Investors with a lot of money to spend have taken a bearish stance on Uber Technologies (NYSE:UBER).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with UBER, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 39 uncommon options trades for Uber Technologies.

This isn't normal.

The overall sentiment of these big-money traders is split between 41% bullish and 53%, bearish.

Out of all of the special options we uncovered, 5 are puts, for a total amount of $316,232, and 34 are calls, for a total amount of $2,204,315.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $50.0 to $100.0 for Uber Technologies during the past quarter.

Analyzing Volume & Open Interest

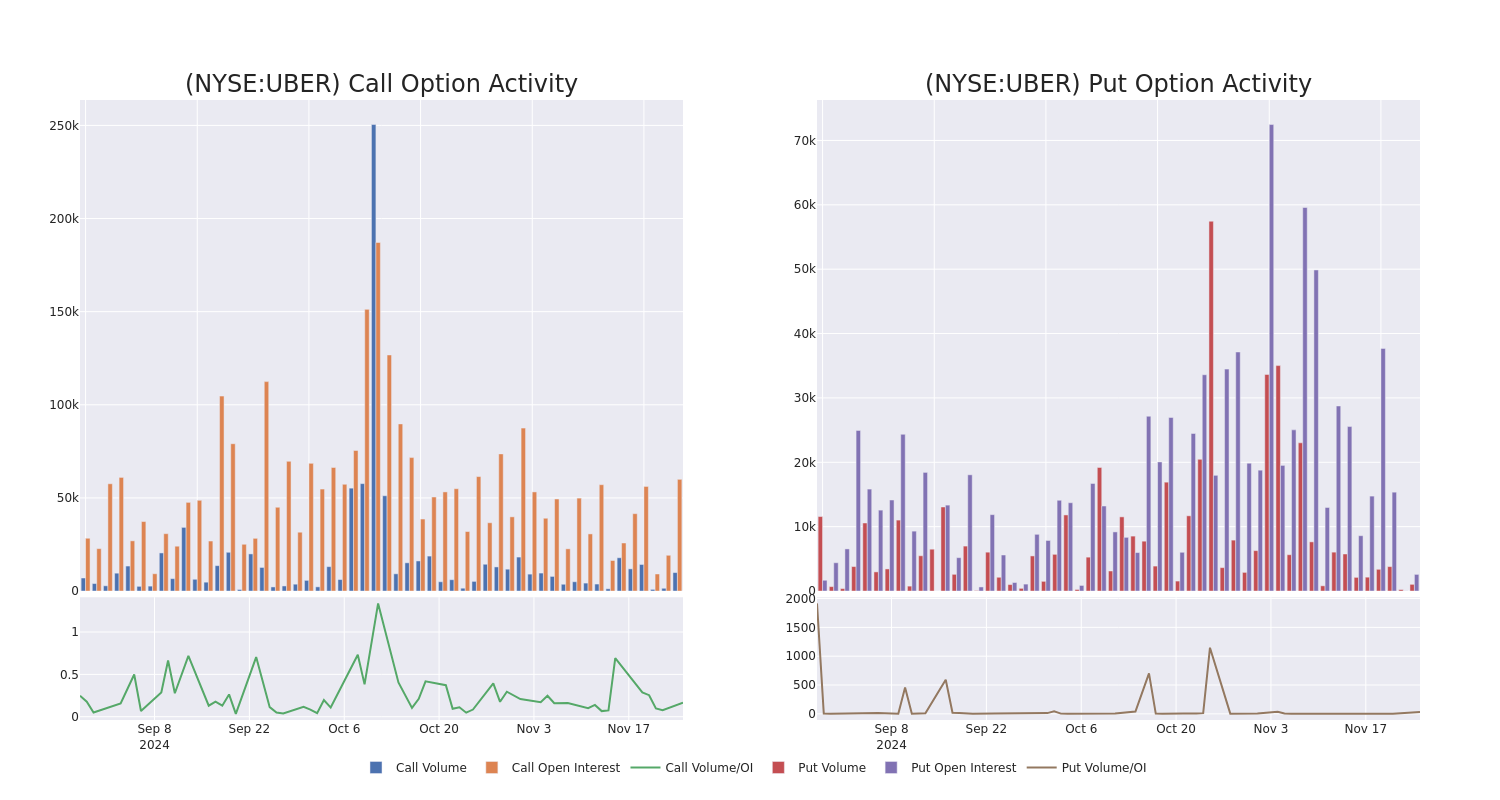

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Uber Technologies's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Uber Technologies's whale trades within a strike price range from $50.0 to $100.0 in the last 30 days.

Uber Technologies Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UBER | CALL | SWEEP | BEARISH | 01/15/27 | $10.95 | $10.85 | $10.87 | $95.00 | $243.8K | 635 | 1.0K |

| UBER | CALL | SWEEP | BEARISH | 01/16/26 | $12.6 | $12.3 | $12.3 | $75.00 | $228.9K | 3.1K | 265 |

| UBER | CALL | TRADE | BULLISH | 01/15/27 | $16.05 | $14.65 | $15.69 | $80.00 | $156.9K | 343 | 101 |

| UBER | CALL | TRADE | BULLISH | 01/15/27 | $15.7 | $15.4 | $15.64 | $80.00 | $156.4K | 343 | 301 |

| UBER | CALL | TRADE | NEUTRAL | 01/15/27 | $15.95 | $15.4 | $15.63 | $80.00 | $156.3K | 343 | 201 |

About Uber Technologies

Uber Technologies is a technology provider that matches riders with drivers, hungry people with restaurants and food delivery service providers, and shippers with carriers. The firm's on-demand technology platform could eventually be used for additional products and services, such as autonomous vehicles, delivery via drones, and Uber Elevate, which, as the firm refers to it, provides "aerial ride-sharing." Uber Technologies is headquartered in San Francisco and operates in over 63 countries with over 150 million users who order rides or food at least once a month.

Current Position of Uber Technologies

- With a volume of 8,625,720, the price of UBER is up 2.51% at $73.31.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 72 days.

What The Experts Say On Uber Technologies

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $93.2.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * Consistent in their evaluation, an analyst from Wells Fargo keeps a Overweight rating on Uber Technologies with a target price of $90. * An analyst from Loop Capital has decided to maintain their Buy rating on Uber Technologies, which currently sits at a price target of $86. * An analyst from Keybanc has decided to maintain their Overweight rating on Uber Technologies, which currently sits at a price target of $85. * Maintaining their stance, an analyst from Evercore ISI Group continues to hold a Outperform rating for Uber Technologies, targeting a price of $120. * An analyst from Gordon Haskett upgraded its action to Buy with a price target of $85.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Uber Technologies, Benzinga Pro gives you real-time options trades alerts.