Bottom Line Up Front: In 2022, Mark Cuban started Cost Plus Drugs with the idea of making pharmaceuticals more affordable for everyone. This has started a years-long journey of reducing healthcare costs for everyone and taking on one of the most entrenched industries in America. With Affordable Care Act subsidies expiring and healthcare talks taking center stage, Mark Cuban has ramped up his critiques of healthcare companies, including saying that pharmacy benefit managers (PBMs) are the healthcare companies’ secret cash cows, followed by advocating for reform.

Why Is Healthcare So Expensive?

There’s no single reason behind why healthcare is so expensive. The industry itself is heavily regulated and operated by individuals who require years upon years of schooling. This means it requires large salaries for the people who run the hospitals, and the latest medical equipment can cost millions. However, there are some clear signs of bloat within the industry, which tend to draw the most scrutiny. The two main groups at the center of those debates are PBMs and hospital administrators.

PBMs are the middlemen between pharmacies, insurance, patients, and drug manufacturers. This puts them in a powerful position to negotiate drug pricing with pharmacies and insurers, all while raking in millions on the spread. They’re often criticized for inflating prices and charging more to everyone involved.

Cuban’s Cost Plus Drugs cuts the PBMs out completely and negotiates directly with manufacturers and generic drug makers to charge the manufacturer’s price “plus” a small fee. This is why Cost Plus Drugs are often many multiples cheaper than those that do use PBMs.

Similarly, hospital administrators aren’t a single class of people, but they receive criticism as unnecessary bloat because, in some cases, administrators outnumber medical professionals, thus driving up costs. Administrators’ job is to work with insurance, billing, Medicare, Medicaid, and billing strategy. In other words, they look to extract value out of the system.

It begs the question: Why not fire all of these people and pass the savings onto the patients? Meaning, consumers might pay hundreds or thousands per month for insurance, and hospitals pay millions in salaries to people whose job is to effectively increase prices for everyone.

Instead of paying those salaries and using them to justify price increases, hospitals could simply run a leaner operation by cutting out the many layers of middlemen, thus saving everyone money.

This mirrors the “cash pay” success of the veterinary industry. By removing the insurance billing friction, vet clinics maintain lower overhead than human primary care offices.

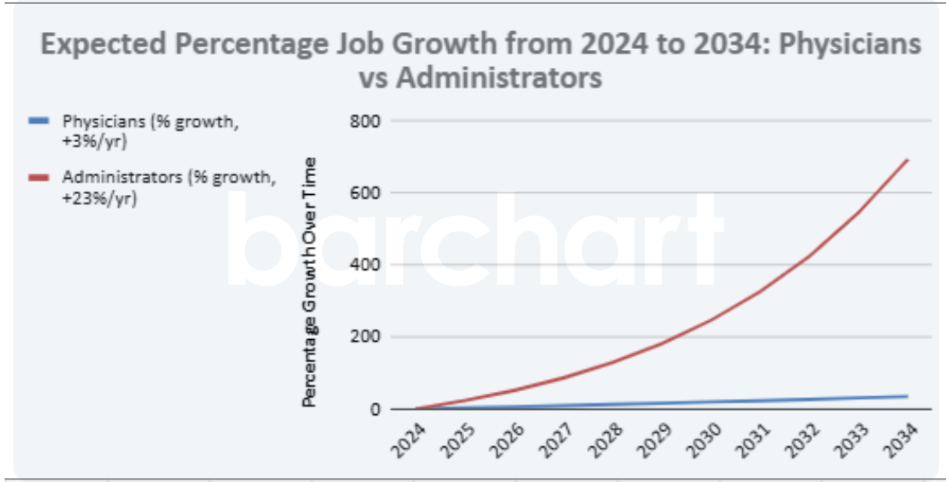

Administrators Are Outpacing Physician Growth By Over 3,000%: How Bad Is the Problem?

Between 1970 and 2010, administrators’ jobs grew 3,200%, while physicians’ jobs grew only a fraction of that. The trend has only continued since then.

According to the Bureau of Labor Statistics, administrator positions are expected to grow at a rate of 23% annually between 2024 and 2034, whereas healthcare positions as a whole, including physicians and surgeons, will only grow at a rate of 3%.

Mark Cuban’s Solution

Mark Cuban took to X, formerly Twitter with an even more nuanced take.

Cuban argues that insurance companies like the PBMs because they’re “cash cows” owned by the health insurance companies themselves. Specifically, he says, “I’m all for PBM reform. But realize that the biggest PBMs are owned by the biggest insurance companies. Right now they use the PBMs as a cash cow. BUT, they aren’t stupid. They will move those dollars wherever they need to compensate for any PBM legislation. They are TOO BIG TO CARE.”What’s Cuban’s solution to this? He says, “The best solution is to make them divest all non-insurance assets. In the interim, if you don’t play out all the money flows, and get ahead of them with legislation. They will laugh all the way to the bank. They already are moving from rebates to fees. They will include things in invoices you have no idea you are being charged for. Employer, patient, state, hospital, physician, if they can charge you, they will. PBMs ARE NOT STANDALONE BUSINESSES.”

Barchart Actionable Insights: The Healthcare ‘Middleman’ Margin Squeeze

From an investment perspective, the “Cuban Effect” represents a direct threat to the high-margin Healthcare Services sector. For decades, vertically integrated giants like CVS Health (CVS) and UnitedHealth (UNH) have used PBMs as “black boxes” to capture spread pricing.

However, as transparency becomes a legislative mandate in 2026, these “cash cows” are at risk. We are seeing a structural rotation away from legacy PBM exposure and toward “Value-Based Care” and “Direct Primary Care” enablers. For investors, the takeaway is clear: the 3,200% growth in administrative overhead is a bubble nearing its peak. As lean operators like Cost Plus Drugs scale, the massive margins previously reserved for middlemen will likely be redistributed back to patients or simply legislated out of existence.