Financial giants have made a conspicuous bullish move on Roblox. Our analysis of options history for Roblox (NYSE:RBLX) revealed 16 unusual trades.

Delving into the details, we found 56% of traders were bullish, while 37% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $189,883, and 13 were calls, valued at $1,026,513.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $40.0 to $65.0 for Roblox over the last 3 months.

Volume & Open Interest Trends

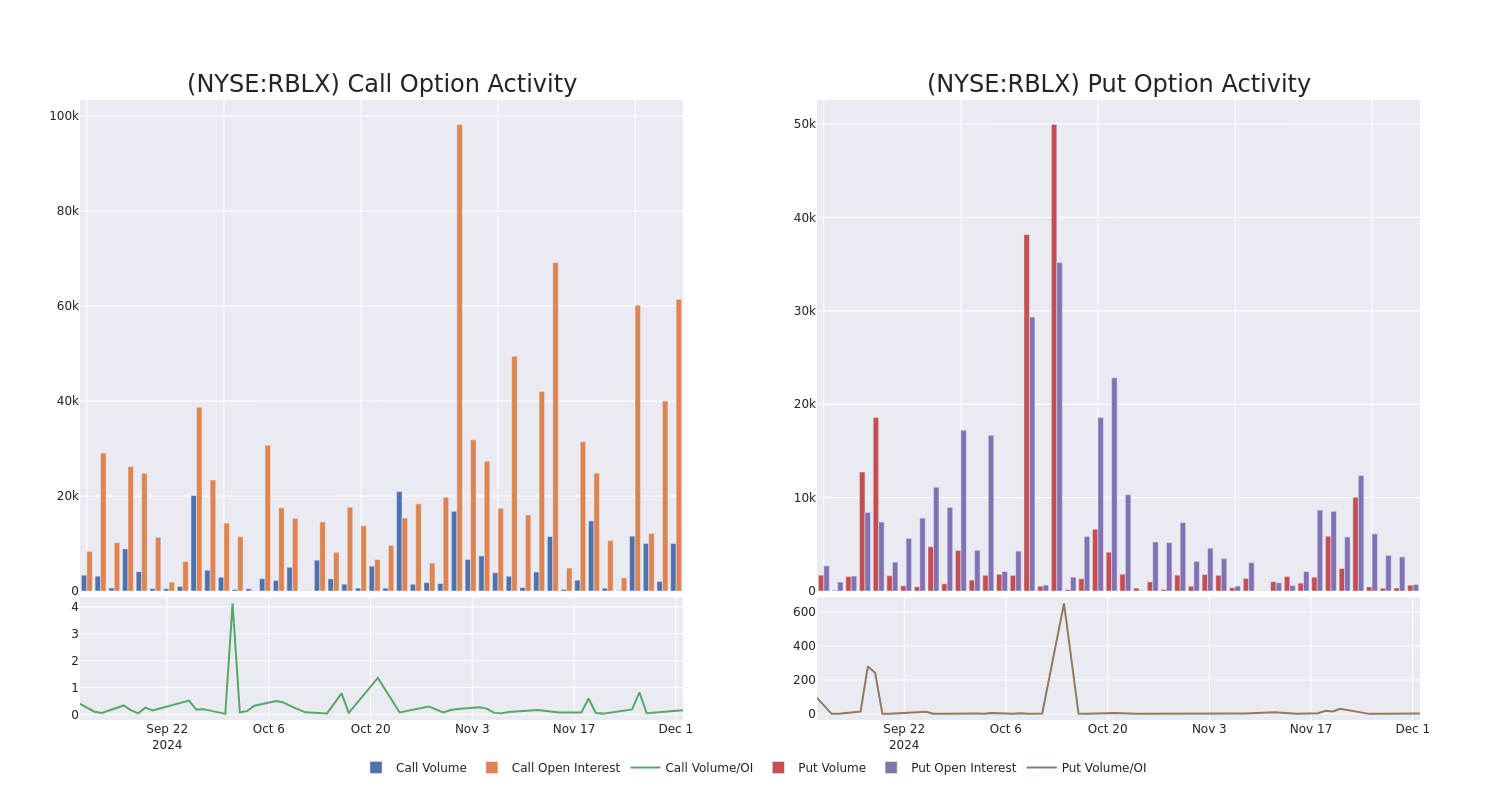

In today's trading context, the average open interest for options of Roblox stands at 4101.15, with a total volume reaching 55,512.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Roblox, situated within the strike price corridor from $40.0 to $65.0, throughout the last 30 days.

Roblox Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RBLX | CALL | SWEEP | BEARISH | 02/21/25 | $3.4 | $3.3 | $3.3 | $65.00 | $329.0K | 2.3K | 2.7K |

| RBLX | CALL | SWEEP | BULLISH | 07/18/25 | $6.7 | $6.45 | $6.69 | $65.00 | $133.6K | 21 | 778 |

| RBLX | CALL | SWEEP | BEARISH | 12/27/24 | $2.44 | $2.42 | $2.43 | $58.00 | $125.1K | 241 | 596 |

| RBLX | CALL | TRADE | NEUTRAL | 12/20/24 | $1.54 | $1.45 | $1.5 | $60.00 | $75.0K | 6.4K | 3.9K |

| RBLX | CALL | SWEEP | BULLISH | 12/20/24 | $18.7 | $18.25 | $18.7 | $40.00 | $74.8K | 2.0K | 40 |

About Roblox

Roblox operates an online video game platform with 80 million daily active users that lets young gamers create, develop, and monetize games (or "experiences") for other players. The firm offers its developers a hybrid of a game engine, publishing platform, online hosting and services, marketplace with payment processing, and social network. The platform is a closed garden that Roblox controls, earning $3.5 billion in bookings in 2023 through in-game purchases and advertising while benefiting from outsourced game development. Unlike traditional video game publishers, Roblox is more focused on the creation of new tools and monetization techniques for its developers than creating new games or franchises.

Having examined the options trading patterns of Roblox, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Roblox

- With a volume of 9,027,378, the price of RBLX is up 7.25% at $58.49.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 62 days.

Expert Opinions on Roblox

1 market experts have recently issued ratings for this stock, with a consensus target price of $60.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * An analyst from Raymond James downgraded its action to Strong Buy with a price target of $60.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Roblox options trades with real-time alerts from Benzinga Pro.