr Stevens praised the federal government for using the windfall from higher revenue to put the budget temporarily back into the black.

"What the economy did for the budget was a large control gain in the bottom line because of strong growth, high commodity prices, and so on," Mr Stevens said.

"I think it's to the government's credit that they've allowed most of that to flow through to the bottom line."

"That's the right thing to do."

The federal opposition and some economists argue that the billions of dollars in spending could fuel inflation and make the Reserve Bank's job harder.

But Mr Stevens doesn't think there will be much impact.

"I would assess....that the budget is slightly expansionary," he said.

"Its implication for interest rates and inflation, I think, to be honest, not that much really."

"The budget is what it is."

"There's a dozen other things also affecting the economy, this is just one of them."

Reserve Bank explains reasons behind 'surprise' rate hike in May

By David Chau

The Reserve Bank has shed some light on why it decided to raise interest rates earlier this month — which caught markets (and most economists) by surprise.

Inflation risks from weak productivity growth, persistently high inflation in the services sector and faster-than-forecast rent increases were the reasons behind the RBA's latest rate hike, according to the minutes of its May board meeting (released today).

The board members also considered a pause, but ultimately decided the high inflation risks warranted a 0.25 percentage rate point increase (after holding rates steady in April).

"In weighing up the two options, members recognised that the arguments were finely balanced but judged it appropriate to increase interest rates at his meeting," the RBA minutes noted.

"Members also agreed that further increases in interest rates may still be required, but that this would depend on how the economy and inflation evolve."

Annual inflation is not expected to fall to 3% (the top of the RBA's target range) until mid-2025, leaving little room for upside risks, the May minutes said.

The RBA board members also noted strong employment data and high services price inflation in March (along with the weaker Australian dollar and rising house prices) may have been in part caused by the central bank's decision to pause rates in April.

Governor Philip Lowe has warned that the RBA cannot take too long to being inflation to heel.

Rates have already risen by a whopping 375 basis points since last May to an 11-year high of 3.85%.

Markets have priced an 85% chance of a pause in June, while seeing a higher risk of a hike in August or September.

Market snapshot at 12:42pm AEST

By Rhiana Whitson

-

ASX 200: -0.2% to 7,251 points

- All Ords: -0.2% to 7,440 points

-

Australian dollar: -0.1% to 66.89 US cents

-

Dow Jones: +0.1% at 33,349 points

- S&P 500: +0.3% to 4,136

- Nasdaq: +0.7% to 12,365 points

- STOXX Europe 600 : +0.2% to 467 points

- Spot gold: -0.1% at $US2,021/ounce

- Brent crude: +0.4% to $US75.67/barrel

- Iron ore:+5% to $US104.40/tonne

- Bitcoin: -0.2% at $US27,290

ASX down, as consumer staples, health and tech drag

By Rhiana Whitson

The ASX 200 is trading lower, down 0.2 per cent to 7,254.

Nine of 11 sectors are in the red. Materials is the best performing sector.

Here's a look at stocks with the biggest gains and declines:

Dismal days for consumer sentiment

By Rhiana Whitson

ABC News business reporter David Taylor's had a look at the latest Westpac-Melbourne Institute Consumer Sentiment report. Here's his take on it:

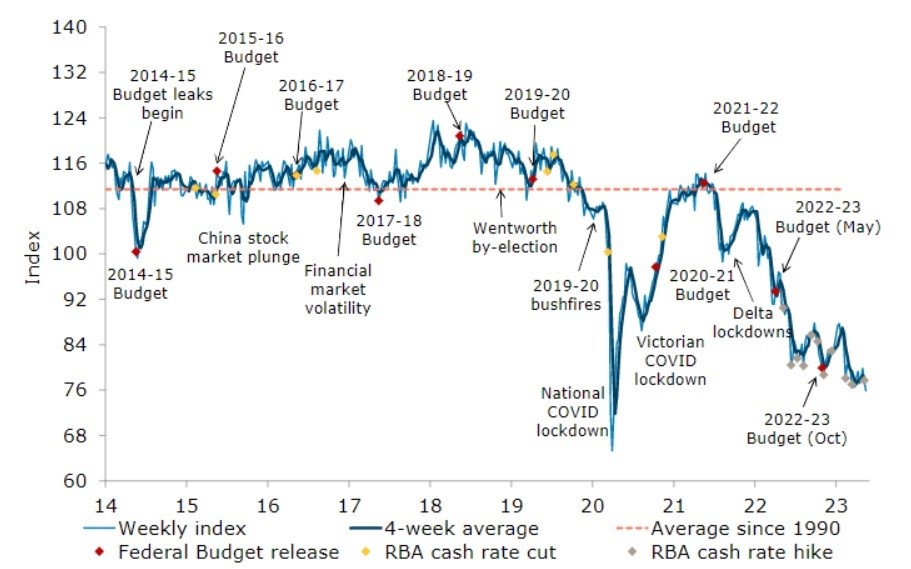

‘Dismal’ is the word Westpac has used to describe how many consumers or households feel at present.

The latest Westpac-Melbourne Institute Consumer Sentiment measure for May fell 7.9 per cent.

“The Melbourne Institute of Consumer Sentiment index fell by 7.9 per cent, from 85.8 in April to 79.0 in May,” Westpac Chief Economist, Bill Evans said.

“The Index has fallen back to just above the dismal levels seen back in March, which recorded the lowest monthly read since the COVID outbreak in 2020 and, before that, since the deep recession of the early 1990s.”

“The two key developments over the last month have been the surprise decision by the Reserve Bank Board to lift the cash rate by a further 0.25% in May and the Federal Budget.”

The bank reports the sharpest drop in sentiment are among those on low incomes, renters, mortgagors and women.

Interestingly, the crisis of confidence among renters is greater than those with a mortgage, despite the interest rate hikes.

Most households expect interest rates to keep rising more here.

Former RBA governor says high rates here to stay for now

By Sue Lannin

Hi, Sue Lannin jumping in with a guest post.

Former Reserve Bank governor Glenn Stevens has told the APPEA oil and gas conference that the world has moved from a world where inflation is too low, to a world where inflation is too high, and a return to ultra low interest rates is unlikely.

The supply chain squeeze led to higher inflation and the pandemic has lead to more government intervention: factors that are likely here to stay.

Mr Stevens is now chairman of financial services giant Macquarie Group.

"I suspect we've moved from one economic era in which inflation, when I finished in central banking nearly seven years ago, inflation was too low, and it was difficult to get it to go up."

"Who would have thought that we now would be in a world where it's too high, and I think it will be difficult to get it to come down."

"I think a return to the ultra low rates that we saw for a while there is unlikely."

"Central banks are in a once in a generation battle to return inflation to the low and stable levels that it was at."

Healthcare and consumer stocks weigh on ASX

By David Chau

Losses across the healthcare, consumer staples and utilities sectors dragged the Australian share market lower on Tuesday morning.

The ASX 200 was down 0.2% to 7,250 points, by 10:35am AEST.

150 stocks out of 200 stocks were lower, with supermarket giants Coles and Woolworths and biotech company CSL down by around 1.2% each.

Today's worst performing stocks include Elders (-3.8%), PEXA (-2%), Lifestyle Communities (-3.2%) and West African Resources (-3%).

Materials and financials were the best performing sectors, led by gains from Allkem (+1.3%), Macquarie Group (+0.9%) and Sandfire Resources (+1.2%).

Shares of James Hardie Industries jumped 8.3% after the company forcast a higher quarterly profit.

The building matierals company said it expects to report adjusted net income in the range of $US145 million to $US165 million for the first quarter of the 2024 fiscal year.

That compares with a profit $US154.3 million in the year-earlier period and consensus estimate of $US137 million, according to UBS analysts.

Market snapshot at 10:25am AEST

By David Chau

-

ASX 200: -0.2% to 7,250 points

- All Ords: -0.3% to 7,442

-

Australian dollar: +0.1% to 67.05 US cents

-

Dow Jones: +0.1% at 33,349 points

- S&P 500: +0.3% to 4,136

- Nasdaq: +0.7% to 12,365 points

- STOXX Europe 600 : +0.2% to 467 points

- Spot gold: -0.3% at $US2,014/ounce

- Brent crude: +0.3% to $US75.46/barrel

- Iron ore:+5% to $US104.40/tonne

- Bitcoin: -0.2% at $US27,290

Consumer confidence sinks to lowest since April 2020

By David Chau

Consumers are feeling incredibly pessimistic, acccording to the latest ANZ-Roy Morgan report.

Last week, consumer sentiment fell to 75.9 points (after a 1.8-point drop).

A score below 100 means the pessimists outweigh the optimists.

This is its lowest level since April 2020, around the early days of the COVID-19 pandemic, closed international borders and widespread lockdowns.

ANZ senior economist Adelaide Timbrell said this was the 11th straight week that consumer confidence has remained below 80 points (a very pessimistic level).

This research shows the Reserve Bank's decision to lift interest rates 11 times (in one year) is having an impact on consumer behaviour.

Markets betting on RBA rate cuts by Christmas

By David Chau

Markets are betting the Reserve Bank will have to cut interest rates by the end of this year due to Australia's expected economic slowdown.

However, NAB is now forecasting the cash rate will rise to 4.1% (or even as high as 4.35%) within months.

In other words, the bank is anticipating one (or two) more rate hikes.

"It remains our view that, as higher rates pass through to household cash flows and the wider economy, the economy will begin to slow more noticeably in the second half of 2023 and into 2024, seeing annual GDP growth slow to below 1% and the unemployment rate begin to rise, reaching around 4.7% in 2024," NAB economists wrote in a note to clients.

"This makes it an increasingly difficult balancing act for the RBA to manage inflation lower without slowing the economy too much."

For more on this, you can watch my finance report from last night's 7pm News bulletin:

Australian hydrogen in demand as South Korea eyes net zero target

By David Chau

Our third largest trading partner, South Korea, wants Australian green hydrogen to help it cut carbon emissions to net zero by 2050.

Korean companies are investing billions of dollars in projects in Australia as the federal government announces extra cash to supercharge the industry.

Analysts say hydrogen could deliver a resources investment boom, as Rachel Pupazzoni reports:

Tough decisions to fix Australia's housing crisis

By David Chau

The gap between housing supply and demand is growing — with demand for multi-unit dwellings expected to exceed supply for the next 10 years.

University of Sydney associate professor Nicole Gurran says the construction of new homes depends on rising house prices.

She also argues that Australia needs investment in social and affordable housing that responds to population growth, and low-income renters should be given adequate subsidies.

You can watch her full interview with The Business host Kathryn Robinson here:

The dirty business behind the PwC tax scandal

By David Chau

Richard Boyle faces the grim prospect of life in prison.

In March, the former ATO employee lost his bid to be declared immune from prosecution on 24 offences stemming from his decision to go public on what he claims were unethical tactics used by his former employer to collect debts.

His plight has highlighted the stark difference in justice meted out to those acting alone as opposed to those protected by the veil of the corporate world.

Ironically, Mr Boyle's Federal Court decision came just weeks after Peter Collins, the former senior tax partner at accounting giant PwC, was barred from practising by the Tax Practitioners Board.

His misdeed? It was discovered that in 2014, Mr Collins had shared confidential tax information with other partners and staff about a federal government initiative to clamp down on multinational tax avoidance.

Ever since the Tax Practitioners Board decision in January, the firm has been desperately trying to contain the damage, hosing down concerns from within and outside the firm. But to no avail.

In the past fortnight, the firm has been plunged into a crisis that threatens its very future in Australia.

For more on this, here's the latest analysis from business editor Ian Verrender:

Gender pay gap data of large Australian businesses will be published in 2024

By David Chau

An extremely embarrassing day for some Australian businesses — and an enraging moment for many workers — is coming.

Early next year, the gender pay gap — the difference between what men and women are paid in the same organisation — of every company with more than 100 employees will be published.

Why? Because businesses haven't been open about whether they pay men and women fairly.

The data will let anyone look inside a business and decide if they want to work there.

When this reform was introduced in the UK six years ago, it was explosive as companies were forced to defend large gaps between what they paid their male and female staff.

They included well-known companies such as airline RyanAir (a 72% gap), bank Barclays (44%), publisher Telegraph Media Group (23%) and consulting firm KPMG (22%).

Although the data didn't fix the problem, it did make a substantial impact.

For more on this, here's the story by Daniel Ziffer:

ABC/Reuters