Whales with a lot of money to spend have taken a noticeably bullish stance on Amazon.com.

Looking at options history for Amazon.com (NASDAQ:AMZN) we detected 71 trades.

If we consider the specifics of each trade, it is accurate to state that 54% of the investors opened trades with bullish expectations and 28% with bearish.

From the overall spotted trades, 2 are puts, for a total amount of $54,943 and 69, calls, for a total amount of $5,638,484.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $175.0 to $270.0 for Amazon.com over the recent three months.

Volume & Open Interest Development

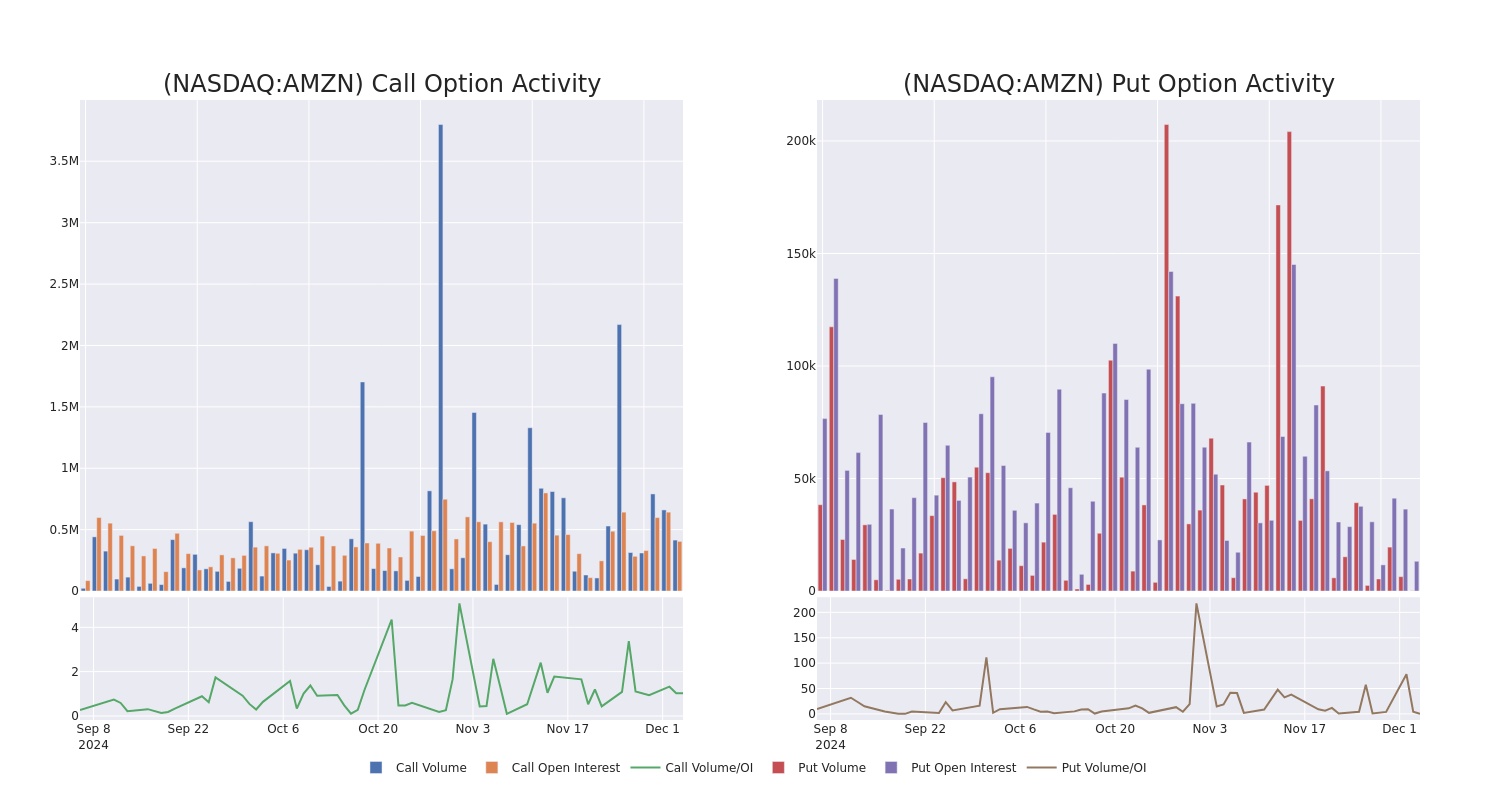

In today's trading context, the average open interest for options of Amazon.com stands at 16065.54, with a total volume reaching 408,506.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Amazon.com, situated within the strike price corridor from $175.0 to $270.0, throughout the last 30 days.

Amazon.com Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMZN | CALL | SWEEP | BEARISH | 12/06/24 | $6.45 | $6.25 | $6.25 | $212.50 | $305.0K | 25.3K | 4.3K |

| AMZN | CALL | SWEEP | BULLISH | 12/20/24 | $18.25 | $17.9 | $17.9 | $200.00 | $274.2K | 24.7K | 359 |

| AMZN | CALL | SWEEP | BEARISH | 12/20/24 | $19.25 | $19.1 | $19.15 | $200.00 | $245.1K | 24.7K | 1.5K |

| AMZN | CALL | SWEEP | BULLISH | 01/16/26 | $57.5 | $57.25 | $57.5 | $180.00 | $189.7K | 7.5K | 49 |

| AMZN | CALL | SWEEP | BULLISH | 01/17/25 | $13.4 | $13.25 | $13.34 | $210.00 | $170.7K | 40.0K | 3.7K |

About Amazon.com

Amazon is the leading online retailer and marketplace for third party sellers. Retail related revenue represents approximately 75% of total, followed by Amazon Web Services' cloud computing, storage, database, and other offerings (15%), advertising services (5% to 10%), and other the remainder. International segments constitute 25% to 30% of Amazon's non-AWS sales, led by Germany, the United Kingdom, and Japan.

After a thorough review of the options trading surrounding Amazon.com, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Amazon.com

- Currently trading with a volume of 7,161,303, the AMZN's price is up by 1.96%, now at $217.62.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 57 days.

Expert Opinions on Amazon.com

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $233.4.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * An analyst from Redburn Atlantic persists with their Buy rating on Amazon.com, maintaining a target price of $235. * Reflecting concerns, an analyst from Needham lowers its rating to Buy with a new price target of $210. * Consistent in their evaluation, an analyst from Needham keeps a Buy rating on Amazon.com with a target price of $250. * An analyst from Loop Capital has decided to maintain their Buy rating on Amazon.com, which currently sits at a price target of $275. * An analyst from Wells Fargo has decided to maintain their Equal-Weight rating on Amazon.com, which currently sits at a price target of $197.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Amazon.com with Benzinga Pro for real-time alerts.