The cryptocurrency industry in recent months has been hit by numerous scandals, which have sharply raised skepticism and mistrust among the general public and encouraged more calls for regulators to step in.

One aspect common to all these crypto scandals is that the big names and players in the sector get spattered by the mess. No one is immune.

It all started last May when sister cryptocurrencies Luna and UST, or TerraUSD, collapsed.

The two tokens crashed after UST lost its peg to the dollar, the foundation qualifying it as a stablecoin. Such cryptocurrencies are tied to more stable assets, like the U.S. dollar or gold. But UST was an algorithmic stablecoin, which was backed not by dollar reserves but rather by its sister asset, Luna.

This disaster caused a credit crunch that proved catastrophic for many firms, including hedge fund Three Arrows Capital, or 3AC, which found itself unable to honor its payments to crypto lenders Celsius Network and Voyager Digital.

3AC was forced into liquidation. Celsius and Voyager filed for Chapter 11 bankruptcy.

The depegging of Terra’s UST coin and the collapse of Celsius and 3AC drove massive losses for investors: $20.5 billion in the case of UST and $33 billion in the case of Celsius and 3AC, according to blockchain security firm Chainalysis.

Factors: Cross-Exposure and Lack of Transparency

This crisis mainly revealed the links and exposure of crypto firms to each other, like the banks during the financial crisis of 2008. The other lesson was the lack of transparency of centralized crypto companies, which are mostly unregulated.

This opacity created another situation that would cause the overnight implosion of FTX a few months later.

The cryptocurrency exchange and its sister company, Alameda Research, a hedge fund that also serves as a trading platform, became the companies through which their founder, Sam Bankman-Fried, took advantage of the crisis of confidence in the crypto industry. He consolidated power and became the new strongman of the crypto space.

Bankman-Fried used the two companies to save other struggling firms, but as would come clear later, some of these deals were questionable, such as the one with lender BlockFi. Less than three months later, the Bankman-Fried empire went bankrupt.

Regulators accused the former trader of defrauding and conspiring to defraud FTX clients and investors. It will take time to determine exactly what happened, but FTX customer funds appear to have been comingled with Alameda's and were illegally used in high-risk transactions.

Bankman-Fried has pleaded not guilty.

According to Chainalysis, the downfall has caused $9 billion of losses for FTX clients, but this number doesn't take into account potential losses for people who deposited their funds with the exchange. The likelihood of these investors recovering them is unclear.

Cuban Sees a Scandal Tied to Wash Trades

As 2023 begins, the question is whether in this new year the crypto industry will also be marked by scandals.

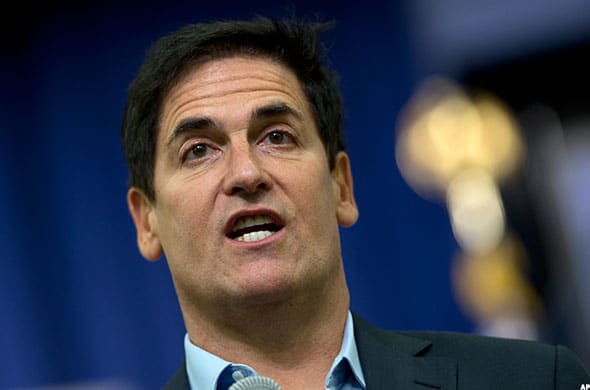

For the billionaire and cryptocurrency investor Mark Cuban, it's a question of when, not whether.

This new scandal, he says, will appear in the form of the implosion of so-called wash trades, according to him, on the centralized exchanges.

"I think the next possible implosion is the discovery and removal of wash trades on central exchanges," the owner of the Dallas Mavericks told TheStreet in an interview by email. "There are supposedly tens of millions of dollars in trades and liquidity for tokens that have very little utilization. I don't see how they can be that liquid."

He cautioned: "I don't have any specifics to offer to support my guess."

A wash trade, an illegal practice, consists of creating artificial interest around a financial product -- a crypto token or coin in this case -- to make a profit. This form of "pump-and-dump" scheme is widespread in the cryptocurrency industry.

Basically, a scammer/trader buys and sells the same tokens, creating artificial trading volumes around that cryptocurrency. The scammer encourages positive social-media comment about the token, giving other traders the impression that the token is popular and in big demand. In turn, that generates more interest in the token, driving up its price. The scammers then liquidate their positions at the peak of demand.

"Wash Trading (is) entering into, or purporting to enter into, transactions to give the appearance that purchases and sales have been made, without incurring market risk or changing the trader's market position," says the The U.S. Commodity Futures Trading Commission.

Bitcoin Is Not Immune From Wash Trades

While many wash trades have occurred in traditional finance, the crypto space is particularly conducive to the practice because nearly 13,000 cryptocurrencies are listed, according to data firm CoinGecko. Scammers have to make one or another token stand out from that pack so they can engage in wash trade.

As an example, according to a 2022 study by Forbes magazine on 157 centralized cryptocurrency exchanges, more than half the volumes of exchanges concerning bitcoin are fake.

"More than half of all reported trading volume is likely to be fake or non-economic," the magazine concluded, adding that it "estimates the global daily bitcoin volume for the industry was $128 billion on June 14. That is 51% less than the $262 billion one would get by taking the sum of self-reported volume from multiple sources."

Consider the figures from the various data firms concerning bitcoin trading volumes. At last check, CoinMarketCap puts the latest 24-hour trading volume of bitcoin at $15.8 billion, CoinGecko at $17.6 billion, Nomics at $26.14 billion and Messari at $3.52 billion.

These disparate figures show that even the most reputable research firms fail to have the same data on bitcoin, the top cryptocurrency in terms of market value.

This suggests that opacity is the key word and raises even larger questions about the data regarding trading volumes of less popular and less exposed cryptocurrencies.

And this question in turn raises that of the solvency of certain centralized cryptocurrency exchanges. More than 560 exchanges are operating, according to CoinGecko.