Investors with a lot of money to spend have taken a bullish stance on ASML Holding (NASDAQ:ASML).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with ASML, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 36 uncommon options trades for ASML Holding.

This isn't normal.

The overall sentiment of these big-money traders is split between 44% bullish and 33%, bearish.

Out of all of the special options we uncovered, 3 are puts, for a total amount of $362,670, and 33 are calls, for a total amount of $1,689,452.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $380.0 to $790.0 for ASML Holding over the recent three months.

Volume & Open Interest Development

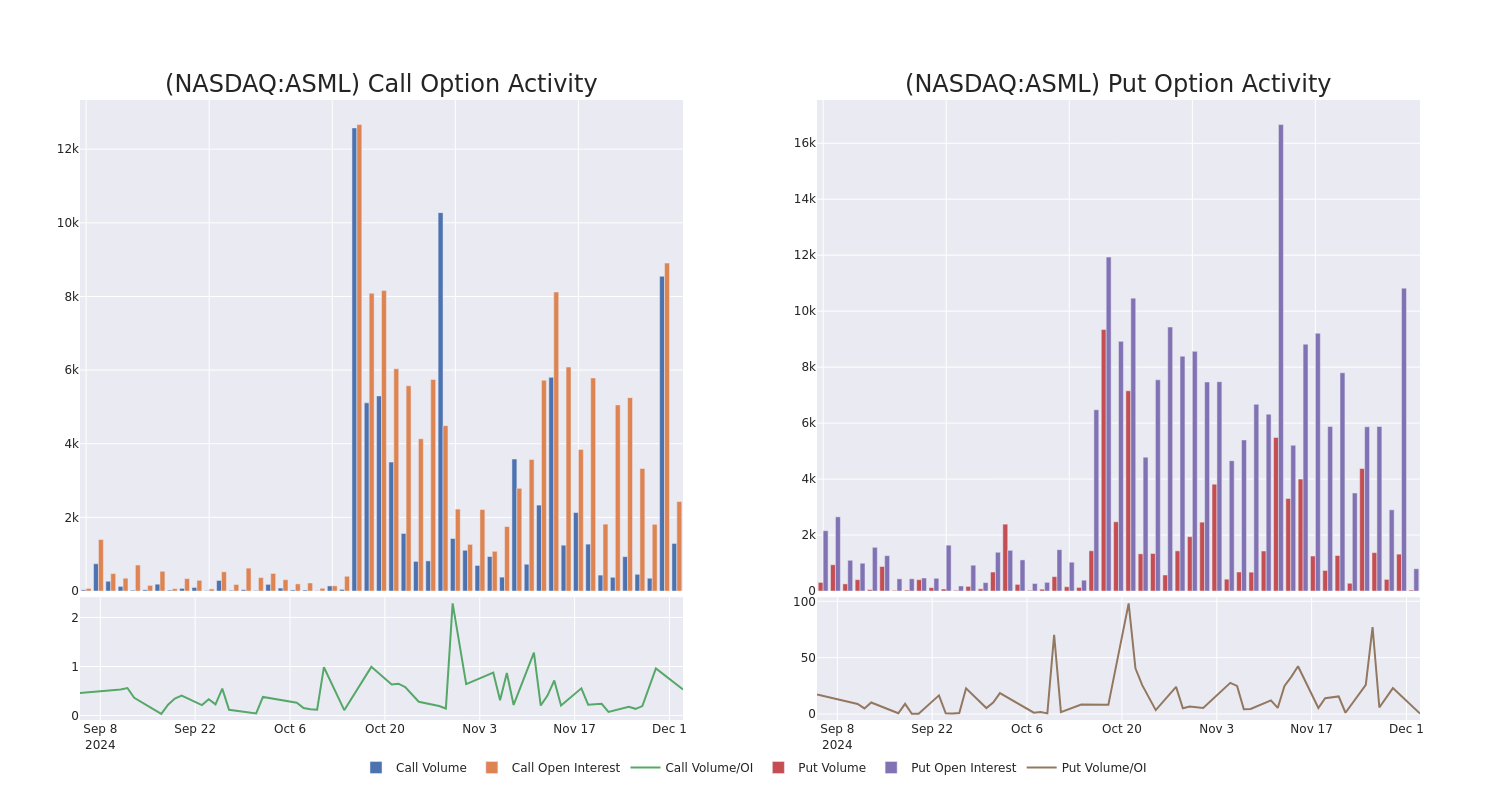

In today's trading context, the average open interest for options of ASML Holding stands at 169.84, with a total volume reaching 1,307.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in ASML Holding, situated within the strike price corridor from $380.0 to $790.0, throughout the last 30 days.

ASML Holding Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ASML | CALL | TRADE | BULLISH | 01/15/27 | $178.4 | $173.6 | $177.7 | $700.00 | $159.9K | 125 | 10 |

| ASML | PUT | TRADE | BULLISH | 01/16/26 | $99.4 | $96.9 | $96.9 | $710.00 | $135.6K | 72 | 14 |

| ASML | PUT | TRADE | BEARISH | 03/21/25 | $54.6 | $54.0 | $54.6 | $710.00 | $114.6K | 151 | 21 |

| ASML | PUT | TRADE | BEARISH | 02/21/25 | $53.5 | $50.9 | $53.5 | $720.00 | $112.3K | 574 | 21 |

| ASML | CALL | TRADE | BEARISH | 12/20/24 | $36.1 | $35.5 | $35.5 | $682.50 | $74.5K | 24 | 21 |

About ASML Holding

ASML is the leader in photolithography systems used in the manufacturing of semiconductors. Photolithography is the process in which a light source is used to expose circuit patterns from a photo mask onto a semiconductor wafer. The latest technological advances in this segment allow chipmakers to continually increase the number of transistors on the same area of silicon, with lithography historically representing a high portion of the cost of making cutting-edge chips. ASML outsources the manufacturing of most of its parts, acting like an assembler. ASML's main clients are TSMC, Samsung, and Intel.

Following our analysis of the options activities associated with ASML Holding, we pivot to a closer look at the company's own performance.

ASML Holding's Current Market Status

- Trading volume stands at 340,838, with ASML's price down by -0.77%, positioned at $706.01.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 57 days.

What The Experts Say On ASML Holding

In the last month, 1 experts released ratings on this stock with an average target price of $767.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * An analyst from Bernstein persists with their Outperform rating on ASML Holding, maintaining a target price of $767.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest ASML Holding options trades with real-time alerts from Benzinga Pro.